The best identity theft protection of 2025: reviewed and ranked by experts

Dark web monitoring, cyber extortion insurance, and credit monitoring - looking for identity theft protection? You're in the right place

If you're looking for expert insights into the best identity theft protection for you, you've come to the right place. Over the past 11 years, we've written thousands of articles about data breaches, the dark web, and identity theft.

Aura is the best identity theft protection service for most people as we have outlined in more detail below. IdentityForce and Experian IdentityWorks are also great services. They all offer everything we look for in the best identity theft protection services and perform very well in our highly detailed testing.

Identity theft protection: Top 3

Best identity theft protection overall

Aura ticks all the boxes for identity theft protection, and offers great customer support options, a free trial, and much more, making it the best pick for most people.

Best identity theft protection for families

IdentityForce offers protection for two adults and an unlimited number of children, making it the best choice for families.

Best identity theft protection for beginners

Experian IdentityWorks is an easy-to-use service with extra alerts, making it the best pick for beginners - and offers excellent credit monitoring as a bonus.

Reader Offer: Save up to 78% on Aura identity theft protection

TechRadar editors praise Aura's upfront pricing and simplicity. Aura also includes a password manager, VPN, and antivirus to make its security solution an even more compelling deal.

Preferred partner (What does this mean?)

The best identity theft protection services 2025:

Why you can trust TechRadar

Best identity theft protection overall

Specifications

Reasons to buy

Reasons to avoid

✅ You want all the bells and whistles: Aura has many features to protect your identity, and it also comes with a VPN, antivirus, and a password manager to boot.

✅ You want to block unwanted calls: Its Call Assistant is included in all family plans, using AI to filter spam and scam calls for you.

❌ You're on a budget: Aura can be quite expensive, so cheaper alternatives such as ADT Identity Protection may be a better option if you're on a budget.

🔒 Aura is a very comprehensive package that offers everything you'd need and more to protect you and your family's identity online. The more premium plans can be quite expensive, though. ★★★★½

Aura has made impressive strides to establish itself as one of the best identity theft protection service. Offering all the critical features you'd expect—including $1 million insurance to cover the costs of identity restoration—it simplifies the protection process through both basic and advanced functionalities.

Partnering with Experian, Aura provides a credit lock feature for easy credit monitoring and a credit score tracker to monitor your progress over time. The platform features an updated graph that displays your credit score and offers personalized improvement tips. A central control panel lets you monitor your credit score, access identity theft protection tools, and safeguard your children's credit. I found this feature particularly useful for tracking which payments were causing the biggest changes in my credit score.

Additionally, Aura allows you to monitor your investment and bank accounts, set transaction limits, and guard your accounts against fraud attempts. It continuously scans the web for potential security breaches, automatically changes passwords, and combats tax refund fraud.

READ MORE ABOUT AURA ▼

Aura's proactive monitoring extends to data brokers, junk mail providers, and spam sources, with the option to remove your data from these entities. It keeps you informed through comprehensive alerts delivered via email or SMS. The Safe Browsing extension enhances web security, and the credit monitoring service provides a holistic package for protecting your identity.

Aura's pricing is tiered: individual, couples, and family. The individual tier is the most budget-friendly, while the couples and family tiers, though pricier, offer more extensive data tracking and unlimited child coverage—ideal for larger families.

The recent design update has made it easier to access needed information with just a few clicks. While Aura focuses mainly on identity theft, bonus features require a bit more navigation. I particularly recommend Aura for its user-friendly interface and organized content, which made it easy to find what I was looking for, with help readily available on most screens and 24/7 support for additional assistance.

I found the web interface to be modern and professional, and both desktop and mobile applications are well-designed. However, the Mac version could use more refinement. Aura's additional online security features should be seen as bonuses—they don't offer the level of protection found in dedicated antivirus software or VPNs, but I found that Aura effectively covers basic security needs. The parental control app is outstanding, and the password manager, though improved, may still lag behind some free options.

While Aura isn't the cheapest identity theft solution, I believe its comprehensive features and thoughtful pricing make it competitive. Flexible pricing plans and thorough protection ensure that Aura is a solid choice for those seeking identity theft protection services. Ultimately, the best option depends on your individual needs and budget.

Read our full Aura review.

Best identity theft protection for families

Specifications

Reasons to buy

Reasons to avoid

✅ You have a big family: IdentityForce supports an unlimited number of children, and has an add-on called ChildWatch that keeps you abreast of concerns relating to your child's identity.

