Coming to terms with Making Tax Digital

How digitisation can impact the UK's small businesses

The UK government's plan to digitize VAT through its Making Tax Digital (MTD) initiative will go into effect this April. The plan, which was first announced during Budget 2015, will transform the way businesses and consumers pay tax with the aim of achieving a fully digitalized online tax system. In the same way that businesses first struggled to comply with GDPR, many organisations are having trouble fully understanding their duties and responsibilities under MTD.

At this year's QuickBooks Connect event in London, the company's Head of Product, Shaun Shirazian will provide an overview of MTD and discuss the latest innovations to help save businesses owners time when transitioning to the new system. TechRadar Pro spoke with him to better understand MTD and how it will affect small businesses in the UK.

- Xero - it’s time for accountancy to break out of the dark ages

- 2019: When Bladerunner collides with business

- Getting to the how of digital transformation

Making Tax Digital is a major focus at this year’s QuickBooks Connect, what exactly does it mean for UK businesses?

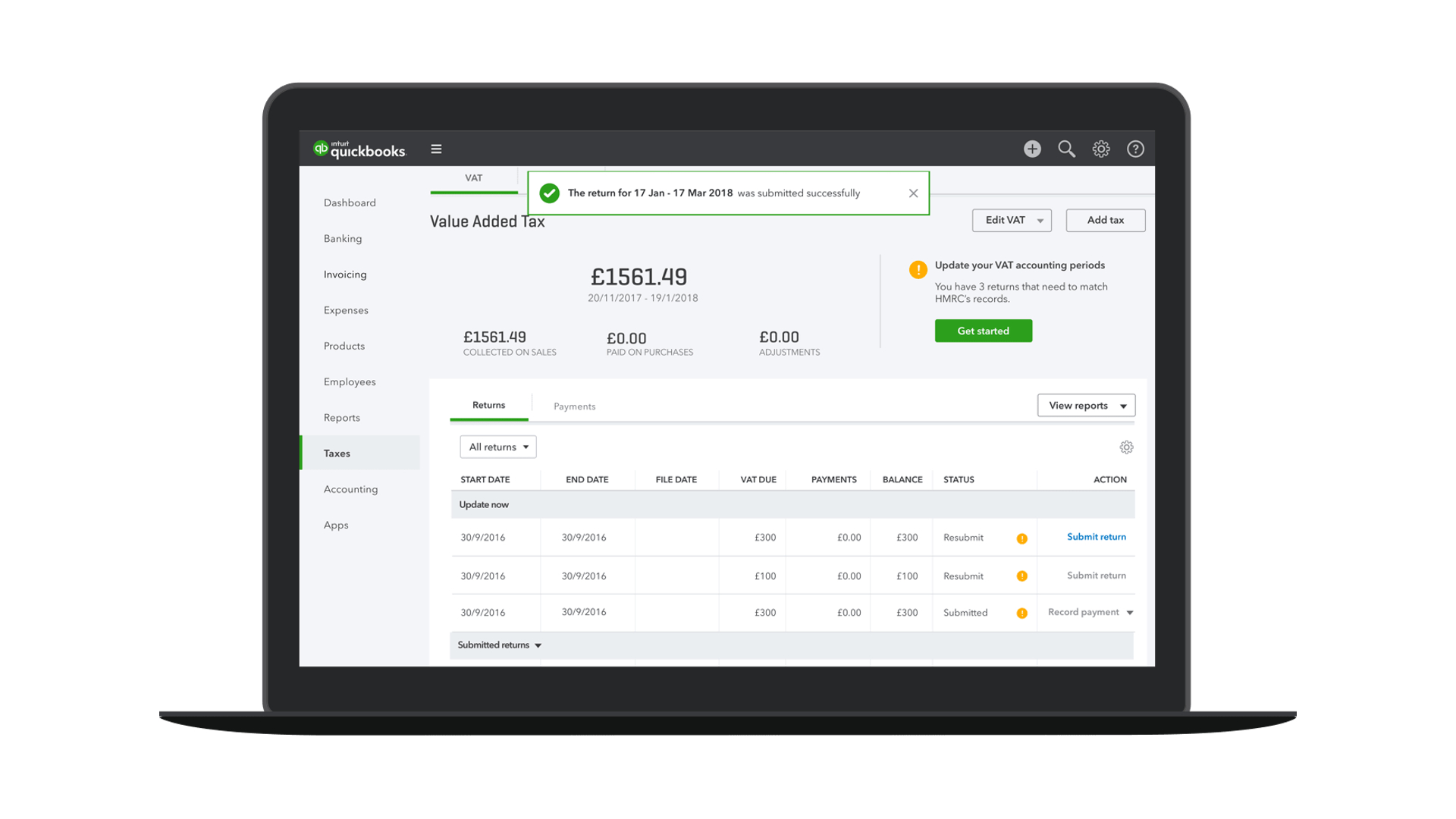

From April 1 2019, HMRC will require all VAT-registered businesses to keep digital records and send returns using Making Tax Digital (MTD) compliant software. This is done through the use of cloud accounting or bridging software capable of securely sending and receiving data from the HMRC website with digital links.

However, MTD compliance is more than submitting VAT returns ‘online’. An important part of QuickBooks Connect is showcasing to all business owners that MTD presents a fantastic opportunity to transition to dedicated software and realise the full benefits of digitalisation such as better cash flow management, significantly less time spent on admin and increased peace of mind about the financial health of their companies.

What are the key benefits of MTD and digitisation and how can small businesses and the self-employed embrace them?

MTD compliance offers a huge opportunity to streamline operations, drive efficiencies and simplify tax. It will help enhance cashflow management and allow businesses to get paid faster and access capital to grow, as well as free up time that can be spent on what really matters – whether that’s business growth or a better work-life balance.

Regulatory changes – like MTD and other digital initiatives, will mean that there is change to the way that small businesses operate, but these needn’t be scary. Adopting new financial management software (FMS) to become MTD compliant can be the first step to realizing these benefits. It can also become a catalyst for further digital transformation of the traditional back-office systems so that they’re more effective, efficient and easier for businesses.

