Xiaomi holds on to its top slot in India’s smartphone market in 2021

Indian market records highest ever shipments, revenue

Despite the last quarter of 2021 being less than satisfactory, India’s smartphone shipments for the year grew 11% (YoY) to reach 169 million units while the revenue crossed $38 billion with 27% (YoY) growth. This despite the 8% YoY decline in volume terms in the December quarter due to supply issues.

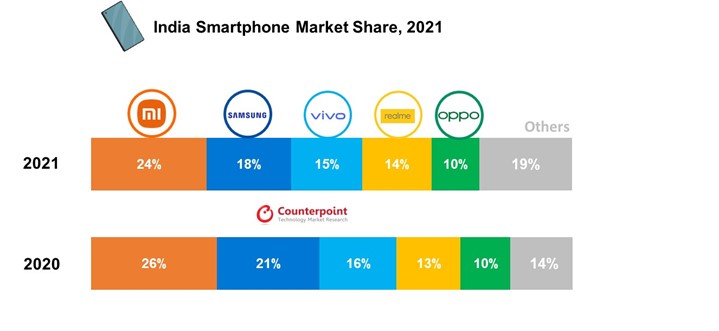

Among the top five brands, only Realme improved its performance in revenue terms, Oppo neither improved or declined, the rest saw their overall market share slip up a bit, but the order of Xiaomi, Samsung, Vivo, Realme and Oppo remain unchanged.

Xiaomi held on to its top position in 2021. Xiaomi grew 258% in the premium segment (phones costing over Rs 30,000) in 2021 with the Mi 11x series, according to Counterpoint's Market Monitor service.

Top brands losing their grip

As per Counterpoint's chart, Xiaomi had 24% market share in India (in revenue terms). It remained at the top even though it had held a 26% share in 2020. The second ranked Samsung ended at 18%, a 3% drop from its previous year's share. Vivo was at 15%, slipping marginally from 16% in 2020. Oppo, which was at the 5th spot, just about held on to its 10% share that it managed in the previous year too.

Only Realme that finished 4th in the list in both the years, managed an improved performance. Its percentage moved from 13 to 14.

If you take shipments numbers, Samsung saw a bigger decline with an 8% slip up. "Supply chain disruptions, absence of new Note series, reduced focus on the entry-level segment and fewer launches in the mid segment compared to the previous year led to an overall decline," Counterpoint said.

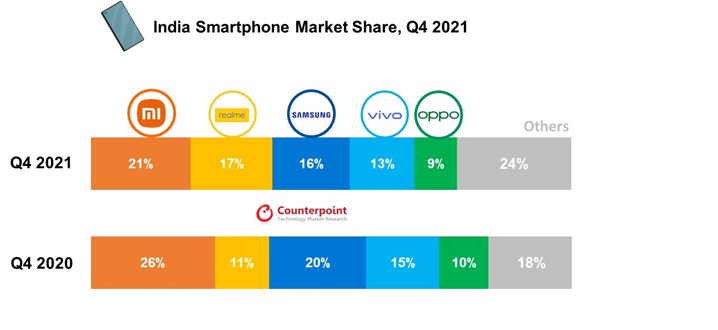

Again in shipments numbers, Realme was the fastest growing in 2021 with 20% YoY growth. It also captured the second spot in Q4 2021 for the first time ever. Realme is aiming to provide 5G in all smartphones priced above Rs 15000. It also plans to enter the ultra-premium segment.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Apart from the top 5, the rest of the brands improved their revenue percentage from 14 to 19.

The Transsion Group brands --- Itel, Infinix and Tecno --- registered 55% YoY growth and crossed 10 million shipments for the first time ever in a single year.

Apple tops in premium segment

In shipments numbers, Apple saw 108% YoY growth. It maintained its lead in the premium segment with a 44% share. "Aggressive offers during the festive season, strong demand for the iPhone 12 and iPhone 13 and increased ‘Make in India’ capabilities drove high growth," Counterpoint said.

OnePlus reached its highest ever shipments in 2021, crossing the 5-million mark with 59% YoY growth driven by the OnePlus Nord Series.

Senior Research Analyst Prachir Singh was quoted as saying, “The Indian smartphone market witnessed high consumer demand in 2021, making it the best-performing year."

Research Analyst Shilpi Jain said, “India’s smartphone market retail ASP (average selling price) grew 14% YoY in 2021 to reach its highest ever at $227."

Want to know about the latest happenings in tech? Follow TechRadar India on Twitter, Facebook and Instagram!

Over three decades as a journalist covering current affairs, politics, sports and now technology. Former Editor of News Today, writer of humour columns across publications and a hardcore cricket and cinema enthusiast. He writes about technology trends and suggest movies and shows to watch on OTT platforms.