Best payroll software for Australia of 2025

Make it easier to manage wages and benefits with the best payroll software for small business

Globalization has meant the best payroll software marketplace has grown a lot in the last few years. As a result, small business owners now have much more choice, which is a great thing for SMEs. It allows them to get many of the same features and functions as large corporations and generally at very competitive rates.

1. Best overall

2. Best for versatility

3. Best dependable

4. Best for SMEs

5. Best mobile-friendly

6. Best no-frills

7. Best for ease-of-use

8. Best for time tracking

9. Best for small business

10. Best simplified

11. Best one-stop option

12. FAQs

13. How we test

Therefore, when choosing the best payroll software in Australia you’re definitely likely to find something that fits your needs, regardless of the size of your company. Thanks to cloud convenience, most if not all of the respected payroll providers can be used no matter where your business location happens to be. Product interfaces are tweaked and currency settings adapted to ensure compliance with the likes of localised employment laws and taxes.

In the case of Australia, where our businesses can often be spread out and found in some of the remotest locations, this sort of convenience is a major bonus. Check through our guide to find a payroll provider that ticks all of your required boxes and then hit them up for a quote. Remember the global approach, which should mean you’ll get a product that’s custom tailored to suit your needs, with a price tag to match. The same applies if you're looking for the best HR software too.

When narrowing down on the best payroll software for Australia, we looked for useful and reliable features, like unlimited payroll runs, easy employee and administrative access, and a simple interface. We also looked at the quality of their customer support across phone, email, and chat, along with the documentation available for learning.

Here we feature the best payroll software platforms currently available.

We've also highlighted the best free software for small businesses and the best tax software.

Best payroll software for Australia of 2025 in full:

Why you can trust TechRadar

Best overall

Specifications

Reasons to buy

Reasons to avoid

Paychex provides a full range of full HR solutions for business, to cover the entire employee lifecycle, including of course Payroll.

This means covering everything from recruitment to onboarding, payroll and benefits, as well as development and training. The software's interface is quite straightforward and accessing employee records and payroll is easy.

Paychex also ensures regulatory compliance and mitigating risk. It does this through a combination of self-service computer software for easier employee management, to personalized support to ensure you're getting the help you need. Performance management also ensures that employee development works in line with your business strategy.

Because Paychex has offices across the world, the company can offer competitive benefits and insurance packages for employees on a par with those offered by Fortune 500 companies.

Read our full Paychex review.

Paychex - flexible packages to suit all businesses

Get the best deal for your business by answering a few questions and you'll be able to get a tailored solution that covers everything from recruitment to onboarding, payroll, benefits and more besides. Get a free consultation with a solutions specialist.

Best for versatility

Reasons to buy

Lots of businesses are moving to flexible, remote ways of working, and plenty of companies are growing quicker than ever. Rippling is the ideal HR provider if you need a company that can cope with the versatility of modern business.

Rippling offers remote laptop management and instant local tax registration, so you can manage staff no matter where they're located. It also provides a slick, straightforward dashboard that you can use to evaluate data, manage employees, pay salaries and alter employee benefits.

This company offers the sort of benefits you'd expect from the most prestigious organizations, and you can rely on one-on-one support from experts on a complete range of issues.

Rippling is eminently scalable, too: it's easy to upgrade or downgrade your services to match your business needs, and it's simple to stop using Rippling if you want to bring HR in-house. Services are billed using a flat per-employee rate, too.

If you've got a company dominated by remote or flexible working or if your business is growing rapidly, then Rippling could be the HR provider you need thanks to its balance of versatility and features.

Read our full Rippling employee management review.

Rippling - employee management and more

Employee management isn't just about processing payroll, which is why Rippling makes a solid option to consider. Keenly priced, this is a software package that delivers a lot for small business owners, without too much cost. It's easy to use too.

Best dependable

3. Gusto

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

Gusto offers a full-service payroll, incorporating time tracking, compliance, as well as managing taxes and benefits such as medical, dental, and vision plans.

Gusto also integrates with a number of existing accounting software and related platforms, such as Freshbooks, Quickbooks, Aplos, Zipbooks and Xero accounting software.

There are a handful of different plan levels available, with the cheapest offering to cover the basics of payroll, by way of a monthly software fee plus a fee per employee. After that plans offer features such as onboarding, time tracking, accounting, benefits, and document management.

There is also a full-service payroll available, which along with employee self-service, also offers onboarding, directories, surveys, as well as support and a resource center. Although Gusto is a brilliant payroll and HR software choice for small businesses and users who are new to payroll, it may not be ideal for larger companies.

Read our full Gusto Review.

Gusto - the complete payroll solution

Choose a plan that suits your business needs. Packages include Core from $6/mo per person, Complete from $12/mo per person, Concierge from $12/mo per person and Contractor from just $6/mo per person.

