How to protect your Social Security number from hackers: simple ways to be more secure

Save yourself some headaches

In the United States, your Social Security number (SSN) doesn't just unlock federal retirement benefits. It's also used for identification purposes. Unfortunately, SSNs are also very valuable to scammers who want to steal your identity to perform theft or fraud because of their uniqueness.

With your SSN, someone could open new accounts in your name, including bank accounts, credit cards, lines of credit, and more. They could also open new services in your name, such as internet accounts and other utilities. In doing so, these thieves could get you in debt and ruin your credit. They could also file income taxes in your name — and get a refund. Your Social Security benefits could also be at risk if someone steals your identity.

There are different ways to protect your social security number, and using these will make it more difficult for others to steal your information.

- You might also be interested in the best internet security suites of the year.

A Techradar Choice for Best Identity Theft Protection

Aura is an excellent choice thanks to its user friendly interface, antivirus service and detailed reporting dashboard. Save up to 50% with a special Techradar discount.

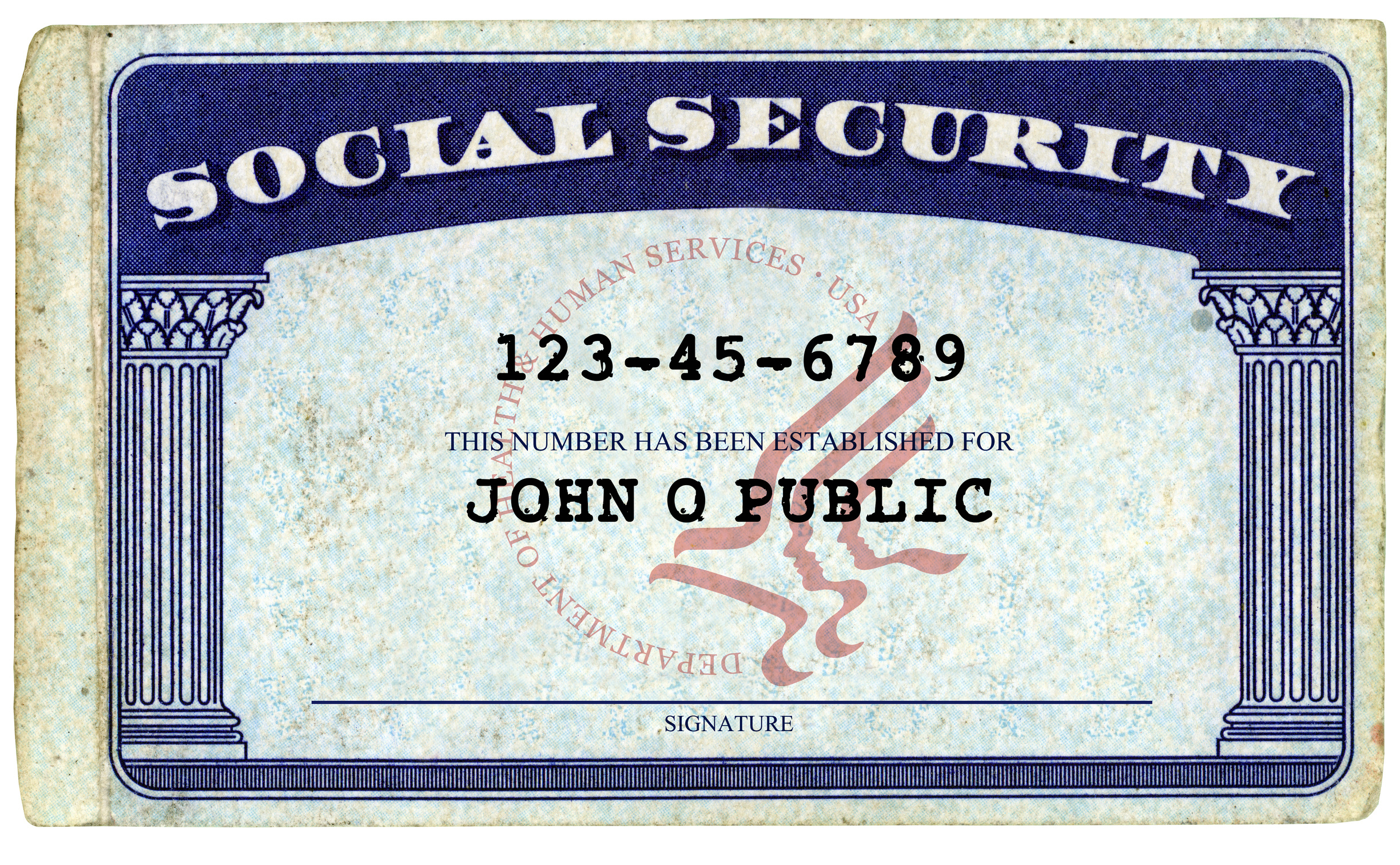

What is a Social Security number?

