Apple Pay Later could make you qualify for its limited financial help

Have you been a good enough Apple customer?

Apple's Pay Later service is apparently now just weeks away for US customers, but rumors suggest the tech giant will make you jump some significant hurdles before granting you its financial help.

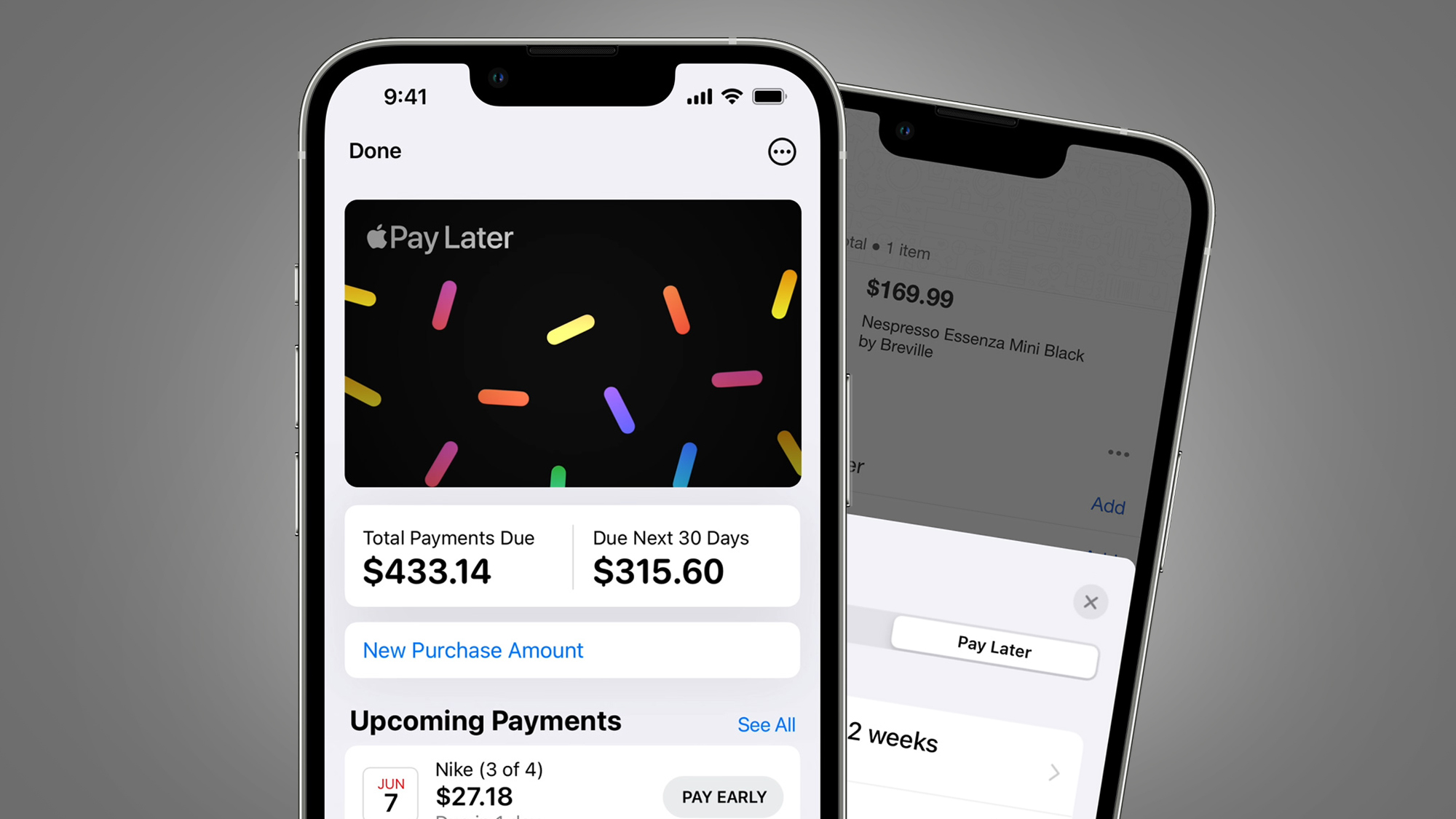

