The Meta Quest 3’s popularity is proof a cheap Vision Pro can’t come soon enough

The Quest 2 and 3's success is a lesson to other VR headsets

The Oculus Quest 2 has been the most popular VR headset in the world for the past couple of years – dominating sales and usage charts with its blend of solid performance, amazing software library and, most importantly, affordability.

Now its successor – the Meta Quest 3 – is following in its footsteps.

Just four months after launch it’s the third most popular headset used on Steam (and will likely be the second most popular in the next Steam Hardware Survey). What’s more, while we estimate the Quest 3’s not selling quite as well as the Quest 2 was at the four-month mark, it still looks to be a hit (plus, lower sales figures are expected considering it’s almost double the launch price of the Quest 2).

Despite its higher cost, $499.99 / £479.99 / AU$799.99 is still relatively affordable in the VR space, and its early success continues the ongoing trend in VR that accessibility is the make or break factor in a VR gadget’s popularity.

There’s something to be said for high-end hardware such as the Apple Vision Pro bringing the wow factor back to VR (how can you not be impressed by its crisp OLED displays and inventive eye-and-hand-tracking system), but I’ll admit I was worried that its launch – and announcement of other high-end, and high-priced, headsets – would see VR return to its early, less affordable days.

Now I’m more confident than ever that we’ll see Apple’s rumored cheaper Vision Pro follow-up and other budget-friendly hardware sooner rather than later.