✅ You want to get rid of junk mail: IdentityForce has a useful junk mail opt-out feature that can save your inbox from getting clogged with useless spam.

❌ You want regular credit reports: Credit reports are only given each quarter with IdentityForce, so not great if you want to stay on top of your score.

❌ You want a good mobile app: Looking at the user reviews, both the iPhone and Android apps appear to need some improvement.

🔒 IdentityForce provides multiple features including credit monitoring, bank fraud protection, and efficient ad and malware blocking, plus $1 million in insurance coverage. While the higher-tier plan provides broader protection, it does incur a higher monthly fee. ★★★½

IdentityForce provides identity theft protection services to individuals, families, and government organizations. The basic plan includes social media monitoring and a feature to eliminate junk mail. The top-tier plan adds credit monitoring from the three main credit bureaus, support for freezing your credit to prevent unauthorized accounts being opened in your name, and alerts for investment accounts.

In my testing, I found that the one big downside to IdentityForce is that credit reports are only delivered quarterly. It is also not the most affordable identity protection service available, though it does offer a 30-day free trial. If you prefer a cheaper alternative that also provides 3-bureau credit reporting and robust family protection, Complete ID is worth considering, especially for Costco members who are eligible for discounts. However, I found that Complete ID's interface is not as user-friendly as IdentityForce's.

The IdentityForce family plan offers additional child protection features, such as ChildWatch, and coverage for an unlimited number of children, making it my recommendation for large families.

Read our full IdentityForce review.

- To speak to an expert about how identity theft protection software can keep you secure online, call IdentityForce directly on this toll-free number 888-266-3930.

Best identity theft protection for beginners

Specifications

Reasons to buy

Reasons to avoid

✅ You want good credit monitoring: As expected of an Experian company, credit monitoring is offered by Experian itself, along with Equifax and TransUnion, ensuring comprehensive credit monitoring services.

❌ You want to cancel easily: IdentityWorks does offer a free week-long trial, but you have to buy it first, then cancel if you want your money back.

❌ You want apps: There are no mobile apps for IdentityWorks, so if these are important to you, then Aura, Norton LifeLock and myFICO are better choices.

🔒 Experian IdentityWorks provides reliable credit monitoring, as one would anticipate from the company, but it falls short in other areas. The absence of mobile applications and a stringent cancellation policy may deter potential users from choosing this service.★★★1/2

Experian IdentityWorks serves as an alluring gateway into the realm of identity protection. With its longstanding reputation in credit reporting, Experian extends its expertise to provide comprehensive credit monitoring services. This encompasses all three prominent credit bureaus: Experian, Equifax, and TransUnion. By leveraging this expansive coverage, Experian IdentityWorks ensures that your credit information is meticulously scrutinized and protected.

The credit monitoring feature offered by Experian IdentityWorks enables you to keep a watchful eye on your credit reports, promptly detecting any suspicious activities or unauthorized changes. This proactive approach allows you to address potential threats swiftly, minimizing the risk of fraud or identity theft. Additionally, Experian IdentityWorks provides regular credit score updates, which were super helpful to help keep on top of my financial well-being and offered advice on making informed decisions regarding credit management.

Beyond credit monitoring, Experian IdentityWorks offers an array of robust identity protection features. It includes dark web monitoring, which scans the hidden corners of the internet where personal information may be compromised or sold.

READ MORE ABOUT IDENTITYWORKS ▼

This feature helps safeguard your sensitive data from falling into the wrong hands and alerts you if any of your personal information is discovered on the dark web. In my testing, I was alerted to 8 potential data breaches that contained one of my emails (yikes).

Experian IdentityWorks also provides identity theft insurance, offering financial protection in the unfortunate event that you become a victim of identity theft. This insurance coverage can assist with expenses related to restoring your identity, such as legal fees, lost wages, and fraudulent charges.

With this service, you get daily reporting and scoring, alerts for significant changes, and dark web monitoring to see if your personal data is exposed online. While the most basic plan is free, it includes minimal features like an Experian credit report, FICO score tracker, and dark web surveillance.

The premium plans offer a more comprehensive suite of features including three-bureau credit monitoring, alerts, and assistance in removing your personal info from certain people finder sites, making it one of the best identity theft protection services for beginners.

Read our full Experian IdentityWorks review.

Best identity theft protection package

Specifications

Reasons to buy

Reasons to avoid

✅ You want great antivirus: Norton is perhaps best known to many for its comprehensive 360 antivirus suite, which is included with LifeLock.

✅ You want other extras: A VPN and a password manager are also included with LifeLock.

