Ethereum is one of the greatest technological innovations of the 21st Century. Its versatility across a wide range of applications, from transactions for financial services through to digital ledgers across many industries, have established it as one of the most important tools driving digital transformation. However, over the past few years, Ethereum has become far slower and more expensive than it used to be. It can take hours for a transaction to process over the network, and the cost per transaction (or gas fees) can be as high as $40.00.

Alan Vey is co-founder and CEO at Aventus Technologies

With the rise of Ethereum-based NFTs taking the art and music world by storm, demand is only going to increase, driving up gas prices and transaction processing times further. This trend begs the question “should businesses give up on Ethereum and find an alternative way to process their transactions?” There is no denying that Ethereum surpassed its anticipated demand, but that doesn’t mean that it can’t outperform other options for businesses. Let’s take a closer look at the main problems with Ethereum, why we shouldn’t give up on it, and how we can make it work in a way that is fast, scalable and, crucially, cost-efficient.

- Here's our list of the best crypto wallets right now

- We've built a list of the best crypto exchanges around

- Check out our list of the best mining rigs out there

The issues with Ethereum

One of the most common misconceptions about public blockchains, especially Ethereum, is that it is a less secure or more vulnerable solution than, for example, a private network. The reality is that Ethereum is highly secure – far less hackable than a cloud server, given it is all open source and has been publicly validated the world over. The real problem with Ethereum is around bandwidth.

When developers first laid the foundations of what has now become the largest public blockchain protocol, there is no way that they could have anticipated the levels of demand for Ethereum. At its peak, Ethereum transactions can reach over 1.4 million in a single day. While this pales in comparison to something like the Visa network for card payments, which passes more than 65,000 transactions per second, stock Ethereum has a hard ceiling. In theory, the network can only support around 2,592,000 daily transactions full stop.

It’s not just about high gas prices when it comes to the cost of transacting Ethereum – it’s about price inconsistency. The gas price at a given time is set by demand for the network. As such, at different times of day or around certain dates, the volume of transactions passing over the network fluctuates significantly. This makes it nearly impossible to predict how much each transaction will cost and forecast your overall cashflow.

Say, for example, that you run a credit card cashback scheme using stock Ethereum to process your transactions. If one of your partner retailers is offering 10% cashback on all purchases, each purchase made will consist of one transaction where you bill the retailer 10% of the purchase, and another where that 10% is paid back to the customer. Depending on the time of day, those transactions could cost anywhere between $0.20 and $40.00 – vastly impacting the profitability of your business.

Why keep Ethereum?

For many applications, Ethereum is by far the best option, in spite of the issues outlined. An Ethereum blockchain solution can be built, implemented, and run indefinitely without any downtime, low risk of fraud, and no interference from malicious parties.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

When you think about what Ethereum enables a company to do, it is clearly superior to any non-blockchain solution for applicable use cases. At the core of Ethereum for enterprise is the smart contract – pieces of code that automatically execute when a set of predefined requirements are met. If you apply that to our cashback example, in very simple terms it means that when a customer makes a transaction, a requirement is met that automatically bills the retailer 10% and pays the customer their cashback.

If you were to run this framework on a private ledger stored in the cloud, there would be no simple way to automate this process. If you wanted to set up a permissions network of any kind, you’d either have to do it yourself by hiring an expensive team of developers and experts, pay a huge fee for a large software company to develop it, or simply use an out-the-box software solution that’s robust and well-established, but may not offer all the functionality you need.

Crucially, if you do not want to manage the whole ecosystem, Ethereum has it automated. As an open public network that has been battle tested for years, Ethereum is inherently more secure than any private network, and can be extremely versatile. It can be shaped to work in a range of applications.

Fundamentally, it is this flexibility and versatility that has led to the main issues associated with Ethereum. It used to be called “great for micro transactions” - today that’s no longer true, as so many people are using the network for an unfeasible range of applications – large and small.

How can Ethereum still work?

