How to get on top of your finances for the New Year using the online Money Dashboard service

Don't break the bank

Take control of your money

Deep down, we all know we should be keeping a better eye on our incomings and outgoings. However, you keep putting it off because of the amount of time it takes – especially if you have a few bank, building society and savings accounts.

Thankfully there's a great website called Money Dashboard that makes managing your finances and balancing budgets a piece of cake. You can add your current, savings and credit card accounts and view them all with a quick glance.

Easy to understand graphs track where your money goes each month, and it can even help you predict your future spending, as well as set goals and budgets to keep you out of the red.

If you're concerned about security, don't worry – Money Dashboard uses the same security measures as banks, so your details are completely safe. You can't use it to move money either, which adds another layer of protection.

1. Set up an account

The first thing you'll need to do is set up an account with Money Dashboard. It's completely free and totally secure as well. Head over to the Money Dashboard website and click on the 'Sign up for Money Dashboard' button to begin.

Enter in your name, email address, date of birth and postcode (the last two are needed to help identify you) and then click 'Next'.

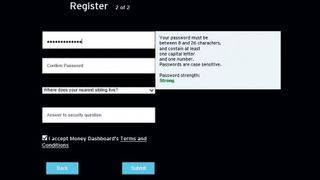

2. Create a password

On the next screen you'll be asked to come up with a complicated password that has between eight and 26 characters (with at least one capital letter and one number in it, too).

As you type, you'll be told how strong your password is. Also choose a security question to answer in case you forget your password.

Finally, click 'Submit'.

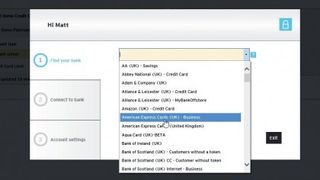

3. Add your bank details

Once you've signed up for Money Dashboard, the next thing you'll need to do is add your bank. Pretty much all banks and building societies are supported in Money Dashboard, and you can quickly begin by searching for your bank on the next screen.

You can then connect to the bank and then log in to allow Money Dashboard to display your finances in complete safety.

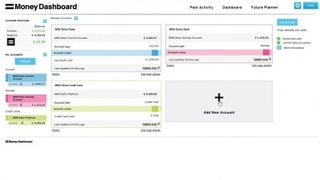

4. Add all your accounts

Once you have connected your primary bank account, you'll see a quick overview of it, with the current balance and any overdrafts or limits.

To get the most out of Money Dashboard – and get a more complete view of the state of your finances – you'll want to add all your other accounts, such as savings and credit cards. Click 'Add new account' to do this.

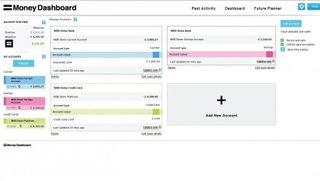

5. Quick overview

Once you've added all your accounts, you'll get a much clearer picture of your finances. The main page shows all of your accounts, which you can colour code, and at the top left you'll see an account overview.

This includes all of your accounts that are in credit and all of your debts, such as credit cards, mortgages and overdrafts, giving you a snapshot of your financial health.

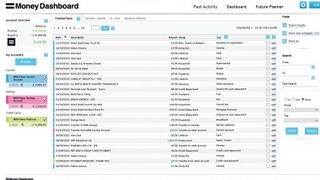

6. View past transactions

Click 'Past activity' at the top of the page to see a complete list of all the payments into and out of your accounts. It's a great way to quickly see where your money is going.

On the left-hand side is a list of your accounts. Uncheck the boxes next to them to remove them from the overview. Click 'Income: Spend' to see a graph of how much you're earning versus how much you spend.

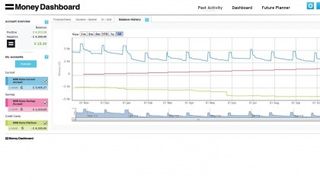

7. Balance history

Click 'Balance history' to see a graphical representation of the balances for all of your accounts. You can choose to view it by month, three months, six months or by year.

It's a great way of seeing what times of the year are the most expensive, when direct debits leave your account and when you get paid, letting you plan your finances accordingly.

8. Advanced views of transactions

Click on 'Transactions' to return to the main 'Past Activity' screen. You can search by date or by text, and you can group or tag payments to make them easy to track.

For example, you could create a group called 'Going out' and create tags for 'Pub', 'Cinema' and more. You could then see how much you spent on beer last month – though that might not be for the faint of heart!

9. Budget for your future

Click on 'Future Planner' at the top of the window to go to the section of Money Dashboard that helps you budget and plan your finances for the future.

The Budget Tracker view lets you see how much you've spent of your budget so far, and how much you have left. Click 'Budget Planner' and select 'Add planned' to create new items for your budget.

10. Reclaim your finances

Click 'My goals' and create objectives like saving a certain amount of money, and Money Dashboard will help you track your progress.

You'll be amazed what a difference this excellent website can make when it comes to understanding your money.

Matt is TechRadar's Managing Editor for Core Tech, looking after computing and mobile technology. Having written for a number of publications such as PC Plus, PC Format, T3 and Linux Format, there's no aspect of technology that Matt isn't passionate about, especially computing and PC gaming. He’s personally reviewed and used most of the laptops in our best laptops guide - and since joining TechRadar in 2014, he's reviewed over 250 laptops and computing accessories personally.

Most Popular