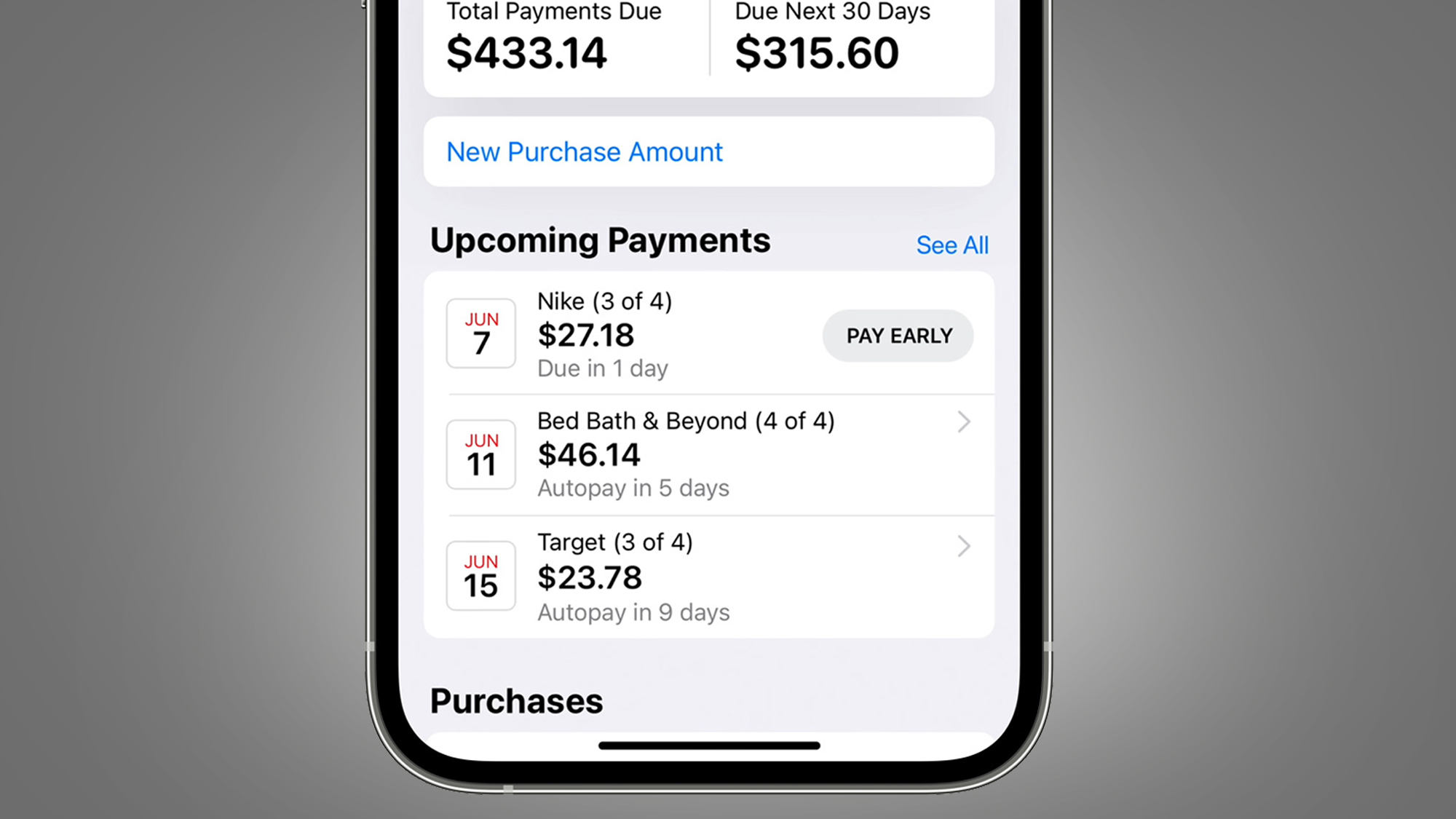

The Pay Later service, which was announced in June 2022 but is still in testing, will let you split any Apple Pay purchase into four zero-interest payments over six weeks. But Bloomberg says you'll need to prove that "you've been a good customer in the past" based on your spending history and "even which of the company's devices" you own.

