Best budgeting software of 2025

Make it easy to manage your finances

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

We list the best budgeting software, to make it simple and easy to manage your finances more efficiently.

This is important for boosting your wealth because it allows you to see where your costs are and how potential savings can be made. Best of all, it will highlight any small but regular costs that can really undermine your finances. These can often be missed by general finance software.

For example, when buying items with cash, what do you do with your change after? This is something that budgeting software can account for that other financial software might miss.

Budgeting software also aims to get you into good habits, such as reducing debt and freeing up savings for investments purposes. However, this also shows the limitations of budgeting software, which doesn't quite do the job of the best tax software, or for that matter, the best accounting software for small business if you run your own company.

Nevertheless, as every business owner soon learns, small costs and miscellaneous spends can really add up. So budgeting software is ideally placed to help you identify these things and ensure that you can take better control of your money and overall finances.

Below we'll list the best budgeting software platforms currently available.

Check out the best free accounting software for small business.

The best budgeting software of 2025 in full:

Why you can trust TechRadar

Best budgeting software for beginners

Reasons to buy

Reasons to avoid

YNAB (You Need A Budget) is a modern approach to applying a budgeting solution to personal finances. Its chic interface is sure to particularly appeal to the millennial generation.

YNAB makes it simple by connecting accounts to come up with an amount to be budgeted, and then assigning where the money goes by the category including immediate obligations such as the rent and the electric bill, true expenses including medical and auto maintenance, and debt payments; the goal is to give every dollar a job.

Via the interface, the right panel clearly displays overall budget information such as the amount spent last month, the budget from last month, and any underfunded categories. Better budgeting habits are taught and encouraged via a weekly video, a podcast series, and a newsletter. It also encourages goal oriented savings, for holiday presents, and even retirement.

You Need a Budget has a deceptively potent interface that can be tailored to suit an individuals needs based on their financial picture. You can add a bank account and import transactions directly from there. Naturally, the way the overall financial picture alters as your new financial data gets entered into the various categories.

You Need a Budget has also been spruced up and the latest version carries new features such as Age of Money (which in a way highlights how prudent you are) and also has the ability to import those direct transactions as noted above. It’s a feature that works for your credit cards too.

There is a free trial period for the curious duration of 34 days, and after that there are options for a monthly or yearly subscription.

Read our full YNAB review.

YNAB - Get a free 34-day trial

If you're keen to get a better grip on your finances then YNAB makes an ideal option to consider. There's a free 34-day trial available currently, which will let you explore all of the features and functions, without any cash outlay.

Best budgeting software for PC

Reasons to buy

Reasons to avoid

Unlike some of the more mobile focused solutions, Quicken is downloadable software for a PC, and is in the minority for supporting both Windows and Macintosh platforms. It is a venerable budgeting and financial program that has been around since the days of DOS and Apple II systems.

Quicken works by downloading all your transactions to make it simple, and obviate the need for tedious manual entries. It offers advanced features including the ability to export data to Excel, integrated Quicken Bill Pay, the ability to generate custom invoices with your own logo, and secure online backup of Quicken files to Dropbox cloud storage.

There are differently priced tiers according to the type and number of features you require, such as customized budgets, priority customer support and free online bill payment, as well as one that can separately categorize both home and business expenses and can email custom invoices.

The most recent update of Quicken resulted in a few handy new features being added, with some real benefits coming along in the Mac version. You’ll begin your financial journey on the Home tab, which delivers a comprehensive snapshot of where you are with your finances. For newbies there is also a neat Wizard-style system.

There are core areas that help build up a picture of your money situation, with a Spending tab, Bills and Income section and so on, all of which are pretty easy to get the hang of. Customization of these areas is also key by allowing you to make Quicken completely personal to your needs.

Read our full Quicken review.

Quicken - Try it for 30 days risk-free!

Start taking control of your money with the Starter package at $35.99/yr, manage your money and save with the Deluxe option at $46.79/yr down from $51.99/yr, maximize your investments with Premier for $70.19/yr, down from $77.99/yr or manage personal and business finances all in one place with Home & Business at $93.59/yr, reduced from $103.99/yr.

Best budgeting software for ease-of-use

Reasons to buy

Reasons to avoid

Moneydance has been a popular desktop money management solution for a good while now and has lots of Mac users as fans. Whilst it’s certainly a treat to use on the Apple OS platform, this software is also available for Window and Linux.

