AMD Ryzen CPUs are selling well and making steady gains as the CPU market looks to be recovering – but how will Intel respond?

With the threat of Zen 5 on the horizon as well, Intel needs to be on its toes

AMD’s Ryzen processors are slowly gaining market share in the CPU world, going by some fresh figures.

Wccftech reported on the latest estimations of desktop processor shipments from analytics firm Mercury Research, in which AMD grabbed turf from Intel, albeit to a modest extent.

Mercury’s stats show that in the final quarter of 2023 (Q4), AMD increased its desktop CPU share to 19.8% compared to 19.2% in Q3. That’s up 0.6%, and it’s up more over the past year, at a 1.2% gain compared to Q4 of 2022. So there’s been a fair old uptick in market share over the course of last year for Ryzen chips.

Mind you, most of that movement happened in Q1 2023, and Q4, with things staying rather flat in the two quarters between.

AMD’s laptop processors also gained share, going up to 20.3% in Q4 2023 compared to 19.5% the previous quarter, so that’s an even bigger shift upwards of 0.8% for mobile silicon.

Wccftech also pointed out new figures on the CPU market from Jon Peddie Research. These didn’t give us any relative breakdown between AMD and Intel, but did show that total CPU shipments were up 7% in Q4 2023 compared to the previous quarter, and up a whopping 22% year-on-year. (Although this includes mobile chips, so it’s not a desktop processor-only metric).

Still, it’s a healthy sign for the CPU market overall, of course, which appears to be recovering nicely.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Analysis: Chipping away at Intel’s turf

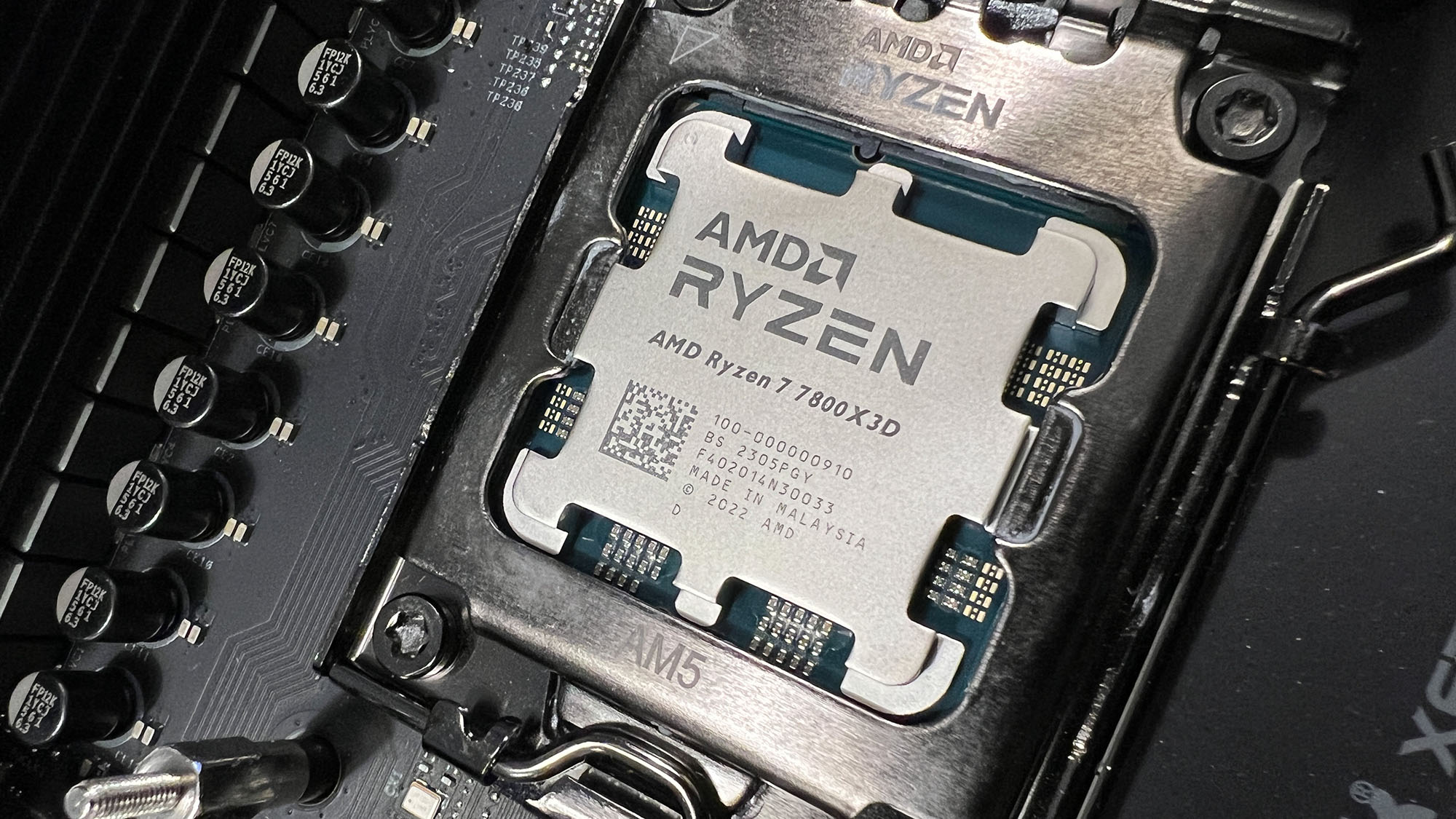

Clearly this is good news for AMD, although as mentioned, it’s more like steady upward progress than any big leaps. But we have to remember that Team Red hasn’t pushed out any major launches in the second half of 2023. (We did get new chips in the first half of the year, notably X3D models for the Ryzen 7000 family, and a few other vanilla non-X chips for the range).

Meaning that AMD hasn’t gained this momentum off the back of any big new releases, it has just been chipping away at Intel’s sales with its existing line-up (mostly).

We witnessed some compelling price reductions towards the tail-end of last year with Ryzen CPUs – including discounts for the excellent-for-gamers Ryzen 7800X3D, and Black Friday price slashes on even premium chips like the Ryzen 9 7950X3D – and that’s probably part of the reason for the improved traction with AMD sales.

Perhaps the arrival of Intel’s Raptor Lake Refresh, and some disappointment around much of that line-up being rather pedestrian (with one notable exception) might have also led to some buyers heading AMD-wards, too.

Whatever the case, AMD will clearly be looking to build on this momentum in the desktop sphere in 2024, and with Zen 5 CPUs (Ryzen 8000 or 9000 models) set to arrive later this year, Intel needs to take this threat seriously.

We can’t be sure when Intel’s next-gen rival desktop chips, Arrow Lake, will arrive, but Team Blue really needs to ensure they’re not far behind Zen 5. Currently, the rumor mill believes that AMD will be first to market – the danger for Intel is that if Arrow Lake arrives too late in 2024, this gives AMD a distinct window of opportunity for a further push off the back of that silicon. Both of those next-gen ranges are highly anticipated and are likely to grab positions on our ranking of the best processors.

If Intel can’t get Arrow Lake out in a timely enough manner compared to the Zen 5 release timeframe, Team Blue may have to look to price cuts for existing CPUs in order to better compete – and not lose further desktop territory.

You might also like

Darren is a freelancer writing news and features for TechRadar (and occasionally T3) across a broad range of computing topics including CPUs, GPUs, various other hardware, VPNs, antivirus and more. He has written about tech for the best part of three decades, and writes books in his spare time (his debut novel - 'I Know What You Did Last Supper' - was published by Hachette UK in 2013).