Apple will also apparently check "whether customers have applied for an Apple Card credit card" and what other cards are linked to their Apple Pay accounts. In other words, you'll need a good credit score and preferably a solid record of buying things from the Apple Store to earn access to Apple's 'buy now, pay later' (often referred to as 'BNPL') service.

Needing to qualify for BNPL credit isn't anything new, but having to prove that you've been a good customer to a tech giant like Apple is less common. Apple Pay Later is significant because it'll be the first time that Apple will use its own in-house payment platform, making it a fully-fledged financial services company.

Apple Pay hasn't been without its controversies, with Apple currently locked in discussions with EU antitrust regulators over a charge that it's been restricting access to third parties who want to develop mobile wallet services for iOS devices. But more important to existing iPhone owners will be the financial help Pay Later promises to bring – which is unfortunately pretty limited.

With Pay Later, which will be US-only at launch, you'll be able to split Apple Pay purchases into four equal payments over six weeks, with no interest or any fees. According to Bloomberg, you'll simply be asked how much you'd like to borrow in the Apple Pay app and it will return with an approved amount.

While that could be handy for those who want to split the cost of a pricey purchase (for example, an Apple MacBook Pro 16-inch (2023)) across a couple of credit card billing cycles, it doesn't really improve on existing options from the likes of Paypal or Affirm (which offer 0% interest over longer periods).

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Analysis: Welcome to the Bank of Apple

It's a sign of the times that Apple's biggest area of expansion and innovation in 2023 is seemingly in financial services, rather than the products that have made it the world's most valuable company.

We recently heard rumors that Apple's iPhone Subscription service is still en route despite delays, and it now seems that Apple Pay Later could also launch soon. Both services are a response to a cost-of-living crisis that has put Apple products beyond the reach of many. But they'll also be a handy financial boost for the tech giant, which takes a small cut from every Apple Pay transaction.

Some of those Apple earnings may take a hit if the EU does indeed decide that the tech giant has been blocking rivals from gaining a foothold in its iOS mobile wallet, with a potential fine reported to be as high as $39bn. But Apple will likely remain undeterred from pursuing its mobile payments side hustle – and that's good news for Apple Pay fans who've been waiting for its Pay Later service to launch.

It's a shame Pay Later's interest-free loans aren't offered beyond six weeks – considering you'll also need to start paying it off just two weeks after purchase, this could limit its early popularity.

But the move to being a fully-fledged financial lender, which has apparently involved Apple creating a separate business to handle approvals, is a huge one for the company, so it may simply be starting cautiously. With the service having now been tested with employees in recent months, Bloomberg says Apple Pay Later should arrive "in the coming weeks". In the meantime, you can get prepared by checking out our guide to the best personal finance software.

Mark is TechRadar's Senior news editor. Having worked in tech journalism for a ludicrous 17 years, Mark is now attempting to break the world record for the number of camera bags hoarded by one person. He was previously Cameras Editor at both TechRadar and Trusted Reviews, Acting editor on Stuff.tv, as well as Features editor and Reviews editor on Stuff magazine. As a freelancer, he's contributed to titles including The Sunday Times, FourFourTwo and Arena. And in a former life, he also won The Daily Telegraph's Young Sportswriter of the Year. But that was before he discovered the strange joys of getting up at 4am for a photo shoot in London's Square Mile.