Rising up the charts

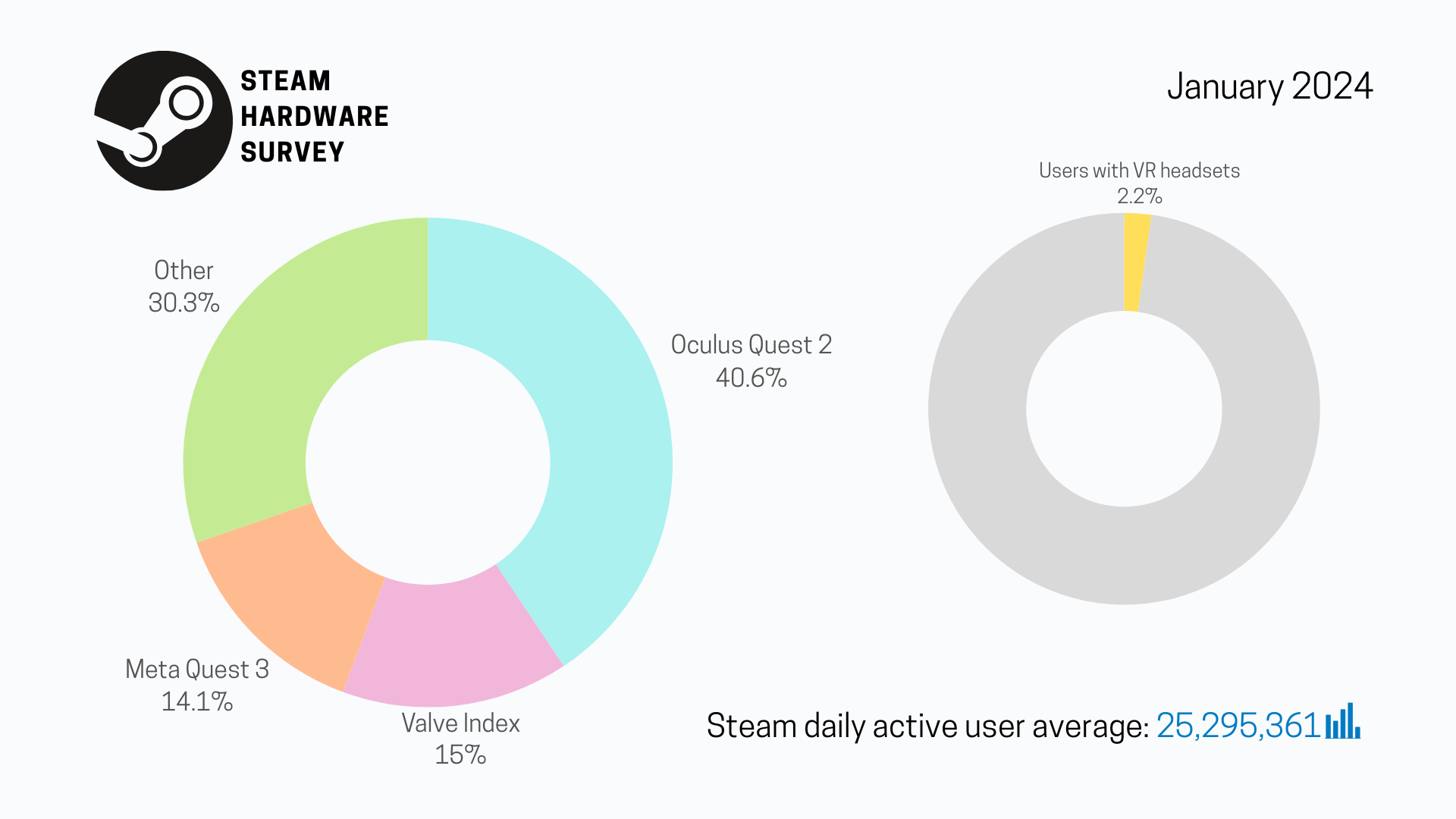

According to the Steam Hardware Survey, which tracks the popularity of hardware for participating Steam users, 14.05% of all Steam VR players used a Quest 3 last month. That’s a 4.78% rise in its popularity over the previous month’s results and means it’s within spitting distance of the number two spot, which is currently held by the Valve Index – 15% of users prefer it over other VR headsets, even three-and-a-half years after its launch.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

It has a ways to go before it reaches the top spot, however, with the Oculus Quest 2 preferred by 40.64% of Steam VR players. The Quest 3’s predecessor has held this top spot for a couple of years now, and it’s unlikely to lose to the Quest 3 or another headset for a while. Even though the Quest 3 is doing well for itself, it’s not selling quite as fast as the Quest 2.

Using Steam Hardware Survey data for January 2024 (four months after its launch) and data from January 2021 (four months after the Quest 2’s launch) – as well as average Steam player counts for these months based on SteamDB data – it appears that the Quest 3 has sold about 87% as many units as the Quest 2 did at the same point in its life.

Considering the Quest 3 is priced at $499.99 / £479.99 / AU$799.99, a fair bit more than the $299 / £299 / AU$479 the Quest 2 cost at launch, to even come close to matching the sales speed of its predecessor is impressive. And the Quest 2 did sell very well out of the gate.

We don’t have exact Quest 2 sales data from its early days – Meta only highlights when the device passes certain major milestones – but we do know that after five months, its total sales were higher than the total sales of all other Oculus VR headsets combined, some of which had been out for over five years. Meta’s gone on to sell roughly 20 million Quest 2s, according to a March 2023 leak. That's about as fast as the Xbox Series X is believed to have sold, which launched around the same time.

This 87% of Quest 2 sales figure can be taken with a pinch of salt – you can find out how I got to this number at the bottom of this piece; it required pulling data from a few sources and making some reasonable assumptions – but that number and the Quest 2 and 3’s popularity on Steam shows that affordability is still the most powerful driving force in the VR space. So, I hope other headset makers are paying attention.

A scary expensive VR future

The Apple Vision Pro is far from unpopular. Reports suggest that between 160,000 and 200,000 preorders were placed on the headset ahead of its release on February 2, 2024 (some of those orders have been put on eBay with ridiculously high markups and others have been returned by some disappointed Vision Pro customers).

The early popularity makes sense. Whatever Mark Zuckerberg says about the superiority of the Quest 3, the Apple Vision Pro is the best of the best VR headsets from a technical perspective. There’s some debate on the comfort and immersive software side of things, but eye-tracking, ridiculously crisp OLED displays, and a beautiful design do make up for that.

Unfortunately, thanks to these high-end specs and some ridiculous design choices – like the outer OLED display for EyeSight (which lets an onlooker see the wearer’s eyes while they're wearing the device) – the headset is pretty pricey coming in at $3,499 for the 256GB model (it’s not yet available outside the US).

Seeing this, and the instant renewed attention Apple has drawn to the VR space – with high-end rivals like the Samsung XR headset now on the way – I’ll admit I was a little concerned we might see a return to VR’s early, less accessible days. In those days, you’d spend around $1,000 / £1,000 / AU$1,500 on a headset and the same again (or more) on a VR-ready PC.

Apple has a way of driving the tech conversation and development in the direction it chooses. Be it turning more niche tech into a mainstream affair like it did for smartwatches with the Apple Watch or renaming well-established terms by sheer force of will (VR computing and 3D video are now exclusively called spatial computing and spatial video after Apple started using those phrases).

