WhatsApp mulls cashback to its digital payment users in India

Only a chosen few will get lucky

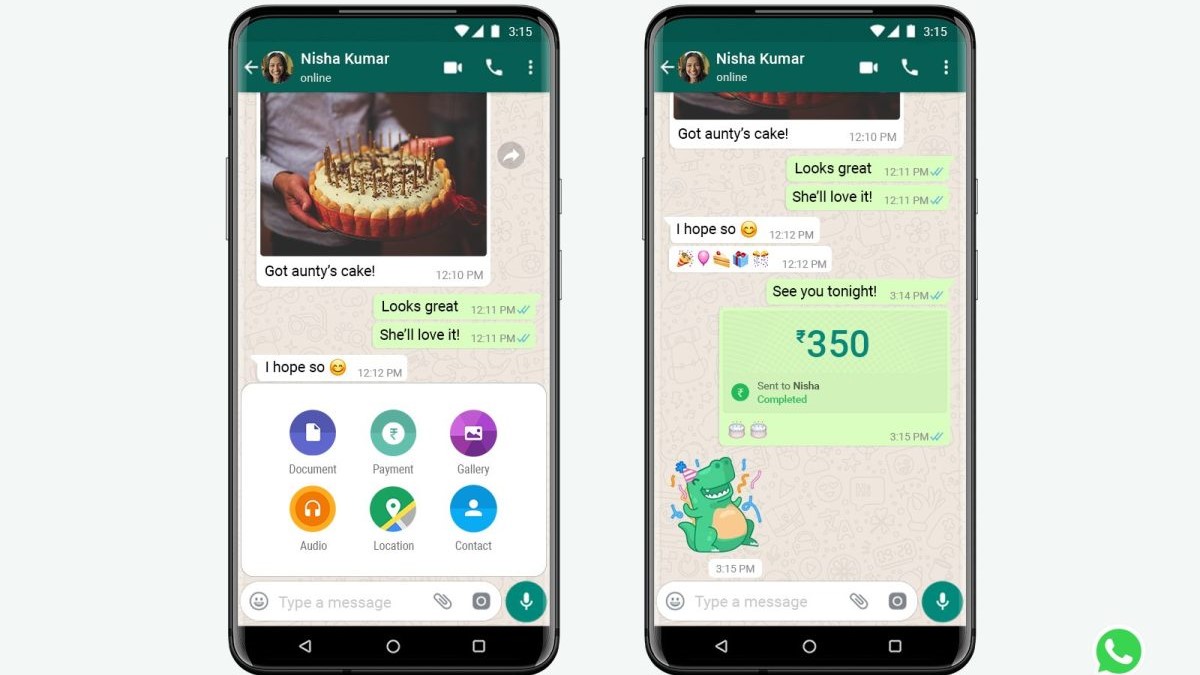

WhatsApp Pay was rolled out almost a year back in India. Despite promising to make life easy by letting users send and receive payments while chatting with their contacts, the UPI-based payment service only received a lukewarm response.

It is now being reported that WhatsApp is looking to shift gears with plans to take on services like Google Pay, PayTM and PhonePe among others. The Facebook-owned messaging platform has started rolling out a cashback feature to lure users into the payment system.

According to the reports, WhatsApp is offering a cashback of Rs. 51 to users for sending payments. This cashback is limited to up to 5 times and is currently available to beta users on iOS and Android.

As of now, the cashback option is available to a limited number of users selected by WhatsApp and there is no way a user can enroll to get the cashback benefits. Also, WhatsApp has not set any limit on the minimum amount to be transferred to avail of this offer.

- WhatsApp Pay: How to setup, send and receive money

- How to use Google Pay in India: a complete guide

- e-Rupi is India’s voucher-based digital payment system

How to sign-up for WhatsApp Pay?

While there is a detailed guide on how to sign-up for WhatsApp Pay that you can browse for more information, here is a quick guide that you can follow to sign-up for the app.

Also, remember that the process of signing up for WhatsApp Pay is similar to any other application and you need to ensure that the relevant SI card is present on the same smartphone which has WhatsApp signed in and your WhatsApp number is the same as the Registered Mobile Number with your bank.

- Tap the “Rupee” icon present in the text field on a WhatsApp chat window

- WhatsApp will ask you to add the payment method

- Choose from the list of banks

- As soon as you confirm the bank, a verification SMS will be sent automatically to your bank

- You’ll need to set up a new pin in case you’re signing up for the first time. In case you already have a UPI pin, you will need to just enter it and your service will be active

When competitors inspire...

To get a pie of the massive digital payment ecosystem in India, WhatsApp appears to be following the footsteps of Google Pay – which used similar cashback schemes to attract users.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

In the case of Google Pay, it offered scratch cards of various denominations and would surprise the users with the cashback which was a maximum of Rs. 1000, in the day. Comparatively, what the Facebook-owned messenger service offers is meagre though they are hoping that its large user-base will help the company spread the message and garner some goodwill.

Similar steps were followed by other companies like PhonePe, though in recent times, the frequency of cashback has reduced and both the payment systems offer discount vouchers from several partners.

ID verification may become mandatory

In a related piece of news, there is a possibility that WhatsApp may make it mandatory for the users to verify their identity to use the platform. According to a report, the messaging platform might soon ask business users to upload their government-issued identity documents.

As of now, the service only verifies users’ phone numbers linked to the bank account via an automated process. Currently, applications like Google Pay and PhonePe do not ask for any document, however, PayTM does have a process in place to verify the user via Aadhar linked biometric verification process.

- Best gifting ideas for family and friends this Diwali week

- This Diwali, convert your house into a Smart Home

Want to know about the latest happenings in tech? Follow TechRadar India on Twitter, Facebook and Instagram!

Jitendra has been working in the Internet Industry for the last 7 years now and has written about a wide range of topics including gadgets, smartphones, reviews, games, software, apps, deep tech, AI, and consumer electronics.