3 ways Google's Android Pay is better than Apple Pay

Google IO reveals tighter rewards integration and authentication

Believe it or not, Google's Android Pay makes it simpler and more rewarding to pay for things with a phone than the already easy-to-use Apple Pay.

With more than one billion active Android users, that's going to give mobile payments a big boost in 2015, at least in the US. This is no half-hearted Google Wallet.

At Google IO 2015, I tested the reinvented contactless payment system on a Coca-Cola machine and a mock online store in the press room.

The result? One 20oz bottle of Coke and three ways the better-late-than-never Android Pay is slightly better than Apple Pay.

1. It's literally more rewarding

Google wants to help the world buy a Coke and maybe teach everyone to sing its praises. It's doing that with a little extra reward right at the machine.

Android Pay, already loaded on my Nexus 6 at a special Coke vending machine, used the built-in NFC chip that's now common among Google-powered phones. It's the same tech Apple uses.

I held the phone to the machine's NFC reader, and a stacked credit and debit card interface popped up automatically, looking almost identical to Apple Pay's design. I tapped my virtual card on the phone to pay, and the plastic bottle rolled out of the machine.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

What's different? Among the card options is the ability to use MyCokeRewards points to pay for the soda (or a healthier beverage like water). Who turns down an earned Coke and doesn't enjoy it?

Google is integrating retailers' loyalty programs right into Android Pay and says this feature is going to be bigger than just soda machines. It's an idea the iPhone's Passbook app doesn't fulfill nearly as well, often turning to little-used and more cumbersome QR codes.

That's going to be an incentive, especially when I'm at local retailers. On an iPhone 6, I often need to get out my loyalty card or recite my phone number, even if I'm paying with Apple Pay.

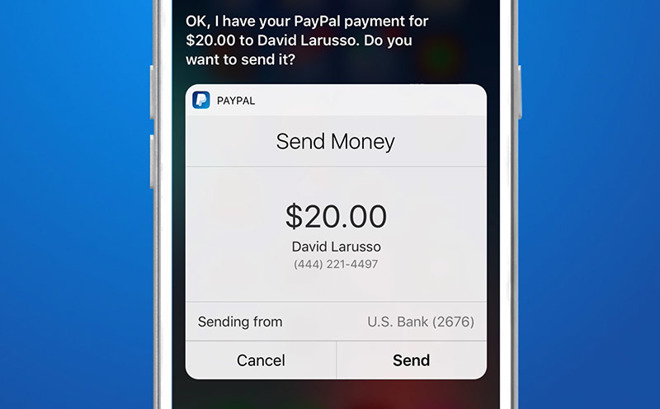

2. Passwords aren't a hindrance

Android Pay requires a lockscreen password, whether it's a pattern, pin or face unlock. Only, its rules are more user-friendly than what's found on an Apple Pay-enabled iPhone.

Its tap-to-pay method of completing a transaction doesn't require that hit-or-miss fingerprint on smartphones. That's why enabling a phone's lockscreen is a must.

This makes Android Pay a little bit faster with no queue displeasing "Let me redo it" when the fingerprint sensor doesn't work. This open platform uses a system-level lockscreen as its security, not a second payment ID for authentication.

Worried about Android eliminating this redundancy? Android M is going to push phones to add a fingerprint sensor. Most Android phones don't have Touch ID-equivalent hardware.

It was sort of funny to hear the Motorola Atrix from 2011 get a nod during the Google IO keynote. There's not much else out besides Samsung's few fingerprint-enabled phones.

What's even better? I'm told that when you disable a password-protected lockscreen, the credit cards don't automatically erase like they annoyingly do with an Apple Pay-linked cards.

That's a requirement of Apple Pay for iPhone and, more precisely, Apple Watch. It forces users who sometimes disable lockscreen passwords temporarily to add and re-authenticate their credit cards all over again. It's a pain.

