Safeguarding your family's future: choosing the perfect identity theft protection service

Here are things you can do to protect your family better

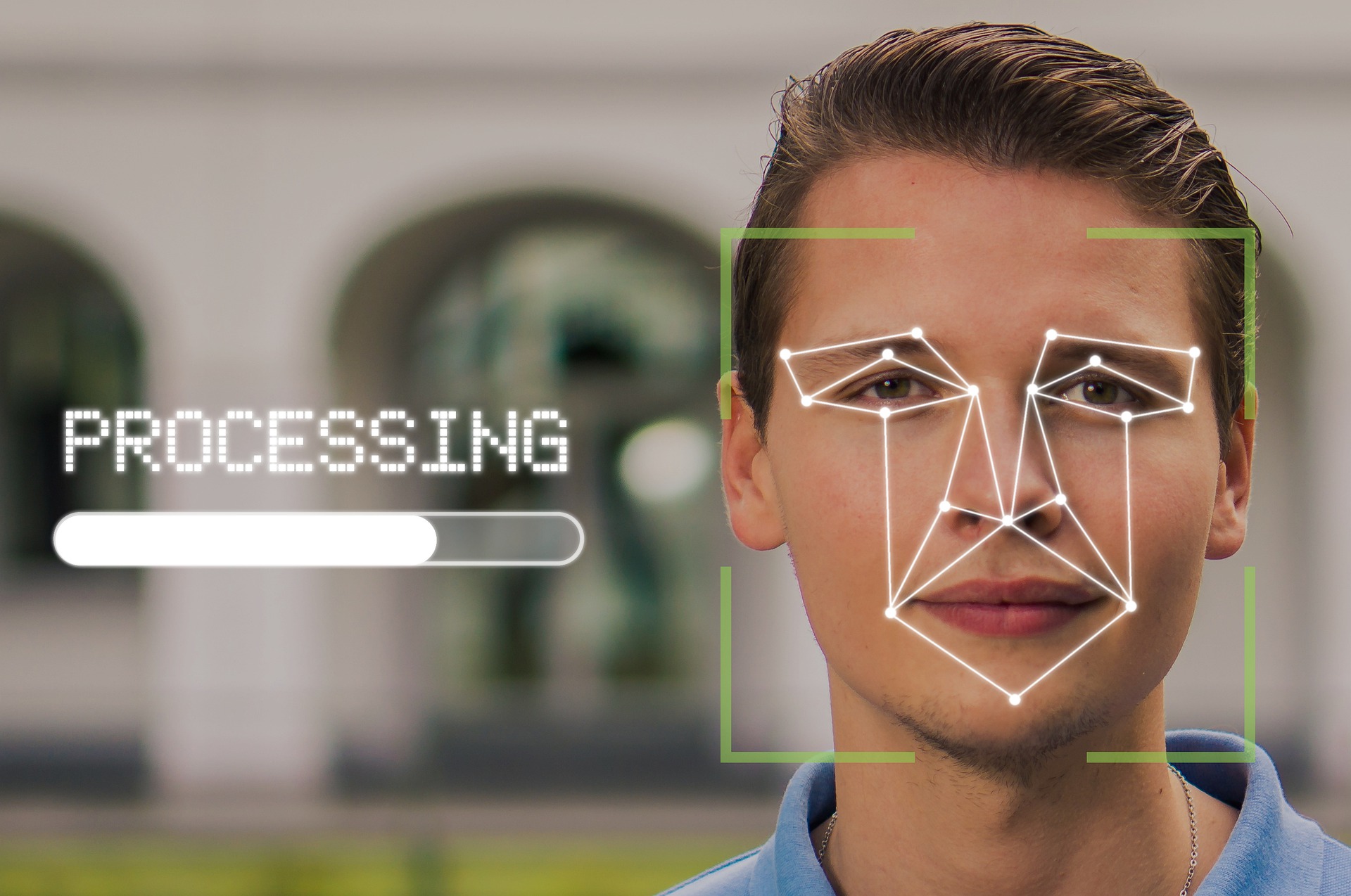

Identity theft is an increasingly common problem that can affect anyone. Luckily, a growing number of identity theft protection services are available to help you safeguard your identity. These services can include various features such as identity monitoring, credit monitoring, identity recovery, and identity theft insurance. The pricing for these services varies depending on the features provided.

Identity theft happens when an individual or criminal group steals someone's personal information and uses it to commit fraud. This information may include names, social security numbers, birthdays, addresses, and bank account details. Criminals can use this information to open financial accounts in someone else's name, steal retirement benefits, purchase real estate, and more.