While, yes, there’s something to be said for the wow factor of top-of-the-line tech, I hoped we wouldn’t be swamped with the stuff while more budget-friendly options get forgotten about because this is the way Apple has moved the industry with its Vision Pro.

The numbers in the Steam Hardware Survey have assuaged those fears. It shows that meaningful budget hardware – like the Quest 2 and 3, which, despite being newer, have less impressive displays and specs than many older, pricier models – is still too popular to be going anywhere anytime soon.

If anything, I’m more confident than ever that Apple, Samsung, and the like need to get their own affordable VR headsets out the door soon. Especially the non-Apple companies that can’t rely on a legion of rabid fans ready to eat up everything they release.

If they don’t launch budget-friendly – but still worthwhile – VR headsets, then Meta could once again be left as the only real contender in this sector of VR. Sure, I like the Meta headsets I’ve used, but nothing helps spur on better tech and/or prices than proper competition. And this is something Meta is proving it doesn’t really have right now.

Where did my data come from?

It’s important to know where data has come from and what assumptions have been made by people handling that data, but, equally, not everyone finds this interesting, and it can get quite long and distracting. So, I’ve put this section at the bottom for those interested in seeing my work on the 87% sales figure comparison between the Oculus Quest 2 and Meta Quest 3 four months after their respective launches.

As I mentioned above, most of the data for this piece has been gathered from the Steam Hardware Survey. I had to rely on the Internet Archive’s Wayback Machine to see some historical Steam Hardware Survey data because the results page only shows the most recent month’s figures.

When looking at the relative popularity of headsets in any given month, I could just read off the figures in the survey results. However, to compare the Quest 2 and Quest 3’s four-month sales to each other, I had to use player counts from SteamDB and make a few assumptions.

The first assumption is that the Steam Hardware Survey’s data is consistent for all users. Because Steam users have to opt-in to the survey, when it says that 2.24% of Steam users used a VR headset in January 2024, what it really means is that 2.24% of Steam Hardware Survey participants used a VR headset that month. There’s no reason to believe the survey’s sample isn’t representative of the whole of Steam’s user base, and this is an assumption that’s generally taken for granted when looking at Hardware Survey data. But if I’m going to break down where my numbers come from, I might as well do it thoroughly.

Secondly, I had to assume that Steam users only used one VR headset each month and that they didn’t share their headsets with other Steam users. These assumptions allow me to say that if the Meta Quest 3 was used for 14.05% of Steam VR sessions, then 14.05% of Steam users with a VR headset (which is 2.24% of Steam’s total users) owned a Quest 3 in January 2024. Not making these assumptions leads to an undercount and overcount, respectively, so they kinda cancel each other out. Also, without this assumption, I couldn’t continue beyond this step as I’d lack the data I need.

Valve doesn’t publish Steam’s total user numbers, and the last time it published monthly active user data was in 2021 – and that was an average for the whole year rather than for each month. It also doesn’t say how many people take part in the Hardware Survey. All it does publish is how many people are using Steam right now. This information is gathered by SteamDB so that I and other people can see Steam’s Daily Active User (DAU) average for January 2021 and January 2024 (as well as other months, but I only care about these two).

My penultimate assumption was that the proportion of DAUs compared to the total number of Steam users in January 2021 is the same as the proportion of DAUs compared to the total number of Steam users in January 2024. The exact proportion of DAUs to the total doesn’t matter (it could be 1% or 100%). By assuming it stays consistent between these two months, I can take the DAU figures I have – 25,295,361 in January 2024 and 24,674,583 in January 2021 – multiply them by the percentage of Steam users with a Quest 3 and Quest 2 during these months, respectively – 0.31% and 0.37% – then finally compare the numbers to one another.

The result is that the number of Steam users with a Quest 3 in January 2024 is 87.05% of the number of Steam users with a Quest 2 in January 2021.

My final assumption was that Quest headset owners haven’t become more or less likely to connect their devices to a PC to play Steam VR. So if it's 87% as popular on Steam four months after their respective launches, the Quest 3 has sold 87% as well as the Quest 2 did after their first four months on sale.

You might also like

Hamish is a Senior Staff Writer for TechRadar and you’ll see his name appearing on articles across nearly every topic on the site from smart home deals to speaker reviews to graphics card news and everything in between. He uses his broad range of knowledge to help explain the latest gadgets and if they’re a must-buy or a fad fueled by hype. Though his specialty is writing about everything going on in the world of virtual reality and augmented reality.