Best stock trading apps

Trade on the go

The best stock trading apps make it simple and easy to to trade online, whether you're at home or on the go, using your smartphone.

Click the links below to go to the provider's website:

This has become possible because apps have revolutionized the way people interact with the world’s financial markets and stock exchanges. Today, the best stock trading apps can help you monitor market trends, make investments, and learn about the world of finance.

Stock trading app developers are constantly innovating and adding new features to make portfolio management easier to do on the go. Many of the latest-gen trading platforms now feature AI-based tools to help you evaluate investment risks. Because these apps are frequently standing in for human brokers, who would traditionally provide insights into potential market scenarios, it’s vital you find a service that enables you to make prudent decisions about your assets.

Trading on your mobile might be easier than ever, but with an expanding selection of services to choose from, working out which to use remains a challenge for many first-time users. To narrow down your choices, decide what your priorities are before downloading a stock trading app.

Will you be making trades frequently? If so, find a trading app that comes with free trades. On the other hand, if you want to put together a stable portfolio and watch your nest egg grow over the years, the cost of performing an individual trade matters less.

Here then are the best stock trading apps currently available.

- We've also featured the best personal finance software.

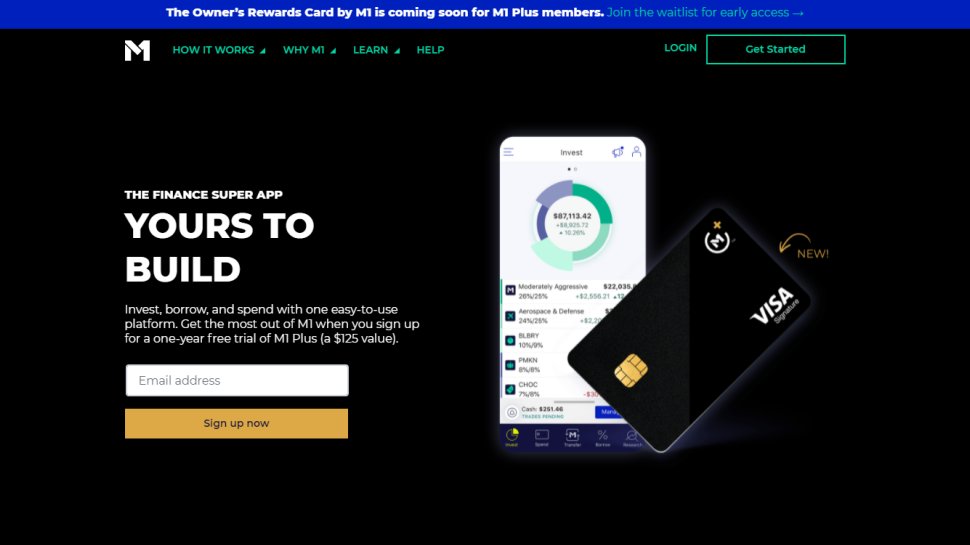

1. M1 Finance

Reasons to buy

Reasons to avoid

Based in Chicago, M1 Holdings Inc is a robo-advisor financial services company that produces the M1 Finance app for Android and iOS devices. You can also make use of the M1 Finance platform on your desktop too, thanks to a handy web interface. Unlike other robo-advisors, M1 Finance enables you to take full control of your investments.

M1 Finance is notable for its well-rounded finance package, which it refers to as Smart Money Management. Besides making investments, you can use the app to borrow — as long as you have $10,000 invested — and spend, with an M1 checking account and debit card.

When it comes to trading stocks, you’ll find that M1 enables you to assemble your portfolio as you see fit, thanks to an impressive suite of automated investing features. With M1, You can decide to base your investing strategy around individual stocks, low-risk ETFs, or create a hybrid of both.

Trading with M1 works through a system of so-called investment Pies. A Pie contains up to 100 Slices, each representing an investment such an ETF, stock, or a different Pie. Once you’ve created your Pie, the app will automatically purchase investments in proportion with your selection. Pre-made investment Pies are also available.

