Unreliable internet connectivity affecting your GPay payments? Here's a fix

You can send money using offline system

India’s digital payments infrastructure has evolved a lot over the years. We’ve come from swiping our debit and credit cards at POS terminals to saving card details and authorizing payments with OTPs. The biggest leap was the introduction of the Unified Payments Interface (UPI) by the National Payments Corporation of India (NPCI). UPI allowed users to create a Virtual Payment Address (VPA) to be linked to a savings or current account. This reduced everyone’s efforts to provide a long list of account details like IFSC codes. Unlike NEFT and RTGS transactions, you also didn’t have to wait for the money to be transferred.

UPI and Wallets introduced the country to the concept of peer-to-peer (P2P) money transfer. The steps to set up the VPA were easy to follow, it was safe since it required you to authorize payments and it was directly linked to your phone number.

Why offline UPI payments?

Perhaps the biggest downside of the service was that it required internet connectivity for to initiate the transactions. We’ve experienced transaction failures in apps like Paytm, Google Pay, PhonePe and WhatsApp Pay when we lose internet connectivity on our smartphones.

While NPCI saw sort to resolve this issue, it also saw the scope of bringing the P2P payments service to citizens in rural areas. The government has been encouraging many people from these areas in the country to embrace saving up their hard-earned money. To make its banking services more accessible, NPCI introduced the offline method of transferring money.

This will help to use the same VPA even in areas where there’s low internet connectivity. It takes advantage of the Unstructured Supplementary Service Data (USSD) framework. You may be familiar with the *121# commands. Similarly, *99# is the code you can dial to set up and enable UPI payments if you feel you are in a locality with weak internet connectivity.

How to set up your offline UPI payment

Before you can begin setting up the offline UPI payments, there are a few points to keep in mind.

- You can only use the mobile number you’ve registered with your bank.

- A charge of 0.50 per transaction will be levied.

- The transaction amount limit is set at Rs 5,000 per transaction.

If you haven’t set up a UPI for your account, you can follow the below steps:

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

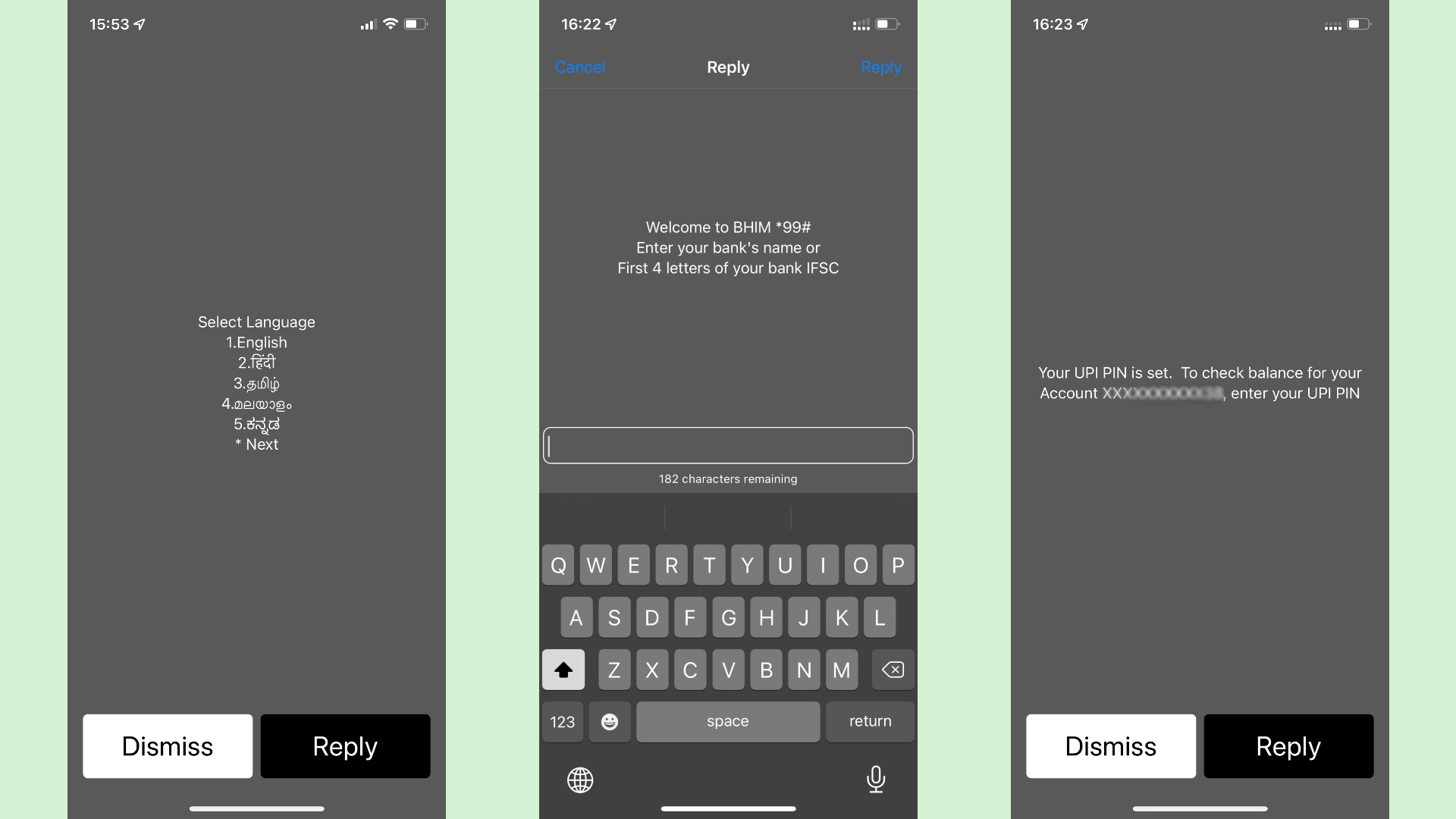

- Dial *99# using your registered mobile number.

- Select your language from the menu.

- Enter the bank name or the first four characters of the IFSC code

- Next, you would need to select one of the accounts identified by the system. It will display the first 4 digits of the account number.

- Once you’ve selected the account, you’ll be asked to input the last 6 digits of your debit card.

- Post that, you will need to input the expiry date of the debit card.

- Now, you will be asked to set up your UPI Pin. This is vital to authorize payments going forward.

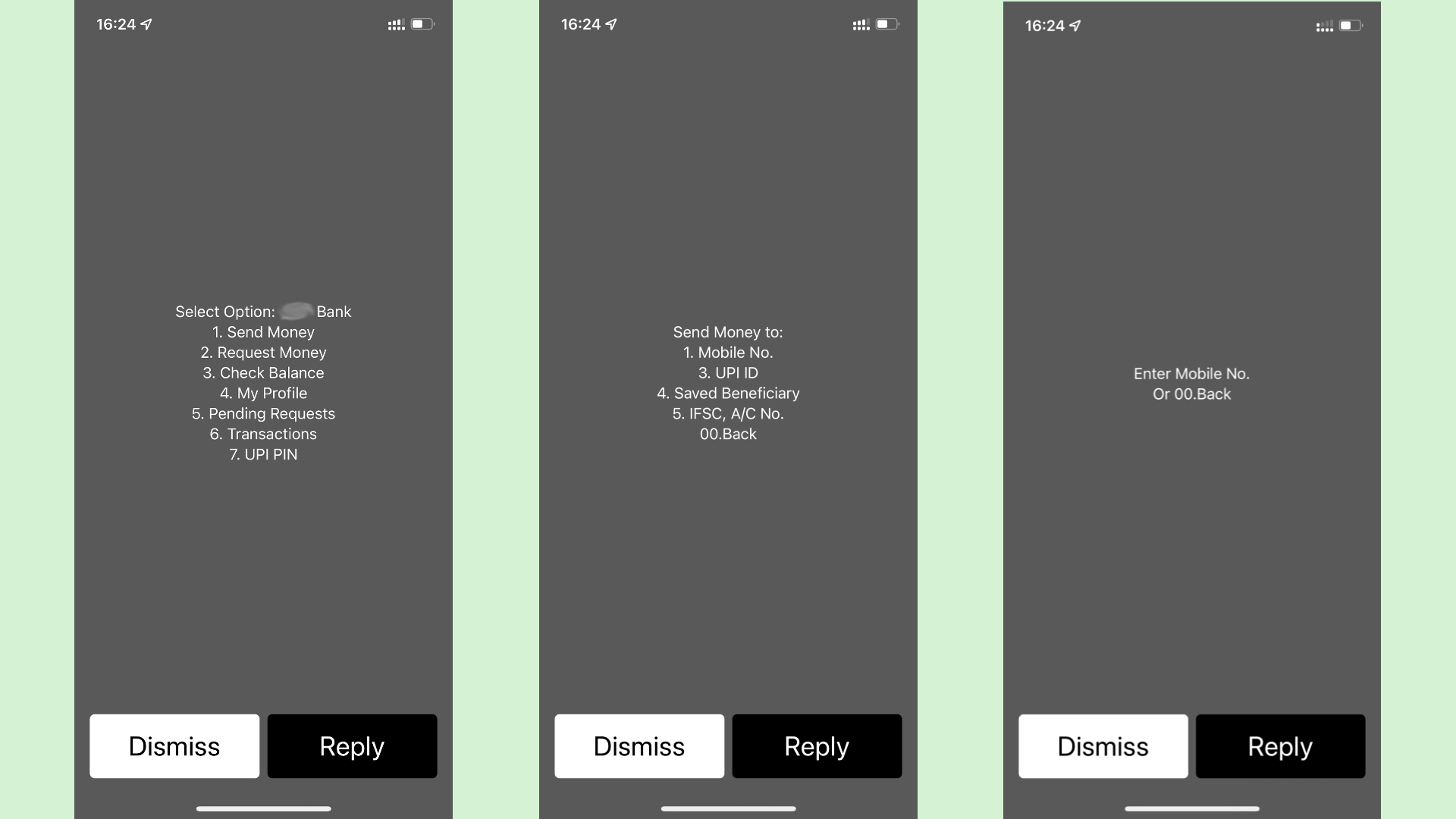

Now that the UPI is set up, you can dial *99# again and will see a new menu option. Here’s what you need to do to send money:

- Select the first option.