❌ You want clear pricing: We found the pricing for LifeLock to be quite confusing, and prices even rise after the first year.

🔒 Norton LifeLock is a good package, complete with the company's industry-leading antivirus suite, plus a VPN and password manager. The pricing isn't something we are too sure of, though. ★★★★

Norton's renowned 360 antivirus suite has solidified its position as a widely recognized name in the digital security landscape. However, Norton's capabilities extend far beyond antivirus protection. The LifeLock bundle takes Norton's security offerings to the next level, combining the robust antivirus suite with a comprehensive identity theft protection package.

At the core of LifeLock's identity theft protection lies its advanced monitoring system. This system continuously scans the dark web, credit reports, and other sensitive data sources for any signs of suspicious activity. In the event of a detected threat, such as unauthorized access to personal information or attempts at identity fraud, LifeLock promptly notifies the user, allowing for swift action to mitigate potential damage.

Furthermore, LifeLock's identity restoration services provide invaluable assistance in the event of identity theft. Dedicated restoration specialists work closely with affected individuals to resolve identity-related issues, including restoring credit scores, removing fraudulent accounts, and contacting government agencies and financial institutions.

READ MORE ABOUT LIFELOCK ▼

Beyond antivirus protection and identity theft protection, LifeLock also includes a password manager and a VPN. The password manager simplifies the task of creating and managing unique, strong passwords for each online account. This eliminates the need to reuse passwords, a common security vulnerability.

The VPN, or virtual private network, encrypts internet traffic, ensuring secure and private online communication. This feature is particularly beneficial when using public Wi-Fi networks or accessing sensitive information online.

By combining these powerful security tools into a single package, LifeLock provides users with an unparalleled level of protection against a wide range of cyber threats. Its comprehensive offerings encompass antivirus protection, identity theft protection, password management, and VPN services, making it an exceptional choice for individuals seeking the best overall security package.

While the basic plan may lack some compared to the best identity theft protection services, it offers up to $1 million in identity theft coverage—a baseline among many services. The plan includes easy-to-use credit locking and firm support if you lose your wallet or encounter identity fraud. However, LifeLock's pricing can be confusing, and prices rise after the first year. LifeLock offers three plans, with the basic one starting at $9.90 per month.

Read our full Norton LifeLock review.