3. Way more compatible phones

Android Pay works with a lot more phones than Apple Pay - a lot more - much to the dislike of iPhone owners who don't yet have an iPhone 6 and iPhone 6 Plus.

Google's casting a much wider net with support for all Android 4.4 KitKat phones with NFC chips, not just its own Nexus devices.

That means the Galaxy S4, HTC One M7, LG G2, original Moto X and Nexus 5, all released in 2013, will work with Android Pay.

That covers a lot of people.

Android Pay stores, credit cards and banks

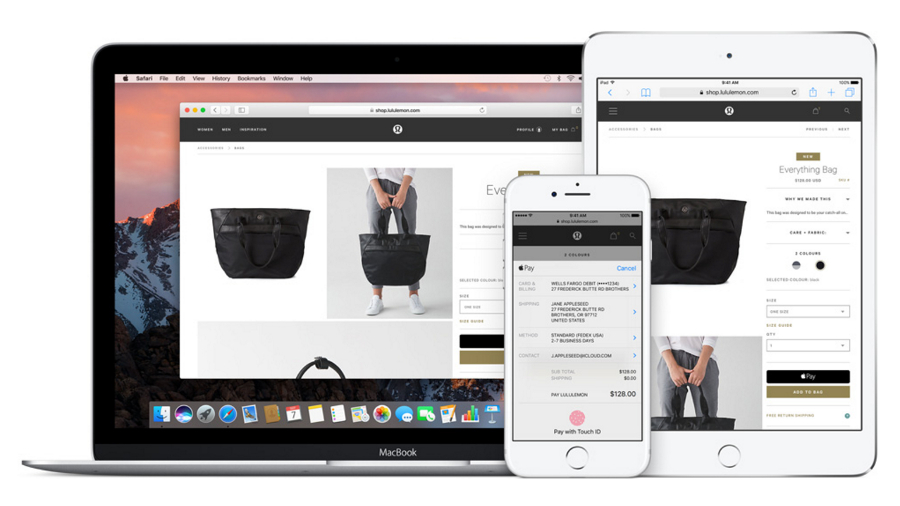

Google is playing catch-up, but Android Pay store locations number 700,000 in the US - too many to list. There are also 1,000 Android apps that plan to use the mobile payment platform.

McDonald's, Chipotle and Subway have fast food covered, while major retailers include Best Buy, Macy's and Walgreens. Coke rival, Pepsi, also signed on, in case you were wondering.

Basically, anywhere you see the new Android Pay or generic NFC logo, your phone will let you make a purchase without swiping your card. That should keep it on par with Apple Pay.

Visa, Mastercard, American Express and Discover are all onboard with Android Pay too, and nine major banks like Bank of America, Chase, Citi, Capital One are here.

Credit and debit cards can be enabled right within bank apps as well, giving users a second way to add their information for Android Pay.

But will Android Pay be a success?

Android Pay is a little more streamlined than Apple Pay, but that in no way means Google's new mobile payments push is going to be as much of a success.

First, it's only being promised for the US. Like iPhone's digital wallet, Google is staying silent on its UK and Australian launch plans. Country-by-country rollout may decide the winner, especially when it comes to China and India.

On one hand, Google's security is akin to Apple Pay. Its tokenization method means retailers never see your actual credit or debit card number, just a virtual account number. On the other, Android users have proven to be more susceptible to hijacking and data mining apps.

Then there's the fact that while Android Pay is getting a bigger push than Google Wallet, it won't get as much attention out of the gate with one single device launch. And Apple could add these Coke and other loyalty rewards in iOS 9 and catch up in an instant.

Nevertheless, you can't deny the appeal of a free Coke and tap-to-pay after bypassing the lockscreen. Right now, it's refreshing to see Google pushing new ideas forward.

Android Pay is set to be coupled with Android M when the new operating system update launches later this year, while phone users with Android 4.4 KitKat and above can expect it "soon."

- More reinvented software at IO: Google Photos review