Happily, M1 is totally free from trading fees. That means no maintenance payments, no trading commissions, and zero up-charging for deposits or withdrawals. However, the platform will charge you for account termination if you close a retirement account early and for inactivity if you have a low balance and don’t use the app for over 90 days.

- Read our full M1 Finance review.

2. TD Ameritrade

Reasons to buy

Reasons to avoid

TD Ameritrade is one of the most influential and popular stock trading services on the market today, and it’s easy to see why.

This broker was one of the first major trading services to remove all commission charges on ETFs and stocks in late 2019. Today, with TD Ameritrade, you can trade commission-free on ETFs, exchange-listed stocks, and options. However, a fee does apply for contracts on options trades. Also, non-US OTC stock trades incur an additional charge.

You can actually access your TD Ameritrade trading account on multiple apps. First up, there’s the TD Ameritrade Mobile App. This is targeted toward relatively simple investments. With it, you can create price alerts, view stock watch lists, and examine charts with custom indicators. If you’re trading stocks for the first time, this will certainly be the right option to use. The app makes it easy to see a summary of your trading activity and access a host of TD Ameritrade content and research to better understand the market.

However, if you’re an experienced trader or day trading rather than using a buy and hold strategy, the thinkorswim app will be a better choice for developing your TD Ameritrade portfolio. This mobile tool is powerful enough that you can use it to develop and execute a complex trading strategy while on the move. The thinkorswim app makes that possible by, essentially, providing the same functionality you’d find in a fully-fledged desktop trading platform, meaning you can stream data in real-time and trade directly from a chart interface.

The TD Ameritrade thinkorswim platform was, in fact, originally launched as a desktop-only tool, which you can still use alongside the mobile application. What’s more, the company recently launched a thinkorswim web edition for a more paired-down trading experience within your browser.

- Read our full TD Ameritrade review.

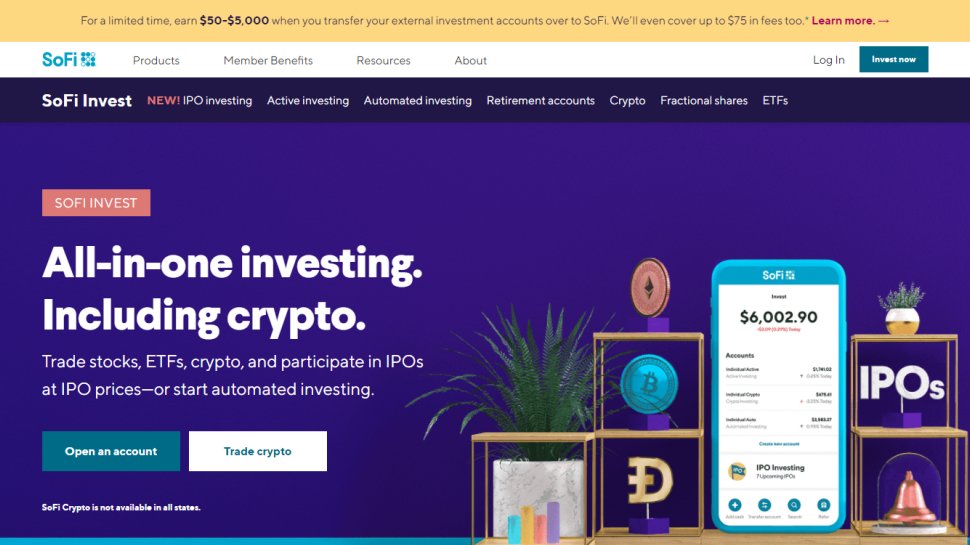

3. SoFi Invest

Reasons to buy

Reasons to avoid

There are plenty of complex stock trading apps out there that can help hardened investors make decisions about their trades based on the market’s latest fluctuations, but that’s not what SoFi Invest is for. This app is self-consciously aimed at users who want a streamlined, user-friendly trading experience and guidance about what stocks to purchase.