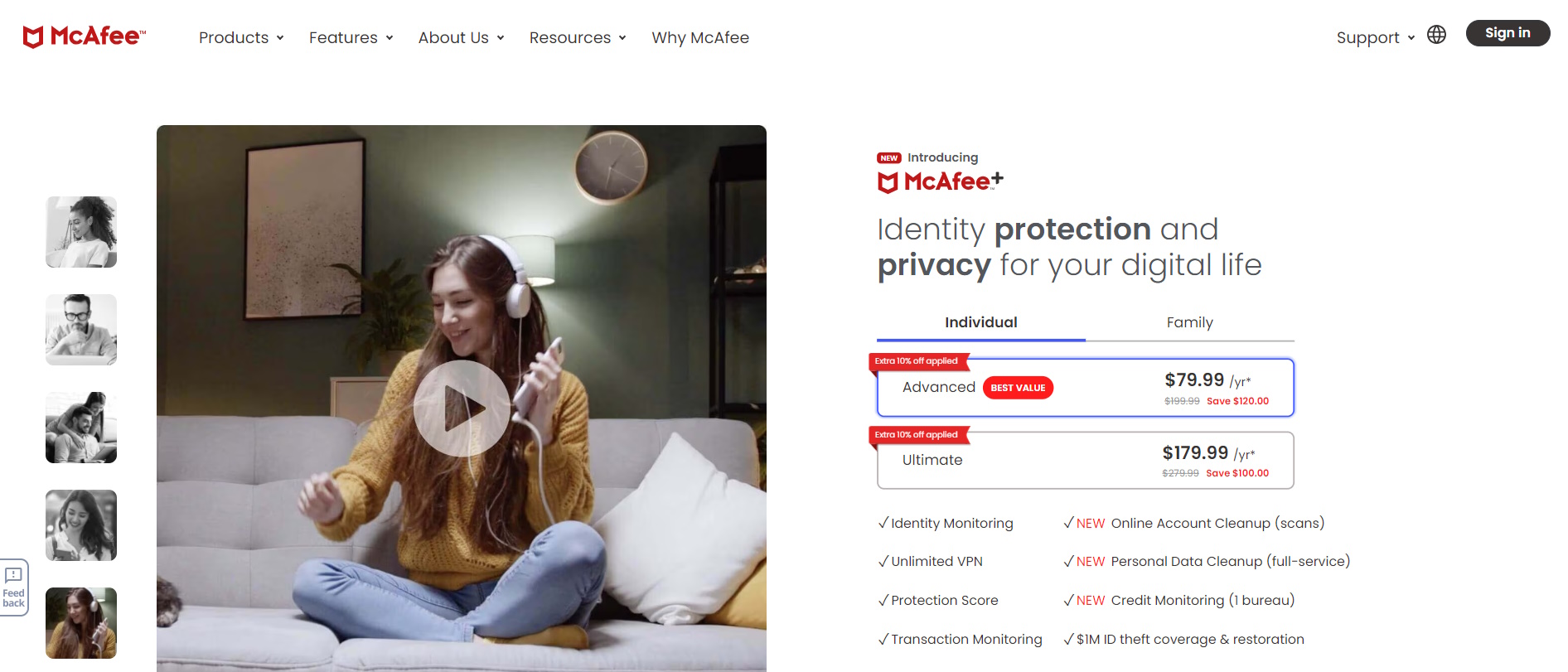

Best identity theft protection for affordability

Specifications

Reasons to buy

Reasons to avoid

✅ You want a package of protection: McAfee Plus is a total package of services for online protection.

✅ You want a top antivirus: As a antivirus provider, McAfee+ comes with one of the best antivirus solutions on the market.

✅ You want to rid the web of your data: A full service personal data cleanup is offered on all plans.

❌ You want to pay monthly: McAfee+ identity protection can only be purchased as an annual plan.

❌ You just want more basic identity protection: The higher price of McAfee Plus, and the annual only payments may be more than some users want to spend for their identity protection.

🔒 McAfee+ offers a great identity theft protection package for individuals and families. The name makes it easier to trust, but the lack of monthly payment options means it is not a flexible option. ★★★★

McAfee Plus, a comprehensive security solution, safeguards your digital life from various online threats. Its robust antivirus protection shields your system from viruses, worms, and malicious programs. The advanced anti-malware engine effectively detects and eliminates malware, including spyware, adware, and ransomware, ensuring your devices remain free of unwanted intruders.

Real-time threat prevention continuously monitors your system for suspicious activities and automatically blocks potential threats before they can cause harm. This proactive approach helps prevent infections and minimizes the risk of data breaches or unauthorized access to your personal information.

McAfee Plus includes a robust firewall that acts as a barrier between your device and the internet. It analyzes incoming and outgoing network traffic, blocking unauthorized connections and preventing malicious software from infiltrating your system, protecting against cyberattacks like phishing attempts and unauthorized remote access.

In addition to these core security features, McAfee Plus offers secure browsing, warning you about potentially dangerous websites and blocking malicious downloads. The identity protection feature monitors your personal information online and alerts you to any suspicious activity, such as attempts to steal your passwords or credit card numbers.

Parental controls allow you to manage your children's online activities, ensuring their safety when browsing the internet. You can set limits on screen time, block inappropriate content, and monitor their online interactions.

McAfee Plus provides peace of mind by protecting your devices and personal data against a wide range of online threats. Its combination of advanced security features and user-friendly interface makes it an excellent choice for anyone seeking a comprehensive and reliable security solution.

Read our full McAfee+ identity protection review.

Best identity theft protection for social media

Specifications

Reasons to buy

Reasons to avoid

✅ You want a licensed private investigator: In the unfortunate event of identity theft, ID Shield offers professional assistance to help you reclaim and restore your identity effectively.

❌ You want a more proactive approach: While IDShield can effectively address identity theft issues after they occur, it would be more beneficial if the service included proactive monitoring and prevention measures to focus more on preventing identity theft in the first place.

🔒 IDShield stands out as a comprehensive identity theft protection app, delivering robust security measures to shield users from potential threats. ★★★1/2

To enhance its brand image and align with its core function, IDShield should consider rebranding with a more fitting name. "IDRestore" would accurately reflect its primary focus on collaborating with investigators to handle fraud cases. This strategic change in nomenclature would provide a clearer representation of the services offered by the app.

In comparison to its competitors, IDShield stands out as an affordable option. Its pricing structure makes it accessible for individuals and families seeking protection against identity theft. The reasonable cost associated with IDShield makes it a practical solution for those prioritizing financial security without overspending.

Despite its affordability, IDShield doesn't compromise on the quality of its services. It employs robust security measures and advanced technologies to safeguard users' personal information. The user-friendly interface and comprehensive features facilitate credit report monitoring, suspicious activity detection, and real-time alerts.

