WhatsApp Pay looks to up its game in India - This is how

But it has a mountain to climb

When Meta, which owns WhatsApp, rolled out in December 2020 WhatsApp Pay in India --- among the first two countries to get the facility --- its hopes of dominating the market was doubtless high. After all, it is in India its largest user base resided, and as a country, it was embracing the digital economy almost with a vengeance. Despite a market cap put in place by the regulator NPCI, the WhatsApp Pay service was expected to walk away with a major chunk of India’s mobile payments market, which is estimated to reach $1 trillion by 2023.

As it happened, WhatsApp Pay huffed and puffed up its way through the Indian market, and its share of UPI transactions stands at less than 1%, whereas Walmart-backed Phone-Pe and Google Pay's market share is 46% and 34% respectively.

But there may be some light at the end of the tunnel for WhatsApp Pay in India. The National Payments Corporation of India (NPCI) has allowed WhatsApp Pay to expand its base in India to 40 million users. It is currently restricted to 20 million users in the country.

- WhatsApp Pay eyes expansion by offering affordable health insurance

- Digital payments in India: UPI transactions cross 2-billion mark in Oct

WhatsApp Pay has a few India-first features lined up

But it is only a partial victory for WhatsApp as it had asked the regular to lift the market cap fully. Also, it is not clear when the new cap would come into effect. At 40 million, the new limit would amount to a paltry 8% of WhatsApp's claimed 500 million user base in India.

Anyway, buoyed by the minor win, WhatsApp Pay is looking to go full steam in India. According to a report in the Economic Times (behind paywall), WhatsApp Pay is planning to invest significant sums in India over the next six months to speed up its growth.

Sometime back we spotted WhatsApp testing cashback to increase traction. In the past, offering cashback has helped competitor like GPay or PhonePe to not only increase their user base but also helped increase the ticket size per transaction. A large chunk of this incoming investment mentioned above may go into acquiring new users via instant cashback.

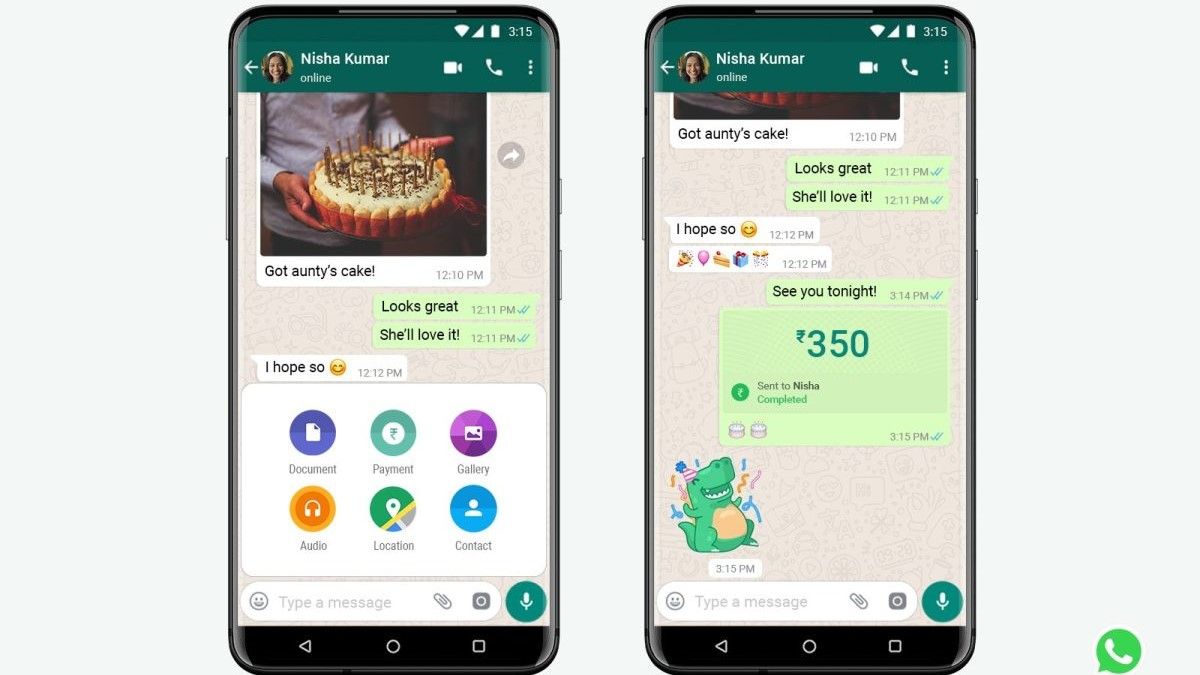

Recently, it introduced India-specific features including adding ₹ (rupee) symbol in its chat composer for sending payments, and the camera icon in composer, which lets users scan any QR (quick response) code.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Manesh Mahatme, director-payments, WhatsApp India, was quoted as saying, “Over the next 6 months, we have planned significant investments in WhatsApp Pay across India — including many more “India-first” features — that we are sure will accelerate our growth.”

WhatsApp Pay may have an image problem

But WhatsApp will not have it all that easy. Its main rivals like Google Pay, PhonePe, and Paytm all seem well entrenched and are in no mood to cede their hard-won dominance.

Aside, WhatsApp is also learning that its ubiquitousness as a messaging platform that is also used to forward some bogus messages is coming in the way of it being accepted as a payments platform. "It is all down to perception," says Prajesh Kumar, a Bengaluru-based fintech analyst. "In our research we get the vibes that people are less trusting of WhatsApp for financial transactions".

But he says these things can be gotten past if WhatsApp works on its image. The new investments planned in India may involve some image makeover exercise too.

Over three decades as a journalist covering current affairs, politics, sports and now technology. Former Editor of News Today, writer of humour columns across publications and a hardcore cricket and cinema enthusiast. He writes about technology trends and suggest movies and shows to watch on OTT platforms.

Midjourney V7 gives the AI image-maker power, speed, and correctly shaped hands

This Ryzen-powered NAS is barely bigger than a shoe box and can hold 11 SSDs and HDDs, delivering more than 500TB of storage

This is the world's first 1TB microSD Express card to go on sale, just in time for the launch of the new Nintendo Switch 2