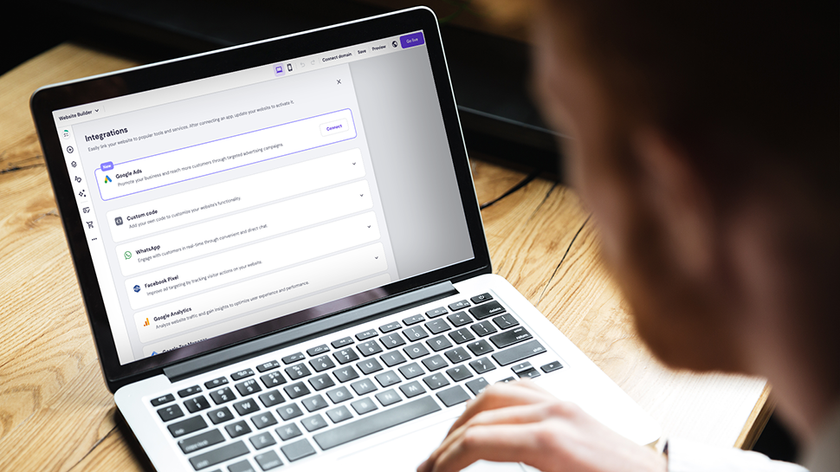

A new service launched by Barclaycard aims to tackle late payments, save time and generate savings for its business customers. Barclaycard Payment Intelligence (BPI) will use data analytics to help provide a much more comprehensive overview of businesses and their supply chains.

As a result, Barclaycard reckons that it will be able to help businesses cut costs by combatting late payment inefficiencies. Using brand new technology the BPI system analyses each supplier against numerous factors in order to create a custom payments strategy for each business signed up for the service.

By combining hundreds of accounts payable data points with internal and third-party information customers will be able to tailor their payment solutions more precisely. The technology allows businesses to catalogue their suppliers based on the number and value of transactions as well as their size, location and industry.

- Have a look at the best accounting software

- The best tax software around today

- Check out the best money transfer apps and services

Barclaycard Payment Intelligence

The system will also be able to tell whether early payment is likely to generate savings by creating a comprehensive overview of the entire supplier framework. For companies of all sizes that work with thousands of suppliers Barclaycard claims the new product will offer significant time and cost saving for business owners.

Anna Parra, Commercial Strategy Director for Barclaycard, said: “Clunky and complex supplier payments processes mean that businesses of all sizes are losing out on time and money.

Barclaycard has looked to make use payments data to identify opportunities for improvements across the procure to pay process and drive actionable insights for both buyers and suppliers. Barclaycard Payment Intelligence is a new suite of tools that harness state-of-the-art data analytics and financial modelling to devise tailored, actionable solutions for our customers.

This approach not only brings tangible benefits to the bottom line, but it also helps to strengthen relationships between buyers and suppliers. As we navigate our way through this difficult period, safeguarding supply chains is a key way of future-proofing operations, and it’s part of Barclaycard’s mission to help businesses realise these benefits.”

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

- We've also highlighted the best budgeting software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.