IDShield offers compelling value by combining a competitive price with effective identity protection services. Its commitment to providing affordable yet reliable solutions makes it an appealing choice for individuals and families seeking to protect their personal information in a digital-first world.

Read our full ID Shield review.

Best for removal of personal credentials from databases

Specifications

Reasons to buy

Reasons to avoid

✅ You want your personal data off the internet: Incogni functions primarily as a data removal service, scrubbing your data from online brokers.

❌ You want all the bells and whistles: Incogni doesn't come with all the usual features you would expect from an identity theft protection service, lacking the antivirus, VPN, dark web monitoring and credit monitoring offered by other providers.

🔒 Incogni, a service developed by the renowned VPN provider Surfshark, empowers users to take control of their online privacy. It effectively assists individuals in removing their personal information from data brokers and various entities on the internet. Supported by a privacy-centric company, Incogni delivers a reasonable pricing structure and an impressive range of features. This combination positions Incogni as a compelling choice for users seeking enhanced control over their digital footprint, making it a valuable tool for preserving online privacy. ★★★★

Surfshark's Incogni is an innovative privacy service designed to safeguard your personal information. By proactively removing sensitive data from the internet, Incogni drastically reduces the risk of identity theft, financial fraud, and other cyber threats. This data removal service empowers you to take control of your digital footprint in 2024 and beyond, ensuring your privacy and personal information are secure.

Incogni provides an enticing service for users seeking control over their privacy. The annual discount, weekly updates, and 30-day money-back guarantee make it an attractive option. Additionally, the service includes robust data removal features, enabling you to efficiently manage your digital footprint.

While Incogni doesn't offer a free trial, and could improve its support setup, it remains an effective and competitively priced service. For individuals prioritizing data privacy- and want out of these many databases- Incogni remains compelling. With its extensive capabilities and dedication to safeguarding user privacy, this platform emerges as a novel solution compared to the approach that its competitors take.

Protect your privacy for less with our Incogni coupons. Get great deals on data removal services and stay in control of your personal information.

Read our full Incogni review.

Honorable mentions

Specifications

Reasons to buy

Reasons to avoid

✅ You want good social media coverage: Social media monitoring is good, as is the Digital Footprint tool which finds the potentially harmful traces you've left online.

❌ You want better credit monitoring: Allstate only monitors credit reports from TransUnion on the basic plans - only the top tier will monitor Experian and Equifax as well. Our top pick, Aura, offers credit monitoring from the triumvirate even on its basic plan.

🔒 Allstate provides good social media profile monitoring tools, but the lack of credit monitoring on the lower plans is a drawback. ★★★★

Allstate comes close to being one of the best identity theft protection services. Social media monitoring is included, along with the obligatory credit monitoring. However, on the latter, you only get monitoring from one agency - TransUnion - on the basic plans; you need to opt for the most expensive plan to get monitoring from Experian and Equifax too.

There are three plans in total, all of which offer financial fraud protection and identity monitoring. In addition to coverage for expenses you incur dealing with fraud - which maxes out at $2m for the top family plans - there is also a stolen fund reimbursement available up to a million dollars for the top tier plan, as well as 401K/HSA reimbursement up to $1m too.

This top plan also offers cybersecurity for your devices and something called family digital safety, which allows you to monitor content, manage screen time, and set location alerts for your loved ones.

Read our full Allstate review.

Specifications

Reasons to buy

Reasons to avoid

✅ You want FICO scores: As you might expect, FICO scores are a given with myFICO. So if you rely on these, then this could be a good option for you.

✅ You want a good UI: the interface and the apps for myFICO are nicely presented, making it easier to navigate your way around them.

❌ You are on a budget: myFICO has no annual plans, making it one of the more expensive options out there.

❌ You want more identity protection features: Identity protection only comes with the more premium plans on myFICO. There are also no family plans.

🔒 myFICO is a great service for those who want good credit monitoring and FICO scores, and there is no cap on wages lost either. But identity protection features are only available with the premium plans, and families aren't catered for, as they are with services like Aura. ★★★★

myFICO gives you regular updates on your credit scores, and naturally this includes your FICO scores, which give you valuable knowledge as to what financial institutions look for when determining your creditworthiness. I also found the UI to be user friendly for desktop and mobile apps, making it easy to navigate.

The basic plan only covers credit score updates, while the Premier and Advanced plans give you identity protection features. You can also buy a single report for your FICO score if you wish, without having to commit to a subscription.

