UPI transactions breach five billion mark in March - It's a first for it

More milestones ahead

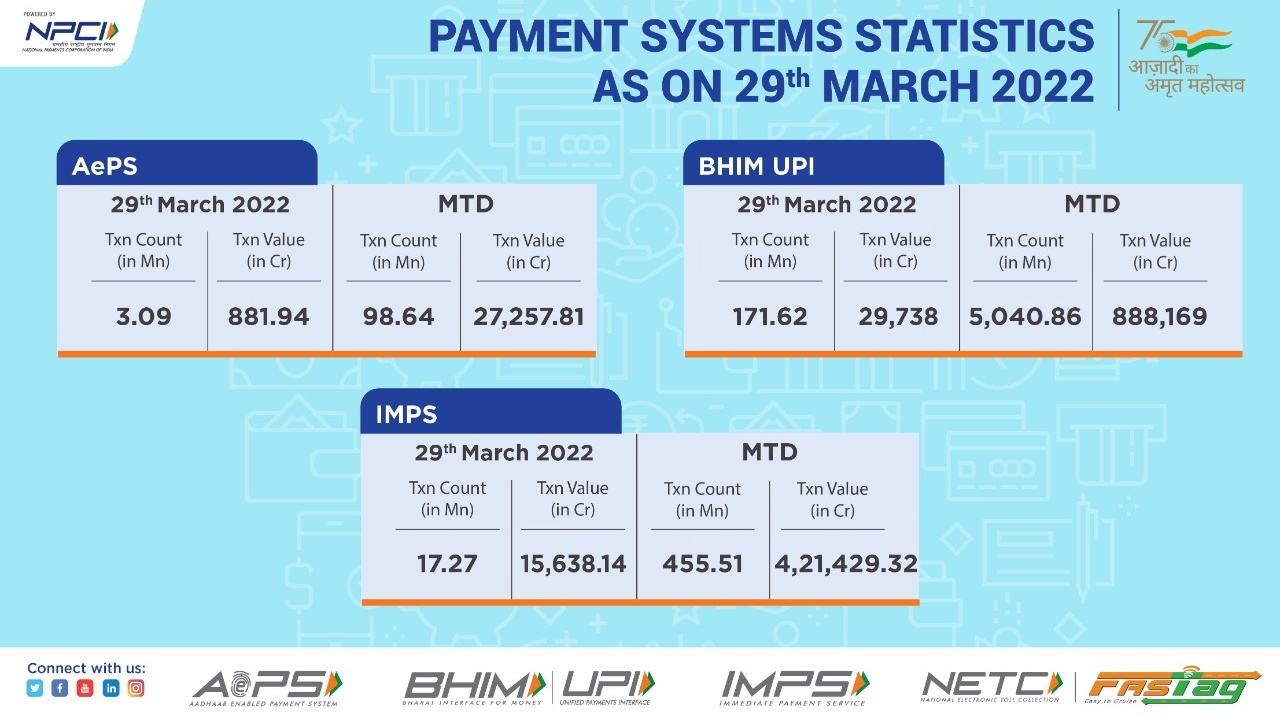

Transactions under the Unified Payments Interface (UPI) have crossed a new milestone. According to the numbers put out by the National Payments Corporation of India (NPCI), UPI transactions, in terms of volume, crossed the 5-billion count for the first time in March. As per NPCI’s data, over 5 billion (504 crore) transactions were recorded by March 29 itself. The total value of these transactions was pegged at Rs 8,88,169 crore. The account-to-account fund transfer platform had crossed 400 crore transactions in the month of October 2021, hitting a new record.

What is impressive about the March record is the fact that comes on the back of small dip in February this year when the value of retail transactions dipped to Rs 8.27 lakh crore from Rs 8.32 lakh crore in January 2022.

Crosses $1 trillion in for the financial year

Further, for the financial year 2021-22, the UPI is said to have crossed the $1 trillion mark in transaction values. The numbers underscore the fact that the UPI, which was launched in 2016, is driving the digital adoption for payments and financial services.

Reserve Bank of India Governor Shaktikanta Das has said UPI could soon record Rs 100 lakh crore worth transactions, thanks to UPI123Pay.

The UPI service, which was limited to smartphones to date, will be now available for feature phones without internet, and this is termed as UPI123Pay. UPI on feature phones will help people in rural areas who cannot afford a smartphone. Customers have to link their bank account with feature phones to use this facility. Users can initiate payments to friends and family, pay utility bills, recharge the fastags of their vehicles, pay mobile bills and also allow users to check account balances. Customers will also be able to link bank accounts, set or change UPI PINs. There are an estimated 40 crore mobile phone users who possess feature phones in India.

UPI’s share in the volume of total retail payments in the country has been increasing consistently. In FY22, 60% of volumes of India’s retail payments came from UPI. And it is the preferred mode of payment for low-value transactions. Around 50% of UPI transactions are up to Rs 200, and 75% of the total volume of retail transactions (including cash) in India are below Rs 100 in value. In this light, it has launched UPI Lite that is meant just for transactions below Rs 200.

Also, the government is planning to take UPI outside the country as well. The NPCI International Payments Limited (NIPL), a wholly-owned subsidiary company of the NPCI, would enable Indians travelling abroad to make payments in a seamless manner without having to worry about cash. At present, BHIM UPI is accepted in Singapore, Bhutan, the UAE and Nepal.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Over three decades as a journalist covering current affairs, politics, sports and now technology. Former Editor of News Today, writer of humour columns across publications and a hardcore cricket and cinema enthusiast. He writes about technology trends and suggest movies and shows to watch on OTT platforms.