A Social Security number is a nine-digit number assigned by the Social Security Administration in the U.S. The card is issued to U.S. citizens, permanent residents, and temporary working residents. The first SSN was issued in 1936 and grew out of the New Deal Social Security program that provides federally funded retirement benefits to those who qualify. These benefits are underwritten by Social Security payroll taxes collected from workers.

SSNs were initially designed to track individuals' accounts within the benefits program. But, over time, they grew into much more. Today, you need one of these numbers to file federal, state, and local taxes; parents need to list the minors' SSN on tax filings to take advantage of child tax credits. SSNs are also used often for employee, patient, student, and credit records.

Interestingly, the original Social Security Act didn't require someone in the country to have a Social Security number. Instead, that requirement comes from the Internal Revenue Code, which involves using a Social Security number for federal taxes.

Today, most parents apply for Social Security numbers for their dependent children soon after birth. Those folks, new permanent residents and non-citizens working inside the U.S., can apply for a Social Security card by visiting a local Social Security Administration office.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Tips to protect your Social Security number

There's much you can do to better protect yourself from Social Security theft and fraud. The tips below involve being proactive in protecting your physical Social Security card and where the number gets used. Other recommendations include being vigilant and closely monitoring your monthly credit reports and not falling for Social Security scams.

Use it sparingly

Because of increased fraud, companies, universities, and other non-governmental entities have been more reluctant to use Social Security numbers beyond federal tax purposes. Instead, they create numbers unique to the organization. For example, it was once commonplace for universities and colleges to use Social Security numbers are student IDs; that's no longer the case.

With this in mind, the best way to better protect yourself from Social Security fraud is to limit its use for tax purposes only.

Know the number, don't carry the card

It's also important to memorize your Social Security number and not carry your physical card. Though most Social Security fraud is performed online, some criminals can cause great havoc by having a physical card on their person. With the card, they can visit any Social Security office and attempt to change your account quickly.

It's also important not to write down your social security number and put it in your purse, wallet, or pocket. Again, this might sound like overkill, but you don't want to risk someone finding the paper on the street or having it stolen.

If you need to jot down the number, store it securely on your smartphone or another mobile device.

When possible, avoid giving your entire SSN online or on the phone

Suppose an organization claims to have your SSN and needs you to use it for identification or verification purposes. Only give them the last four digits of the number. This should be enough for any reputable organization to verify your ID. If they say it's not, avoid giving them further information such as your address or banking account number. It

If you're asked to verify your ID with an SSN or other means, go with the latter. For example, use a driver's license number or another form of ID instead.

Should someone on the phone seek your SSN, you assume the call is reputable, but you're still not comfortable giving out the information, take another path. Visit the organization in person or use the main phone number listed on their website to make contact.

Never use the SSN as a password

It should go without saying never to use a Social Security number as an online password. Instead, use a password generator that's designed to create secure passwords.

Destroy documents that include the number

Leave it to the Internal Revenue Service (IRS) to require full SSNs on federal tax documents! This includes your number and that of your significant other and children. The IRS requires you to keep a copy of tax records for up to seven years, depending on your situation. Do so by keeping the documents in a safe or other secure location in your home. (Ideally, keep digital copies of these documents, not physical ones.)

When the time comes, use a recommended shredder to destroy the documents before disposal.

Monitor your accounts

Scammers ultimately want to take something that belongs to you; in most instances, that's your hard-earned cash. So always check your accounts for unrecognized transactions and alert your bank, credit card company, or other financial institution immediately if you find something irregular. The longer you wait, the less likely you'll get a favorable resolution.

Check your credit

Credit cards, mortgages, and other lines of credit ultimately show up on a credit report. Because of this, make it a regular habit of reviewing this important information. You might also want to consider signing up for a credit monitoring service. These programs alert you immediately whenever something new happens on your credit report for a low monthly fee.

Sign up for a ID protection service

Finally, consider signing up for an identity protection service. Typically, these programs go beyond credit card monitoring and include features like highlighting potential scams where personal information is stolen through data breaches. For example, identify protection services will keep track of your emails, phone numbers, and other personal information and inform you if the content appears on the dark web. These breaches may have nothing to do with Social Security numbers. And yet, by knowing some information about you, scammers can gain access to others and cause you real problems and headaches.

Bryan M. Wolfe is a staff writer at TechRadar, iMore, and wherever Future can use him. Though his passion is Apple-based products, he doesn't have a problem using Windows and Android. Bryan's a single father of a 15-year-old daughter and a puppy, Isabelle. Thanks for reading!