Technology will continue to play an ever-increasing role in a business world that demands more flexibility and innovation. Businesses that embrace MTD to bring to the forefront real-time insights into how they operate, will be those that grow and evolve in an increasingly competitive landscape.

What new products have you launched at QuickBooks Connect for new businesses to help with MTD?

One product we’re especially excited about is our Receipt Capture function for our QuickBooks Online customers. Revealed today, this new feature will enable small businesses to use their mobile to snap a photo of a receipt, and QuickBooks will automatically import and match it to a transaction.

It’s time to put away the old shoebox of receipts and bring tax returns into the 21st century. The tool will help users track receipts on the move, attach receipts to invoices, eliminate lost or damaged receipts, and store them for easy reference. Which of course, was one of the key reasons behind the whole drive towards Making Tax Digital in the first place.

What’s next for small businesses after MTD?

The digital world is driving fundamental change in how we work across all sectors. It is prompting new ways of working and provides an opportunity for businesses to offer new sets of services. Businesses that embrace MTD and adopt new digital process that bring to the forefront real-time insights into how they operate, will be those that grow and evolve in an increasingly competitive landscape.

There are a lot of companies that will be moving over to a new way of doing things because of their need to be MTD compliant. By adopting digital into their back-office systems we hope that UK small businesses will be able to use this as a springboard to add value to their business in many different ways.

And for QuickBooks?

At QuickBooks we’ll continue to back the UK’s small businesses, accountants and bookkeepers – to champion their successes and help them deliver the best for their clients and customers, be that through improved bookkeeping, cash flow, payroll or taxes.

We’re a tech company that put people at our core, so we’ll continue to work with the brightest minds and pioneering talent in collaboration with our customers, to innovate and adopt new technologies such as AI, machine learning and automation and inspire growth and prosperity throughout the UK.

- We've also highlighted the best accounting software

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!