Best for SMEs

Specifications

Reasons to buy

Reasons to avoid

Sage Business Cloud Payroll is a payroll platform that makes it easier for businesses and human resource managers to process employ payments. Sporting a quick, four-step pay run, the platform lets you enter hourly or annual pay, and Sage will then handle the rest.

There are tools to process absence, bonuses, expenses, holiday pay, pensions and student loans. Additional features can process PAYE and HMRC tax filing, and there is even a mobile app to manage payroll while on the go.

More than anything, the software is easy and quick to use – you don’t need any experience or training to get around the user interface. However, if you do end up getting confused or experiencing an issue, you can access a 24/7 support service.

What’s worth noting is that this software is aimed squarely at small and medium-sized businesses, and offers transparent pricing.

Read our full Sage Payroll review.

Sage Business Cloud Payroll - feature packed solution

Explore the multiple features and functions of Sage by trying this exclusive offer: Get Sage Payroll today and enjoy 90% off for 4 months. The offer doesn't run for long but Sage always has great deals on the go.

Best mobile-friendly

Specifications

Reasons to buy

Reasons to avoid

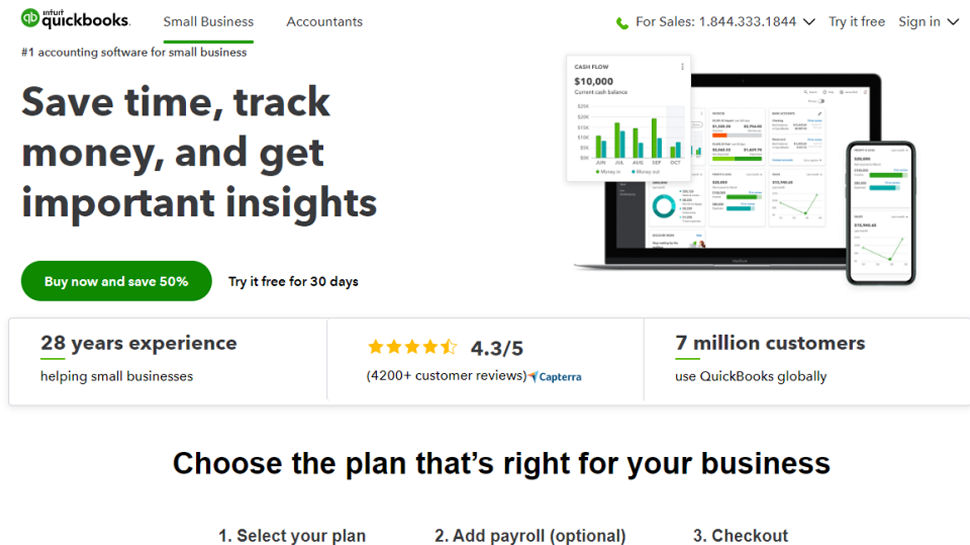

If you are looking for a mobile-friendly payroll application you should definitely take a look at the venerable QuickBooks from Intuit. Working across smartphones, tablets and computers, the software functions as an affordable and easy system for managing employee payments.

Through the platform you will be able to generate pay slips and send them directly to employees, as well as mandatory forms. There is a feature to calculate maternity and sick leave too, and QuickBooks will also remind you to send payments so you don’t forget. You can also quickly access employees and manage pension contributions from one dashboard.

The QuickBooks self-service payroll package has both a monthly cost for the service, plus an additional fee per employee, with fees varying according to the number of features and payment tier required.

Read our full QuickBooks review.

QuickBooks - great deals on one of the best payroll bundles

One of the biggest and best names in the business always has deals and incentives available. For example, save time, track money, and get important insights using a plan that's right for you. Try it free for 30 days or buy now and save 50%.

Best no-frills

Specifications

Reasons to buy

Reasons to avoid

By using Patriot Payroll it’s possible to tackle both your accounting and payroll tasks, with the emphasis on ease of use, especially for small business owners. Patriot also gets a resounding thumbs-up for its efficient support infrastructure. The company has a long-standing pedigree too, with around three decades of experience shaping the look and feel of the current package.

Choose from one of two different packages that include the Accounting Premium option, which lets you handle business expenses, financial affairs and invoicing duties too.

Payroll can be tackled with a full service payroll package option. If you plump for this package you can run Payroll and Patriot deals with the payroll taxes side of things. Opt for the cheaper basic payroll edition and you’ll need to handle payroll and payroll taxes yourself.

Lookout for plenty of features, including unlimited payments to vendors, the option or creating expenses and income tracking. There’s also the option for producing unlimited customer invoices, accepting credit card payments, recording payments, importing bank transactions automatically and integration of your accounts with payroll.