However, I found that one of the glaring omissions from myFICO is the lack of family plans, and the premium plans are quite expensive. However, for those plans, claims for wage losses are uncapped (other services usually top out at $7,500). You can also get assistance with travel expenses and getting new documents, such as a passport or driving license. MyFICO is also underwritten by the American Bankers Insurance Company of Florida.

Read our full myFico review.

Specifications

Reasons to buy

Reasons to avoid

✅ You want to know where your data is: Bitdefender Digital Identity Protection is excellent for monitoring your digital footprint and tracking down where your data is.

❌ You want more than identity theft protection: Bitdefender Digital Identity Protection offers little else in terms of security, lacking antivirus, VPN, and credit monitoring.

🔒 Bitdefender Digital Identity Protection offers good digital footprint monitoring and is great at tracking down your data. However it does not offer a family plan, nor does it offer the range of security features that you can get from its competitors. ★★★

Bitdefender is an award winning name in the security world, however I can't help but feel let down by its offering for identity theft protection.

To start, there is no offer for family protection, limiting the plan to a single user which can quickly get expensive if bought for a whole household. Moreover, you aren't getting the same level of security and privacy protection as your do for other services at a similar price. The fact that Bitdefender offers standalone antivirus and VPN solutions, but does not include these as standard is curious.

If Bitdefender were to include more of its range of robust cybersecurity products within its plan, it may just make it on to our list of recommended identity theft protection solutions. Until then, however, it will have to remain as an honorable mention.

Protect your devices with our Bitdefender coupons. Get top-notch cybersecurity at a discounted price and keep your online activities safe.

Read our full Bitdefender Digital Identity Protection review.

We've also featured the best credit monitoring service.

The best identity theft protection FAQs

What is identity theft protection?

Identity theft protection services safeguard your personal information (PII), which is essential for various online accounts. If any of these accounts are compromised, your sensitive details, including banking information, address, and potentially information about friends and family, could be stolen.

Considering the numerous accounts you have online, from banking and credit cards to social media and more, it's easy to understand why cybercriminals are so determined to steal and sell data.

Effective identity theft protection services can alert you to potential breaches, identify compromised accounts, and monitor your digital footprint for signs of stolen information. They also often include credit monitoring to detect suspicious activity like fraudulent loans or credit cards opened in your name.

By receiving timely alerts, you can take swift action to cancel cards, amend accounts, and notify banks about fraudulent activity. Many identity theft protection services offer assistance throughout this process.

How does identity theft happen?

"Identity has become the key to accessing a wide range of goods and services, and in turn, has become a prime target for malicious actors," says Mike Tuchen, CEO of Onfido.

"Fraudsters are targeting unsuspecting individuals, convincing them to reveal personal information so they can impersonate them. Sophisticated fraudsters are even attempting to hack into identity databases that store the personal information of millions of consumers."

"It’s no wonder that the frequency of data breaches has increased exponentially. In fact, in 2022 alone, identity theft reached a staggering $42 billion in the US," Tuchen concludes.

Identity theft is a growing concern due to technological advancements and sophisticated tactics employed by cybercriminals.

Data breaches, often resulting from ransomware attacks, are a common source of compromised personal information. When organizations choose not to pay ransoms, cybercriminals may sell stolen data on the dark web.

This stolen data can be used to access existing accounts or create fraudulent accounts for activities like obtaining loans and defaulting on them, leaving victims liable for the costs.

What types of identity theft are there?

Financial Fraud: They may access your bank accounts, apply for fraudulent loans and credit cards in your name, and transfer funds to their own accounts. To protect against this, credit monitoring is essential.

Tax Fraud: Criminals can file false tax returns using your personal information. The IRS will typically contact you to investigate and inform you of the suspicious activity.

Healthcare Fraud: They may use your medical insurance to cover their treatments, prescriptions, or claims. If you suspect this is happening, contact your healthcare provider to verify your medical records and dispute any unauthorized charges.

How can I identify signs of identity theft and protect my personal information?

There are several warning signs to watch out for that may indicate your identity has been compromised. One of the most common signs is suspicious charges or bills on your financial accounts. Another red flag is being contacted by debt collectors seeking payment for unknown debts. Cybercriminals are known for their cunning, so don't overlook seemingly small or unusual charges as they could be testing your vigilance.

In the event of a potential identity theft, prompt action is crucial. Contacting the appropriate organizations, placing locks on your credit, and setting up fraud alerts in your name are essential steps to safeguard your accounts and protect yourself from becoming a victim of identity theft. These measures help secure your financial information, minimize the risk of unauthorized access, and keep you informed of any suspicious activity.