- Next, input the UPI ID of the person to whom you would like to transfer the money.

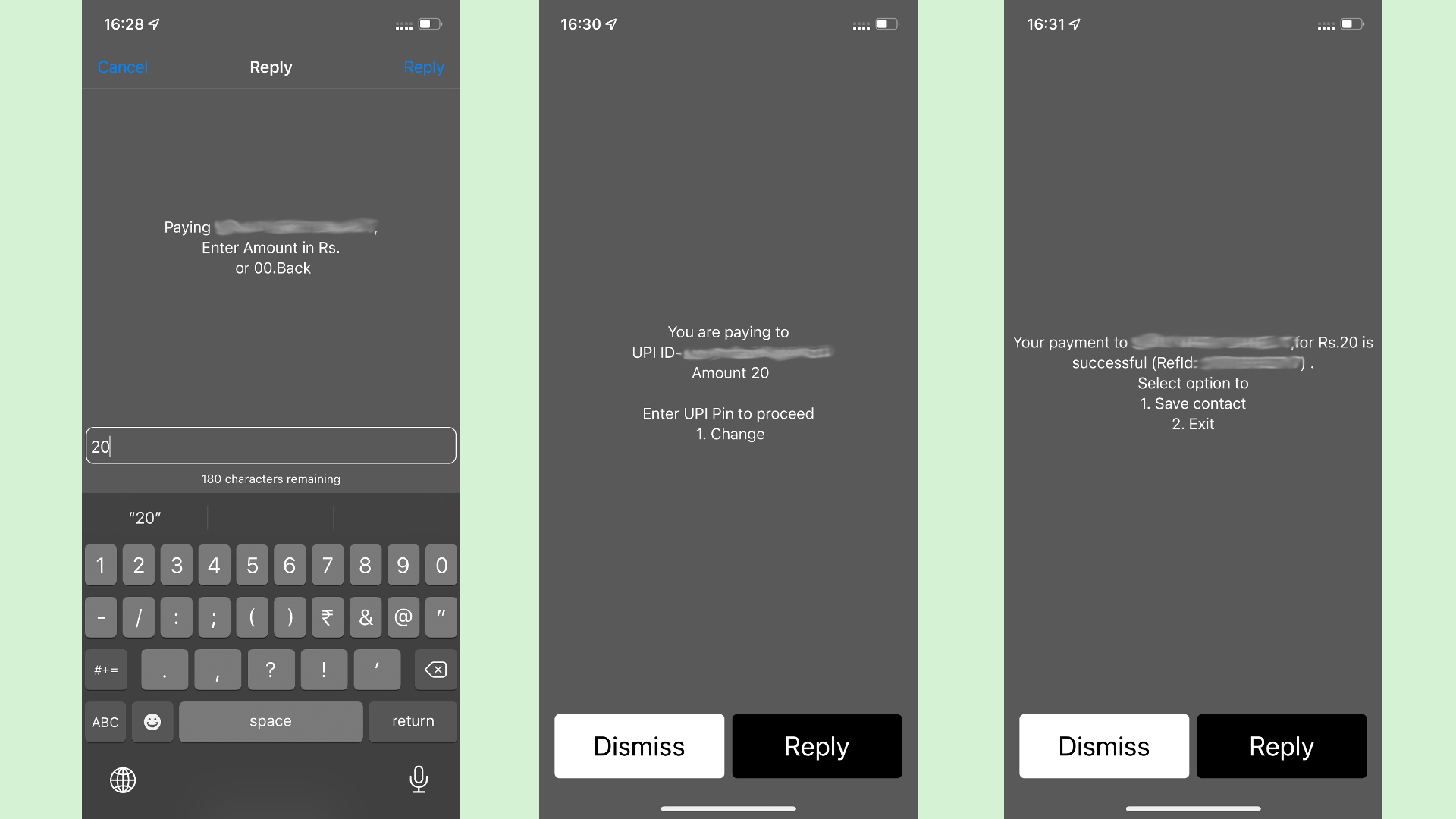

- On the next screen, you will need to input the amount to be transferred.

- Once submitted, you will be asked to enter the UPI pin you created.

A Malayali-Mumbaikar, Sachin found an interest in all things tech while working in the BPO industry, often spending hours in tech blogs. He is a hardcore foodie and loves going on long bike rides. Gaming and watching TV shows are also some of his other hobbies