If Ethereum didn’t work extremely well, then the gas fees would have simply reduced over time as businesses and projects turned to alternative options. This has not been the case – the value of Ethereum remains clear to many different organizations. The question is, how can people still use Ethereum despite the issues outlined, and how many of these problems can be eliminated in the future?

There are two main schools of thought when it comes to future-proofing the network. The first is Ethereum 2.0 – a significant update to the way that Ethereum functions that promises to increase its bandwidth and reduce the gas fees. Ethereum 2.0 is currently being tested with the ‘Medalla Testnet’, which involves over 20,000 validators worldwide. However, the new Ethereum has been plagued by delays and setbacks - the main network was meant to go live last year.

What’s more, among the many concerns aired in the developer community is the security of Ethereum 2.0, along with some questions about whether it is scalable enough. The testnet points towards the fact that 2.0 will be able to achieve around 3,000 transactions per second – far better than Ethereum 1.0’s 15, but still nowhere near Visa’s 65,000.

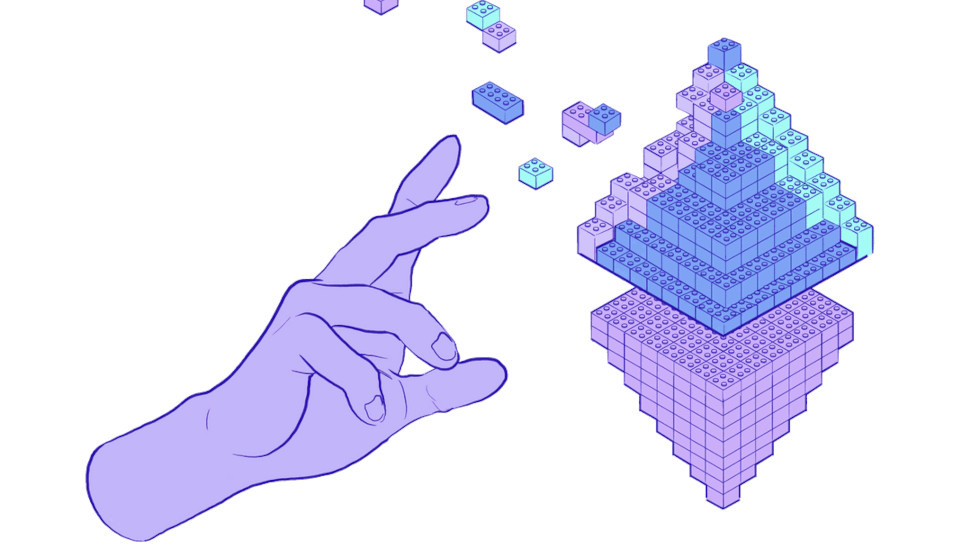

The second school of thought is with Layer 2 solutions. These are solutions designed to solve issues with stock Ethereum by handling transactions off the main Ethereum chain while still taking advantage of the many benefits it has to offer. These have the capability to solve many of the problems with Ethereum – from the gas fees through to speed and scalability.

There are scores of Layer 2 solutions available to organisations. The key for any business looking at using a Layer 2 solution is to assess exactly what they are looking to achieve. The best-in-class Layer 2s can entirely mitigate the issues around cost, speed, and scalability, and make Ethereum work efficiently and indefinitely for any use case.

The future of Ethereum

Ethereum no doubt has incredible potential – there really is no other solution that provides such a tool kit of functions. As the blockchain space expands, it is crucial that the market continues to look for creative ways that the technology can be applied and bring value to different industries. Then, as an industry, we can expand the capability of Layer 2 solutions to patch all the existing gaps and build a more solid ground for a broad range of applications.

TechRadar is supported by its audience. TechRadar does not endorse any specific cryptocurrencies or blockchain-based services and readers should not interpret TechRadar content as investment advice. Our reporters hold only small quantities of cryptocurrency (under $100 in value), as is necessary to perform wallet and exchange reviews, and do not hold shares in any publicly listed cryptocurrency companies.

- We've built a list of the best mining GPUs on the market

Alan Vey is co-founder and CEO at Aventus Technologies