Read our full Patriot Payroll review.

Patriot Payroll - affordable options for businesses

Frequently ranked as Best Value for Money, Patriot Payroll delivers easy onboarding, payroll delivery in three simple steps, free USA-based support and free direct deposit. Run unlimited payroll for your business free for 30 days.

Best for ease-of-use

Specifications

Reasons to buy

Reasons to avoid

When searching for a good payroll solution you will generally find that most HR technology companies offer their own payment features or applications. BambooHR, for instance, provides a separate payroll platform that syncs with its employee-management software.

The software allows you to eradicate double entries, add new employees quickly, and track employee hours and bonus payouts. Other features of the platform include time-off tracking, staff database and records, an applicant tracking system, performance management and electronic signatures.

BambooHR offers two tiers of subscription, starting with the Essentials plan at the lower end. The upgrade is the Advantage plan with a gaggle of additional features including support for on-boarding and off-boarding, electronic signatures and custom email alerts. Unfortunately, pricing is opaque, and you'll have to get in touch for a quote.

Read our full BambooHR review.

Bamboo HR - fuss free payroll and more

Get a free price quote for one of Bamboo HR's packages that include everything needed to keep your business running efficiently.Choose from Essentials or Advantage options, which come with a complete collection of features and functions aimed at improving efficiency.

Best for time tracking

Specifications

Reasons to buy

Reasons to avoid

Hourly payroll covers other crucial areas of your business, with unlimited payroll runs, direct deposit and paper checks, automatic tax filing and more all featuring as part of the package. Lookout too for easy handling of garnishments and benefits, while the combination of Time Tracking and Payroll offers the added benefit of smart works comp insurance. Priority phone support is included too.

If you’re looking for a combination of payroll and time management software, with a worker’s comp insurance package also included Hourly is well worth investigating. It’s already doing a decent job of rivalling the likes of Gusto and OnPay, with two plan options including Time Tracking, Payroll or a combination package that includes both.

Opting for the combination deal lowers the cost overall. You can also experience it by requesting a demo if you’d like to see exactly how it ticks.

Features are many and varied, with the Time Tracking package including the ability to track time for all of your workers with the benefit of automatic timesheet creation and GPS clock-ins. Overtime and breaks can also be monitored with ease and it’s all supplemented with detailed reports and audit logs.

Read our full Hourly review.

Hourly - quick and easy payroll

Hourly is the payroll app for small business owners who hate paperwork. Choose from the Gold edition, $6/mo Per person + $40/mo Base or Platinum for $10/mo Per person + $60/mo Base.

Best for small business

Specifications

Reasons to buy

Reasons to avoid

The benefit of Workful for small business owners has to be its ability to cover many bases at once thanks to payroll, HR and timesheets all being handled within one package. Developed by the people who brought TaxSlayer to market, this is an easy to use option that has a relatively straightforward setup process.

Pricing is keen too, with a free 30-day trial and the single tier pricing helps to keep things even simpler while still offering payroll, time tracking and a host of employee tools too.

For the payroll aspect of the package you get unlimited payroll runs, multiple pay rates, built-in time tracking, state/federal tax forms and integration with QuickBooks. On top, you can also prepare tax forms, create reports, produce electronic paystubs and carry out direct deposits.

In addition, users get an employee portal for forms, onboarding tools, check printing and everything can be access from any location. Time tracking follows suit with more on the features front, including payroll syncing, automatic calculation of overtime and hours plus PTO tracking. It also delivers customized policies and there are multiple accrual methods.

Employee tools add another edge to the feature set, with the aforementioned employee portal allowing easy onboarding, expense tracking and a place to store documents and file for mileage reimbursement.

Read our full Workful review.

Workful - One price payroll deals

Enjoy the benefit of payroll, time tracking and lots of employee tools with a package from Workful. Explore the benefits with a free 30-day trial and then pay $25/month + $5/employee/month.

Best simplified

Specifications

Reasons to buy

Reasons to avoid

The appeal of Uzio is its SaaS-based package that lets you streamline many of your business administration tasks into one single online platform. You get plenty of tools for getting the job done too, with everything from HR issues through to tax affairs all covered by the package. Add in the ability to manage records, ensure compliance and cover payroll duties and you have many business bases covered.

This cloud-based package does need to be tailored to fit your business, which means there are no off-the-shelf pricing options available. However, this will probably prove more favourable to businesses as it can be scaled to suit the requirement, with the likes of onboarding new employees, time-tracking, PTO and personnel tracking all on offer for companies of varying sizes.

Payroll is similarly well covered, with a fully integrated cloud-based system that integrates with the HR side of things. Therefore, your business can manage payroll, handle taxes, salaries of employees and then carry out year-end reporting all within the same application. That’s always going to be a bonus.