While some signs of identity theft may be evident, others are more discreet. For instance, not receiving a regular monthly bill or statement could signal that someone has altered the mailing address associated with your account. Signs of identity theft include new accounts opened in your name and a sudden drop in your credit score. These actions can indicate unauthorized access to your personal information.

What are the steps to take to prevent my identity from being stolen?

The most effective way to protect yourself from identity theft is to take proactive measures. Strong cybersecurity practices are essential. This includes using unique, complex passwords and considering a reliable password manager to streamline password management, as well as using an authenticator app to ensure it is definitely you logging in to your accounts

If you suspect identity theft, take immediate action. Report the incident to both law enforcement and the affected organizations, such as financial institutions. Dispute unauthorized charges and place fraud alerts on your personal information.

Protect your credit by freezing your credit report with all three major credit bureaus: Equifax, Experian, and TransUnion. Freezing your credit prevents criminals from opening new accounts in your name.

If you would like more information about identity theft protection, take a look at our 5 tips for avoiding identity theft, as well as our guide on free identity theft protection.

Should I get identity theft protection?

From tiny tots to wise seniors, identity theft is an equal opportunity offender that shows no signs of slowing down. Protect yourself and your loved ones by considering these seven groups that could benefit from identity theft protection:

1. Digital Doers - Anyone who spends a significant amount of time online or has numerous financial accounts is at higher risk for identity theft. Every account is a potential point of attack, so be wary of suspicious activity or messages.

2. Senior Savers - Older Americans may have more money saved, but they're also less tech-savvy, making them prime targets for identity thieves.

3. Family Firsts - Children and teens with clean credit histories can be attractive targets for fraudsters. Keep them safe by signing up for a family identity theft protection plan.

4. Repeat Victims - If you've been hit by identity theft once, you're more likely to be targeted again. Stay ahead of the curve with reliable protection.

5. Busy Bees - If you don't have the time to monitor your accounts constantly, identity theft protection services can help.

6. Insurance Insureds - Don't risk losing everything. Protect your home, savings, and credit score with an identity theft insurance policy.

7. Dark Web Dwellers - After a data breach, your account credentials could be floating around on hacker forums. Use Identity Guard's Dark Web scanner to keep an eye on any potential leaks.

Remember, the more accounts you have, the more important it is to keep your identity safe.

Is identity theft protection worth it?

If you frequently shop online and have shared your personal information with various online retailers, identity theft protection is a valuable investment.

These services continuously monitor your credit reports for signs of identity theft, offering a level of protection that traditional security software often lacks.

The decision ultimately depends on how much you value your identity and the lengths you're willing to go to protect it. While our guide includes more affordable options, they may not offer the same comprehensive features and protection as premium services.

It's important to note that according to the FTC, $10 billion was lost to fraud in the US alone in 2023. The costs associated with identity theft can be significant, making proactive protection a worthwhile consideration.

Identity Theft Protection vs Monitoring Services: What's the difference?

Although identity theft protection and monitoring services have similarities, there is a significant distinction. Monitoring services primarily focus on providing insights into your credit rating and sending notifications if it changes. However, they offer limited protection for safeguarding your identity beyond this aspect.

Identity theft protection services go beyond to offer comprehensive safeguards. They actively monitor the dark web for your personal information, including sensitive details like Social Security numbers. In addition to detecting potential threats, many services provide insurance to cover financial losses resulting from identity theft. They also offer expert guidance and best practices to help you protect your identity and minimize risks.

If you would like to learn more about the differences, we have a dedicated guide to the differences between credit monitoring, credit protection, and identity theft protection services.

How to choose the best identity theft protection services

When choosing an identity theft protection service, these are the key factors you should consider to help you find the right service for your needs:

• Monitoring: Determining which aspects of your digital life require monitoring for you and your family is crucial. While many services offer credit report monitoring, not all of them do. Additional essential checks to consider include criminal and court records, as well as bank accounts. The speed and quality of alerts provided by these services will significantly impact their effectiveness.

• Family protection: Whether you require individual protection or family coverage. If you reside with children who possess online devices, a family plan is recommended, as it extends protection to them. Bear in mind that family plans tend to be more costly compared to individual plans.

• Customer support: In the event of identity theft, where prompt action is crucial, the quality of customer service and the user-friendliness of the service itself become paramount. To provide comprehensive information, we have thoroughly evaluated the services listed in this guide and detailed their performance across various fronts. Additionally, we highly recommend reading customer reviews when selecting any service or product, as they offer valuable insights and experiences from real users.

