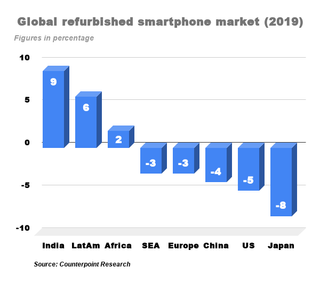

Global refurbished smartphone market declines for first time in four years in 2019

US, China and Europe lose ground while India, Latin America and Africa gain traction

Refurbished smartphone market declined for the first time in four years in 2019 due to downturn in new smartphone sales in key regions such as the US, China and Europe.

According to Counterpoint Research, the global market declined by 1% year on year in 2019 to just over 137m units despite a 1% increase in the second half of the year.

Varun Mishra, Research Analyst at Counterpoint Research, said that the growth of the segment will be impacted this year due to Covid-19.

Apple and Samsung continued to dominate the secondary market in 2019.

Apple continues to foster its trade-in and insurance programmes while Samsung’s Galaxy S series is the main driver.

Samsung is getting more aggressive with buy-back programmes and adding more repair partnerships. Certified pre-owned volumes are likely to increase in 2020.

The combined sell-through in the US, China and Europe declined 6% year on year during 2019.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Despite a decline in the overall market, there were several growth markets like India, Latin America and Africa.

Jeff Fiedhack, Research Director at Counterpoint Research, said that the upgrades in the premium segment also remained slow, as users held on to their devices and replacement cycles lengthen.

“China, the largest market for refurbished devices, declined 4% year on year during the year. This was due to the combination of a sluggish economy and the fact that it is harder for players within the refurbished market ecosystem in China to make a profit,” he said.

Moreover, he said that the China-US trade tensions have also affected the secondary market as many large players are being much more cautious on purchases.

Huawei’s strength in new sales and brand building efforts has helped it increase its presence within the used/refurbished market but the US sanctions are likely to hurt sales and the brand outside of China in 2020 unless a US-China trade agreement is made.

However, Fiedhack said that many of the smaller players in the ecosystem have seen growth, but it was not the case with the larger players.

Mishra said that the refurb ecosystem in these economies is at a nascent stage. In terms of smartphones, he said these markets remain underpenetrated.

“Many users are looking for affordable devices to come online. The transition from feature phones to smartphones and the aspiration of premium devices at an affordable price point continue to fuel growth in these markets,” he said.

Moreover, he said that there is also the ongoing transition of the refurb segment from the unorganised sector to organised in countries like India which is opening opportunities.

Most Popular