Automation is central to a lot of what Uzio does too, which, combined with intuitive dashboards and controls, makes multi-tasking a doddle. Uzio also offers a high level of employee self-service access too.

Read our full Uzio review.

Uzio - Transparent pricing and no hidden fees

Pick from a range of payroll packages that can be tailored to suit your business. Payroll from $4.50/month per employee + $30pm or sign up today to get the benefit of a 30-day free trial. Uzio also has HRIS, time tracking and more for your business needs.

Best one-stop option

Specifications

Reasons to buy

Reasons to avoid

Small business users looking for a cloud-based package that can handle HR tasks and payroll will find Zenefits a good fit. It features three different variations on the theme, starting with Essentials which features HR, time and scheduling, integrations and a mobile app as part of the package.

The packages do have a minimum of 5 employees requirement however. If your business has less, you’ll still effectively be paying for at least 5. No matter, as Zenefits delivers the goods with its next option, the Growth package, which includes core HR, time and scheduling, integrations and a mobile app. On top of that there are compensation management and performance management tools.

Meanwhile, a Zen package rounds it out, and features all of the elements of the Growth bundle plus Wellbeing tools and the option for carrying out employee engagement surveys. Of course, Zenefits revolves around its powerful HR tools, from general administration through to onboarding and performance reviews.

The useful thing is that the HR data can also be used to tackle benefits options for employees and can be used to cover payroll, which is now an included part of the package. On top of that there are additional advisory services, which gets you unlimited access to a team of HR and payroll experts.

However, there is an additional cost per employee for this. Another cost option is the ability to carry out benefits administration using your own broker. In addition, the payroll aspect comes with reporting tools plus tax and filing assistance.

Read our full Zenefits review.

Zenefits - Plans to suit all budgets

Zenefits has a great selection of packages including Zen at just $21 down from $27 per month per employee, Growth at $18 down to just $14 per month per employee or the super value Essentials at $8 per month per employee, down from $10. Lookout too for special one-day offers.

Also consider

While our main listing includes the top names in payroll software there are many other options to choose from. If you're in business and have employees you'll also need software to help handle HR requirements. There are payroll software packages that make this possible, all from within one interface. Others let you tackle numerous admin chores too, all within the confines of one bundle.

Here's our selection of other best payroll software packages worth considering.

Square Payroll - basic but practical

While it may not bristle with quite as many bells and whistles as some of its payroll counterparts, Square Payroll is mighty handy. This is especially so if you already make use of other Square apps in the portfolio, most notably for processing payments through your business using point of sale products. Get started for free.

SurePayroll - Great all rounder

Small business users with reasonably modest needs will find the power and potential behind SurePayroll ideal. It offers quick and easy payroll processing, but it's also useful for handling and managing company data. SurePayroll can also be easily adapted to suit the needs of businesses working across a variety of industries.

OnPay - power packed payroll and HR

If you're looking for a one-stop payroll and HR solution OnPay is well worth further investigation. It has a great selection of scalable features, which make it suitable for business of all shapes and sizes. Competitively priced, OnPay is also free to set up.

FAQs

What is payroll software for Australia?

Payroll software is an essential tool for companies to manage their accounting and payroll processes. This software simplifies otherwise arduous processes, like managing employee salaries, wages, and deductions, and it integrates with existing HR or accounting systems.

How to choose the best payroll software for Australia?

In order to compile our best payroll software for Australia list, we tried all of the software options available over a period of time. This allowed us to evaluate all of the features and functions designed to help small and medium-sized business work more efficiently.

If you run a business and have employees then a good quality, robust payroll package is invaluable for letting you get the task completed. Processing payroll doesn't just involve producing checks and direct deposits either because you'll want to have a payroll system that can help you with calculating taxes correctly and staying on top of other accounting chores.

Quite how many features and functions you'll need from your payroll software largely depends on how big your business is. While larger brands such as Sage and QuickBooks can often be easily scaled up as you need more functionality, it may be an idea to stick with a smaller scale, slightly cheaper option. After all, there's no point in paying for the best payroll software if it contains more features than you actually need.

How we test

We look for a solid collection of features and functions when we test the best payroll software for Australia. That means we're on the lookout for unlimited payroll runs, options for administrative and employee access, plus cover for things like health benefits and workers comp.

Given that payroll software can frequently have its complicated aspects we always make a point of checking the customer support side too. This should ideally include phone, email and chat options, supplemented by plenty of documentation and training where possible.

Read how we test, rate, and review products on TechRadar.

Get in touch

- Want to find out about commercial or marketing opportunities? Click here

- Out of date info, errors, complaints or broken links? Give us a nudge

- Got a suggestion for a product or service provider? Message us directly

- You've reached the end of the page. Jump back up to the top ^

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.