A Techradar Choice for Best Identity Theft Protection

Aura is an excellent choice thanks to its user friendly interface, antivirus service and detailed reporting dashboard. Save up to 50% with a special Techradar discount.

What do identity theft protection services do?

Protection services are crafted to prevent identity theft, alert the customer that identity theft might have occurred, or assist with identity recovery.

- Identity monitoring services scan the internet and online databases for personal information, such as Social Security numbers and email addresses, belonging to their subscribers. If such information is found to be part of a reported data breach, the subscriber gets notified and offered suggestions on what to do. These services are primarily used as a preventive measure to avoid identity theft.

- Credit monitoring services provide customers with easy and quick access to their credit reports and scores through various online tools, both free and paid. This allows the subscribers to keep an eye on their financial accounts and to identify any problems that may arise.

- Identity recovery services come in handy after a crime has occurred. These companies help with freezing credit reports, drafting letters to creditors indicating theft has occurred, and contacting law enforcement as needed to assist the victim.

- Identity theft insurance is designed to reimburse victims for any expenses incurred while reclaiming their financial identities and repairing credit reports. It is generally not necessary and can be avoided with proper preventive measures.

Points to consider when looking for a identity theft protection service

There are different points worth exploring when deciding on an identity theft protection service that's right for you.

Remember there are THREE credit bureaus

In the United States, there are three credit bureaus that operate independently: Experian, TransUnion, and Equifax. Each of these bureaus provides updated credit reports and credit scores, although the content may differ slightly from one bureau to another. If you're searching for an identity theft protection plan, it's important to make sure that it provides access to all three bureaus. Many basic programs may not offer this, so it's important to keep this in mind. Only by having access to real-time credit reports from all three bureaus can you be able to identify and address all potential issues.

Remember the free trials

Identity theft protection providers are competing with each other to win your business, which is why they are offering free trials to new customers. You can take advantage of these trials to compare different programs and determine which features are more important to you than others. However, keep in mind that premium features will increase the cost, so it's important to only pay for what you need. To avoid being charged a monthly fee, make sure you cancel your free trial before the end date.

Look for discounts and whether you already have access to identity theft protection

Discounts are available for the most popular identity theft protection plans. These discounts can be obtained by using a promotion code found online or by purchasing a yearly membership instead of a monthly one. Additionally, discounts are sometimes offered when enrolling in autopay.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

It's worth noting that you may already have access to a free identity theft protection plan without even realizing it. For instance, companies often offer free protection plans to potential victims after a retail data breach, but the freebie is usually only available for a limited time. You can usually find out about these offers in the letter or email you receive following a data breach.

Additionally, some banks and credit unions now offer free identity theft protection as part of their membership. Credit card companies also do this with increasing frequency. Employee benefits plan, and homeowners'/renters' insurance policies sometimes offer ID protection, as do service organizations such as AAA and AARP.

One point to remember: Some companies offering identity theft protection plans only provide basic packages. You might need to upgrade to a premium plan to gain features if options are missing. However, in most cases, you'll receive the upgrade for a discount.

Family or individual plans?

Unfortunately, you aren't the only one in your family that needs identity theft protection. Kids, for example, are often targeted by scammers because they don't yet have a credit history. In some cases, this makes it easier for criminals to open new accounts in their names. So you might find buying a family identity theft protection plan vs. an individual plan a better choice in your situation. And the price difference might be minimal.

Do you need identity theft insurance?

There's much you can do to protect yourself from identity theft and clear recovery steps to follow when something does happen. Besides the yearly or monthly cost of identity theft protection itself, identity theft won't cost you out-of-pocket financial loss once it's proven something criminal has occurred. The most significant expense isn't monetary but rather the time and hassle involved in clearing your name from discrepancies. Because of this, it's not necessary to pay extra to add identity theft insurance to your plan.

Besides, most banks and credit card companies already provide fraud protection guarantees for free. It's one of the reasons credit card interest rates are so high, after all!

More from TechRadar Pro

- Be sure to review the eight surprising facts about identity theft

- You might also be interested in learning how credit monitoring services work

- Looking for a free identity protection plan?

Bryan M. Wolfe is a staff writer at TechRadar, iMore, and wherever Future can use him. Though his passion is Apple-based products, he doesn't have a problem using Windows and Android. Bryan's a single father of a 15-year-old daughter and a puppy, Isabelle. Thanks for reading!