Whichever flavor you’re keen on the software is undeniably quick and easy to use. And, if you’re in the US then it has been continually improved to work with all of your bank accounts, which makes it hugely appealing, as well as credit cards and investments.

Moneydance comes with the same price tag for each version, so from the Mac OSX edition through to the Windows and Linux versions the cost is the same. There are also editions available for those who prefer a mobile solution, with versions on iOS and Android.

However, the good news is that when you download the software you do actually get a demo edition, which allows you to discover the features and functionality of Moneydance before committing fully.

That said, you’ll subsequently need to pay a fee for the software in order to lift the limitations that prevent the demo option being a full bells and whistles experience.

Read our full Moneydance review.

Moneydance - Buy now for just $49.99

For personal use, people who use Moneydance should buy one license per household, no matter how many computers you install it on, operating systems you use, people who use Moneydance, or data files you create. For business use, please buy one license per computer Moneydance is installed on, or per data file (on a shared network), whichever is smaller.

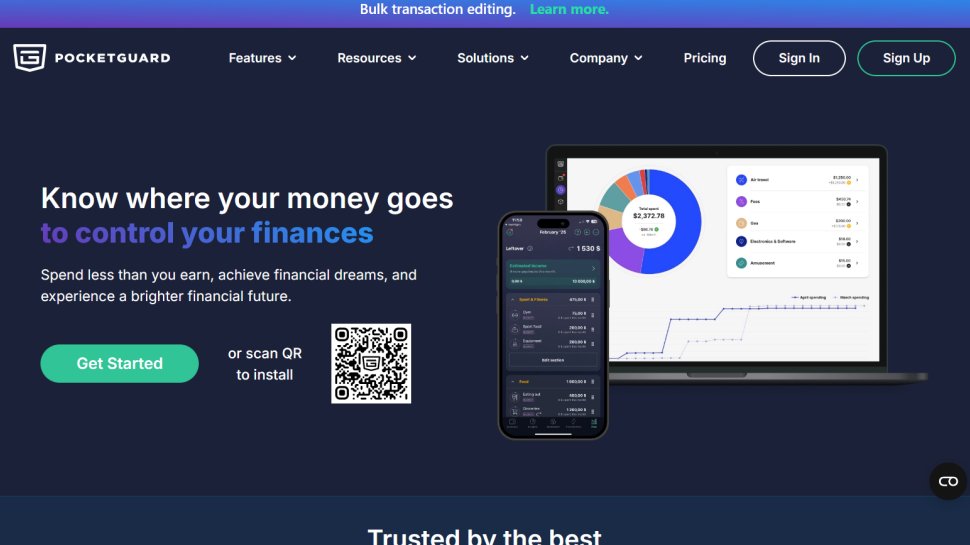

Best basic budgeting software

Reasons to buy

Reasons to avoid

Pocketguard is perfect you’re often in the position where you’re feeling a little bit nervous about just how much you're spending. This is a financial management app, for both Mac OS and Android, plus there’s a desktop edition too.

However, if you're looking for a handy quick reference guide to your finances at any time of the day, or night, then the mobile edition of this package is certainly one to try.

It’s available for both the US and Canadian markets and allows you to get all of your incoming and outgoings into one convenient place and subsequently get budgeting much more efficiently thanks to its central In My Pocket star feature.

Pocketguard comes in a basic edition, which is still pretty well stacked, that comes with no cost attached. If you’re suitably smitten with what it does then you may want to boost the usability by plumping for the Pocketguard Plus model, which has a monthly or yearly subscription.

Highlights include the capacity for tracking your incoming and expenses, seeing just how much you've got spare. Meanwhile, Pocketguard also lets you build up a bigger picture of your money matters over time. Other key features are the options for creating spending limits so you can cap outgoings where needed, as well as the capacity for setting savings goals.

Add it all together and the picture of your finances becomes very clear indeed. Once you’ve got all your data into the software you’ll have an In My Pocket zone, which is the true strength of the app as it gives an instant overview of your money.

Read our full Pocketguard review.

Pocketguard - Simple budget tracking

PocketGuard makes it easy to take control of your money, optimize your spending and grow your savings automatically. Better yet, it's easy to sign up and try the software for yourself. Even in its most basic guise the package has plenty of features, but get the best from Pocketguard by heading for the Plus edition.