SoFi offers two main account types, Active Investing and Automated Investing. Both of these work alongside other SoFi financial products — such as loan refinancing — and can be used to access a range of stocks and ETFs

A SoFi Invest Automated Investing trading account is effectively a robo-advisor service where the platform decides how to handle a portfolio on your behalf. This option is worth considering if you want an almost completely hands-off stock trading experience. When you sign up for an Automated Investing account, the platform will ask a few questions about your risk preferences and then suggest an appropriate pre-made portfolio. Most robo-advisory tools charge management fees of up to 0.5% per year, but SoFi’s is totally free.

On the other hand, SoFi’s Active Investing accounts are totally self-directed, so you can decide exactly how to divide up your capital between different ETFs and stocks. Like many of the other best stock trading apps we’ve assembled here, SoFi is commission-free so you can make as many trades as you want without paying a cent.

One of the coolest things about SoFi is what the company refers to as Stock Bits. These are effectively fractional shares that can be purchased by dollar amount. You can use Stock Bits to get a slice of your favorite companies without having to commit to an entire share.

Although it lacks some of the advanced search tools, metrics, and customizability you’ll find with other stock trading tools, the SoFi Invest app design is clear and easy to navigate on desktops and mobile. This makes the platform an ideal option if you don’t want to be overwhelmed by stats each time you log in to check on your holdings.

4. Fidelity

Reasons to buy

Reasons to avoid

Fidelity Investments is a reputable global stockbroker that was originally founded in 1946. Like TD Ameritrade, if you open an investment portfolio with Fidelity, you’ll be able to manage it through multiple mobile, web, and desktop applications.

If you want a capable service that provides access to a wide range of asset classes and holdings, Fidelity could well be the brokerage for you. Unlike many of the simpler stock trading apps featured here, you can actually choose your base currency — 16 are available — and you can use Fidelity to invest in non-US stocks and bonds.

So that you can monitor your investments wherever you are, the standard Fidelity app is compatible with a large selection of devices including Apple TVs and Amazon products.

No matter what you install the Fidelity app on, you’ll be able to use it to find detailed charts and important data to inform your investing strategy. On the app, you’ll be able to request real-time quotes, access the broker’s latest research, and set up multi-leg options trades. In case you run into trouble, you can call a Fidelity representative from within the app itself.

To enhance and complement Fidelity’s core app, the company has recently released Fidelity Spire, a free tool to help match your investments with your financial goals. Also available is Fidelity’s Active Trader Pro, which can be used to create a tailor-made news feed for day trading. If you have sufficient assets held with Fidelity, another desktop tool, known as Wealth-Lab Pro, can be used to test and develop advanced trading strategies.

5. Stash

Reasons to buy

Reasons to avoid

Stash was founded to make stock trading accessible for inexperienced investors. To facilitate easy multi-portfolio investing, Stash supports micro-investing with fractional stocks. That means that, like with SoFi’s Stock Bits, you don’t have to put up the cash to purchase an entire share.

A complete lack of account minimums similarly makes Stash a worthy option for newbie investors. You can open and begin investing with whatever level of capital you have access to.

Even better, Stash will actually help you to find extra funds to expand your investment portfolio through something called Automated Investments and SmartStash. If you enable these options, whenever you buy something using a Stash-linked account, the platform will automatically round up your purchase to and invest the additional cash. If you buy a $3.55 latte, for example, Stash will withdraw and invest an extra $0.45.

So that you can make prudent choices about where to put your cash, Stash provides plenty of easy-to-digest information about any ETF or stock it recommends investing in. This includes a brief synopsis regarding the nature of the investment, a price ticker, and a visual depiction of the risk associated with investing.

Stash works on a monthly subscription model that costs between $1 and $9 per month depending on the level of functionality you require access to. To open a retirement account or a custodial plan, for instance, you’ll need to upgrade to one of the move expensive Stash subscriptions.

- Read our guide to the best forex trading apps.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.