Can Samsung keep smaller Chinese smartphone players at bay this year?

South Korean giant will have a sigh of relief as Huawei is not in the race but it is likely to face stiff competition from Oppo, Xiaomi, Vivo and Realme

Samsung has room to play and will have a sigh of relief this year as Huawei is not in the real smartphone competition due to lack of Google Play Store but the South Korean giant is going to face stiff competition from other Chinese players, industry experts said.

Samsung is having a very good start for the year with Galaxy S20 series and Galaxy Z Flip devices.

Research firms told TechRadar Middle East that it is an innovative device and the best Samsung device to date by far, especially the S20 Ultra with specs that are off the chart, with 16GB of RAM, 45W superfast charging, 108MP main camera and 100x digital zoom.

Shobhit Srivastava, Research Analyst at Counterpoint Research, said that Samsung is targeting the market with different SKUs.

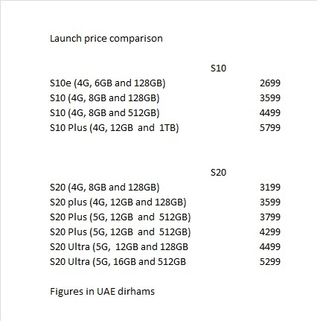

With S20, Samsung launched three variants – S20, S20 plus and S20 Ultra – similar to S10 – S10e, S10 and S10 plus.

“Samsung has priced the S20 a little bit lower than S10 on certain models and they are playing around the market to see how users are reacting to it. They have learned that by having different SKUs with different price points, it will be well accepted in the market,” Srivastava said.

Srivastava said that S20 will achieve better sales volume than S10 in the Middle East and increase its market share and year-on-year sales by a single digit.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

The research group expects Samsung to sell over 40m units of S20 units globally in 2020 compared to about 35m for S10, well below the 50m mark for S7 devices in 2016.

Although Samsung had a very strong volume growth in the Gulf Cooperation Council (GCC) countries last year, up from 24% share in the fourth quarter of 2018 to 40% share in the fourth quarter of last year, Nabila Popal, Senior Research Manager at International Data Corporation (IDC), said it is not likely that this rate of growth will continue in 2020, as Apple and Huawei are still significant in share and will continue to be, plus the growth of other Chinese brands like Oppo, Vivo and Xiaomi will continue to give Samsung a competition.

While Huawei flagships have certainly suffered since the second quarter of last year due to the Google issue, she said that it is low- to mid-end devices are still doing quite well, so they – along with a cocktail of other brands – will continue to provide Samsung with some competition in those price segments.

- Korean smartphone vendors lead 5G market share compared to Chinese rivals

- Higher price, fewer models and brands pose challenge to adoption of 5G smartphones in Gulf

- Huawei’s Harmony has potential to become ‘national OS’ of China

Flagships contribution to sales is very small

Huawei has already fallen to third place in the GCC as of third quarter of last year from a high of 26% in the first quarter of last year to 17% in the third quarter.

This year, Apple is very likely to overtake Huawei and rank second globally, after Samsung.

Moreover, Popal said the point to note is that no matter how well flagship devices do, they only contribute a small percentage of the total Samsung’s volume.

Even last year, she said that it was the success of the low- to mid-end devices like ‘A’ series that contributed to the massive volume growth.

Srivastava also echoed in the same voice that the volume growth of Samsung devices came from refreshed ‘A’ series in the mid-priced segment.

“Middle East is a market for high and low USPs. In the UAE and Saud Arabia, people buy flagship models while there are countries which buy lower-priced models,” he said.

Middle East is like the Indian market, he said, where players are skipping countries to find a way to reach customers through e-commerce.

“Chinese players will leverage the strength of the online market, especially Xiaomi, Oppo and Vivo, but will not be able to fill the gap created by Huawei. There are also brands like Tecno and Itel Mobile, which are really strong and catering to the African markets,” he said.

There will no one-single brand that will gain from Huawei and there is space for all the brands in the Middle East, he said and added that Oppo and Vivo will target the market where 5G is gaining traction while Xiaomi and Realme will target entry-level markets.

“Middle East is not a saturated market like China where if one brand increases its market share, it has to gain the market share from other players. As the affordable segment is more in the Middle East, Xiaomi and Realme are expected to increase its market share this year in the region than Oppo and Vivo,” he said.

Samsung to face heat from Apple in 5G devices

Popal said that Oppo, Xiaomi and Vivo have all grown rapidly in the region, especially the first two, and increasing their focus on the GCC.

“They are a force to watch for closely, especially with their combined growth, they have and will continue to give the entire Android space strong competition in their respective price band. However, it will not be easy for any brand this year with the coronavirus situation, and especially if it worsens and not contained in the coming weeks,” she said.

Srivastava said that Apple has a place in the region to grow as it has an aspirational value, especially in the UAE and Saudi Arabia.

“Apple will give a tough fight to Samsung this year in terms of 5G devices but as Samsung’s 5G devices are already available in the market, it will have an uphold this year as Apple’s 5G devices are expected to be available in the third and fourth quarters of this year,” he said.

Apart from this, he said that Apple’s 5G devices are going to be really expensive.

“Apple’s strong market is in the US and China and the fight is not between Apple and Samsung, it will be between Apple and Android,” he added.

Osman Albora, Head of Mobile Division at Samsung Gulf Electronics, said that 5G is the future and claims that Samsung’s market share in the UAE for 5G phones is close to 80% but did not mention if it is for 2019 or only for the fourth quarter.

Akash Balachandran, senior research analyst at IDC, said that brands shipped about 2,000 5G devices into the UAE and both Huawei and Samsung held 45% market share while the rest for ZTE and Oppo.

“Samsung had a good run for 5G devices in the fourth quarter of last year as other brands were not available in major stores,” he said.

He said that 5G’s share in the GCC countries is expected to remain small in 2020 at 2.7% of the total shipments to just over 500,000 units compared to 0.1% unit share in 2019.

“5G smartphones are expected to grow significantly as prices drop and 5G becomes available in mid-range devices, which currently make up the bulk of the smartphone shipments in GCC,” he said.

By the end of 2023, he said that 5G devices are expected to grow to make up over 38% unit share in the GCC smartphone market.

Most Popular