• Insurance: Review your insurance policies to determine the extent of coverage you have in case of identity theft and associated financial losses. We have included this information, when available, in our recommendations for the top identity theft protection services.

• Price: When considering identity theft protection services, it's crucial to factor in the price. Family plans are often more expensive than individual ones, and be wary of services that raise their charges after the initial year.

You can also read our in-depth guide on how to choose the best identity theft protection service for you.

Feature | Aura | IdentityForce | Experian | Norton | McAfee+ | IDShield | Incogni |

|---|---|---|---|---|---|---|---|

Price (per month) | $9 - $24 | $19.90 - $34.90 | $9.99 | $7.50 - $32.99 | $14.17 - $22.50 | $14.95 - $29.95 | $7.49 - $32.98 |

Insurance | $1 million per adult | $1 million | $500,000 - $1 million | $1 million | $1 million | $1 million | $1 million |

Family Plan | Yes | Yes | Yes | Yes | Yes | No | Yes |

Credit monitoring | Yes | Yes (on higher tiers) | Yes | Yes | Yes | Yes | No |

Dark web monitoring | Yes | Yes | Yes | Yes | Yes | Yes | No |

Antivirus | Yes | No | No | Yes | Yes | Yes | No |

VPN | Yes | Yes | Yes | Yes | Yes | Yes | No |

How we tested the best identity theft protection

Our reviews of the identity protection apps in this guide looked at the features they offer, as well as their value for money and how well they compare to one another.

It is important to note that we did not deliberately compromise our own personal accounts and sensitive information to see how well each identity theft protection service worked.

Instead, we made our choices based on each service's reputation, as well as a desire to include those with differing features, use cases and pricing. We were also on the look out for services that provided additional features, such as dark web monitoring, VPNs, password managers, antivirus, and credit monitoring at the best price. Customer support was also a key factor for deciding the top results, and services that offer a free trial or a discount if purchased annually were also a bonus.

Read how we test, rate, and review products on TechRadar.

When choosing the best identity theft protection, I recommend keeping these key features in mind:

- Identity Theft Insurance: should be at least $1 million per adult

- Credit Monitoring: very important for spotting the early signs of identity theft, such as credit fraud or score fluctuations

- Family Plan: protection should be offered on a family plan to keep everyone protected

- Dark Web Monitoring: your details can crop up on data breach sites before your identity is stolen, so dark web monitoring is essential

- Antivirus: if your credentials are stolen, antivirus software can protect your devices from hackers looking to install snooping software or malware

- VPN: helps to keep your internet traffic encrypted and hidden from hackers looking to steal your data

- Customer Support: identity theft can happen at any time, so support should be offered on a 24/7 basis

When ranking the best identity theft protection, I pay particular attention to the features that matter, such as insurance coverage, breadth of credit monitoring, and other security tools such as a VPN and antivirus services. Customer support is also a priority feature I consider to ensure that victims of identity theft can get the help they need immediately.

Tested by

John's tech journalism career spans decades, and during that time he has covered many stories related to identity theft and reviewed numerous protection services. He has also written features and weekly columns for TechRadar.

Sead is a seasoned freelance journalist based in Sarajevo, Bosnia and Herzegovina. He covers all things cybersecurity, including ID theft, ransomware, and data breaches, as well as laws and regulations related to the field.

Why you can trust us

You can trust our opinion on identity theft protection services: our journalists are experts in the topic, and cover all the latest news and developments in the field. They have also closely reviewed dozens of products from the biggest names and the lesser-known alternatives.

Disclaimer

We may earn a commission when you click on links to buy products in this guide. However, our product reviews are impartial and only take into consideration the qualities of the services themselves. They are also not influenced by our advertisers.

Get in touch

- Want to find out about commercial or marketing opportunities? Click here

- Out of date info, errors, complaints or broken links? Give us a nudge

- Got a suggestion for a product or service provider? Message us directly

- You've reached the end of the page. Jump back up to the top ^

Benedict has been writing about security issues for over 7 years, first focusing on geopolitics and international relations while at the University of Buckingham. During this time he studied BA Politics with Journalism, for which he received a second-class honours (upper division), then continuing his studies at a postgraduate level, achieving a distinction in MA Security, Intelligence and Diplomacy. Upon joining TechRadar Pro as a Staff Writer, Benedict transitioned his focus towards cybersecurity, exploring state-sponsored threat actors, malware, social engineering, and national security. Benedict is also an expert on B2B security products, including firewalls, antivirus, endpoint security, and password management.