Best budgeting software for tracking expenses

Reasons to buy

Reasons to avoid

Mint is another mobile based solution from the folks that brought us TurboTax and Quickbooks. It makes it easy to track expenses and balances. By creating an account, and connecting all your financial accounts, Mint can then provide analysis, to help find savings by providing potentially money saving offers for credit cards, retirement rollovers, and savings account deals.

Mint provides security via multi-factor authentication, security scanning with VeriSign and the ability to remotely delete your financial data in case your mobile device is lost.

Mint also conveniently provides a convenient way to know, and track your credit score. The cost is free, and the company makes money through affiliate offers.

It’s certainly not complicated to master, but the options it provides you with are actually many and varied. The action centers on a few main features, with Mint offering the ability to connect to your bank, or banks, and other financial interests along with keeping an eye on your credit score.

The good thing is that you can also ‘unplug’ these as and when you need to, or if you want to block out specific areas of your finances. Doing all this is really easy and involves nothing more than adding in accounts with the odd screen tap or two. As you’d expect, Mint keeps a firm grip on security and uses 256-bit data encryption, plus VeriSign security scanning.

Read our full Mint review.

Mint - The free way to manage money

Reach your goals with personalized insights, custom budgets, spend tracking, and subscription monitoring and all for free. Get Mint for Apple or Android devices and sign-up for an Intuit account, allowing you to gave easy access to Mint and other products in the portfolio.

Best budgeting software for mobiles

Reasons to buy

Reasons to avoid

CountAbout is a personal financial and budgeting software solution. It is notable as it can import data from Quicken, or Mint, and is one of the few solutions that can do this. When you sign up you're encouraged to do that early on, and there are some decent instructions that walk you through the steps.

It also connects to your other financial assets, including banking, credit card and retirement accounts, which includes thousands of financial institutions. Additional features include multi-factor login protection, categories can be customized, running register balances, and support for recurring and split transactions. It also facilitates advanced budgeting, via activities such as account reconciliation, and tracking register balances.

CountAbout is available for the iOS and Android platforms, and can also be used on a full PC via the web-based interface. It is available via a subscription interface, starting with a Basic account, but requires transactions be entered manually, or a more usable Premium account can automatically download transactions from your financial institution.

You also get an easy access Account Maintenance option, which during setup means you can choose to have transactions automatically downloaded from the financial institutions you deal with. Once you’re into the main working area you’ll find that the interface is clean, fuss-free and easy to navigate.

The interface is additionally impressive in that it can be customized to suit your individual needs. For example, any kind of additional category can be added into the left-screen menus, while others that you don't need can be removed. The ability to add in and manage invoices is another boon, especially if you’re a small business owner.

Read our full CountAbout review.

CountAbout - Premium features for low money

Premium $39.99 / year package provides full access to all CountAbout functions, including automatic downloading of banking, credit card, and other financial transactions. Basic edition is $9.99 / year and provides full access to all CountAbout functions except for automatic downloading of banking, credit card, and other financial transactions.

Best budgeting software FAQs

How to choose the best budgeting software

Not everybody finds it easy to manage their money, which is why budgeting software can be such a help. The great thing is that in many cases, where budgeting software isn't free, it can be trialled so you can make an informed decision on the one that suits your needs best without any major commitment.

Choosing the right budgeting software involves having a short checklist of wants in your head, usually surrounding how many tools will be at your disposal to help manage your personal finance more effectively.

However, if you've got relatively simple financial affairs there's also no point in heading for a complex and very powerful package. What usually happens in that scenario is you'll end up with lots of features and functions that are rarely, or never used.

Ideally then, choosing the right budgeting software is all about keeping things simple.

How we tested the best budgeting software

When it comes to lining up our shortlist of best budgeting software we spent time working our way through all of the features and functions on offer.

Central to the list of requirements is ease of use, because it doesn't matter if you've got lots of tools at your disposal if they're too hard to figure out. We also looked at value for money, how software programs worked on different platforms and if app editions lived up to our expectations.

We were also keen to see how many budgeting programs have kept up with the times. After all, the financial picture is constantly changing for all of us, so knowing that you've got a software program that can handle the latest rules and regulations is a must-have.

Read more on how we test, rate, and review products on TechRadar.

We've also featured the best mobile payment apps.

Get in touch

- Want to find out about commercial or marketing opportunities? Click here

- Out of date info, errors, complaints or broken links? Give us a nudge

- Got a suggestion for a product or service provider? Message us directly

- You've reached the end of the page. Jump back up to the top ^

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Jonas P. DeMuro is a freelance reviewer covering wireless networking hardware.