WhatsApp Pay off to very slow start in its first month in India

No big momentum

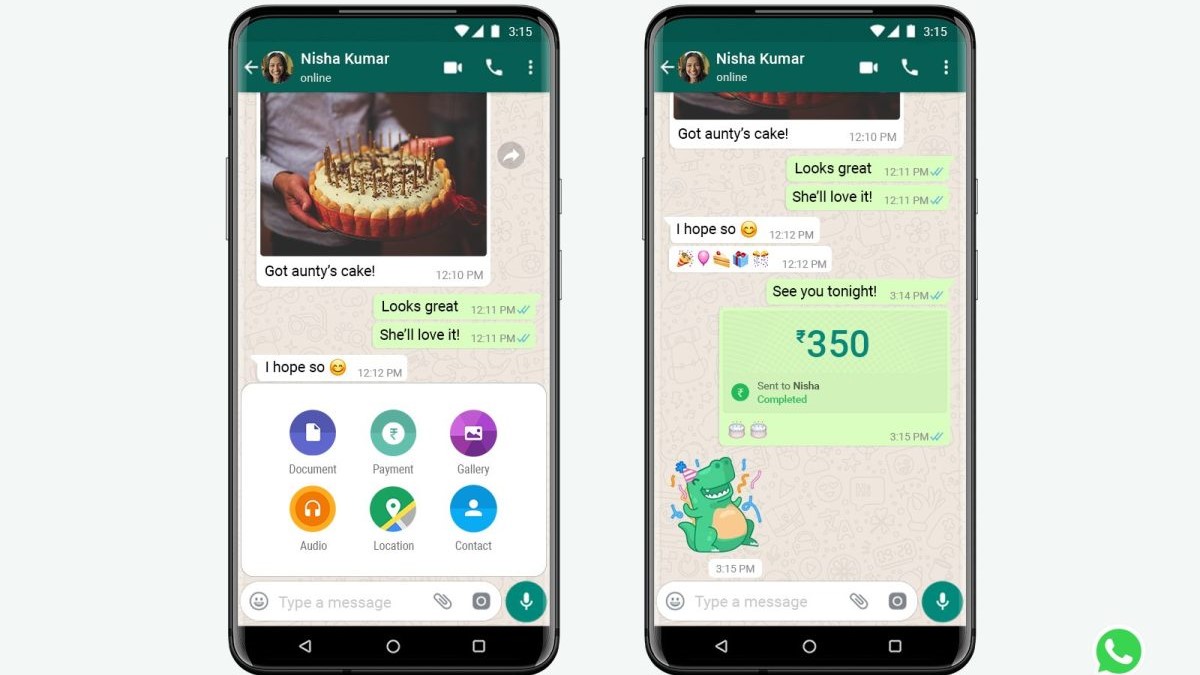

WhatsApp Pay which was rolled out in India amidst high expectations, is not exactly setting the Ganges on fire, as it were. Though these are admittedly early days ---- it was rolled out in India on November 6 --- it has processed 310,000 transactions by the end of November 30.

The number is decidedly low considering the user base that WhatsApp has. Of course, WhatsApp Pay user number is capped at 20 million. But 0.31 million transactions seems too low a number, especially considering what the well-entrenched competitors have pull off in the same month.

Further, the transactions were worth a piddly Rs 13 crore.

A total of 2.2 billion transactions worth Rs 3.91 lakh crore were processed on UPI in November. UPI (Unified Payments Interface) is the flagship payments platform of the National Payments Corporation of India (NPCI).

WhatsApp Pay is, however, expected to improve its show in the coming months.

- Digital payments in India: UPI transactions cross 2-billion mark in Oct

- PayTM has returned to Play Store - but, the battle is far from over

Google Pay tops the charts

Google Pay was the most-used UPI application in November, facilitating 960 million transactions worth Rs 1.61 lakh crore with a market share of over 43%. Its chief competitor was Walmart’s PhonePe that had 868 million transactions worth Rs 1.75 lakh crore.

Paytm and Amazon Pay processed 260 million and 37 million payments, respectively.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

NPCI’s BHIM application was the fifth most used payment app with 23 million transactions worth Rs 7,427 crore in the month.

But when it comes to the total value of transactions on UPI, PhonePe was the leader, having close to Rs 1.75 lakh crore of transactions in November, while Google Pay registered transactions worth Rs 1.61 lakh crore transactions on its platform.

Between them, Google Pay and PhonePe garnered 82% of the overall volumes on the NPCI retail payment platform.

Gates praises India's digital payments platform

But as per new NPCI guidelines, both PhonePe and Google Pay would have to reduce their market-share to less than 30% by the end of 2021. For others, these limits would kick in from January.

The cap of 30% will be calculated on the total volume of transactions processed in UPI during the preceding three months. The reason for the 30% cap is to “address the risks and protect the UPI ecosystem as it further scales up.”

Google Pay and PhonePe have said that the cap is against the ‘free market’ principles of UPI.

Google, Facebook and Amazon are also keen to have tie ups with Indian firms to create a rival to NPCI.

As it happens, elsewhere, Bill Gates has praised India for digital payments policies. At the Singapore Fintech Festival yesterday, Gates said that India has built an ambitious platform for digital payments, including a system for sending rupees between any bank or smartphone app.

Gates said such advancements in financial innovations have drastically reduced the cost and friction of distributing aid to the poor, especially during the Covid-19 pandemic.

Via: NPCI

Over three decades as a journalist covering current affairs, politics, sports and now technology. Former Editor of News Today, writer of humour columns across publications and a hardcore cricket and cinema enthusiast. He writes about technology trends and suggest movies and shows to watch on OTT platforms.