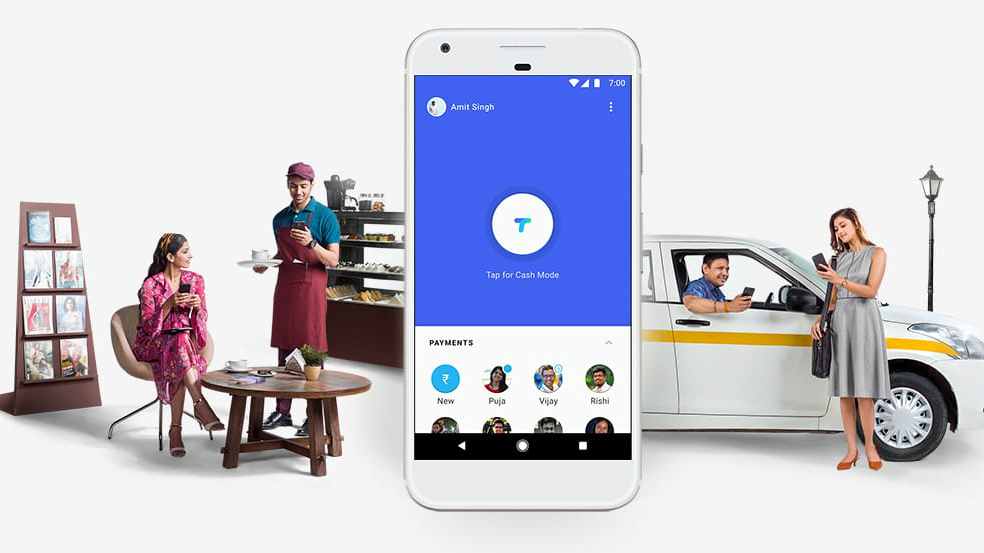

Google introduces Tez, its India-focused digital payment solution

Android Pay for India

Empowering government's Digital India drive, Google has come up with yet another India focused application made for digital payment. Google Tez, the newly launched app is designed especially for smartphone users in India but will work on web browser as well. Like most other payment apps, Tez lets you send and receive money, and also allows to pay for your purchases.

While a lot of us were awaiting Android Pay support in India, Google decided to customise the experience focused on Indian users. The Tez app is based on Unified Payment Interface (UPI), which came into existence soon after demonetisation, to boost digital economy of the country. The app is available on both Android and iOS devices.

Like most other conventional digital payment app, it works as a mobile wallet and allows users to transfer money directly from the bank account. Unlike PayTm, Tez doesn’t ask its users to top up money into the app, instead it links the wallet directly to your bank account and the transaction is done in straight in the bank account. Most UPI based payment apps allow transactions up to Rs 1,00,000 and up to 20 transfers a day, similarly the Tez app also works on alike set of rules. It allows instant money transfer with no transaction fee.

“Send money home to your family, split a dinner bill with friends, or pay the neighbourhood chaiwala. Make all payments big or small, directly from your bank account with Tez, Google’s new digital payment app for India,” says Google.

Tez app supports various banks like HDFC Bank, ICICI, State Bank of India, Axis and several other banks that support UPI. You can pay at Dominos, Redbus, Jet Airways and more using Tez. Moreover, the app is available in multiple local languages including Hindi, Bengali, Gujarati, Marathi, Tamil, Kannada and Telugu. Google has partnered with Nokia, Panasonic, Xolo, Micromax and Lava, users buying phones from any of these companies will get Tez app pre-installed.

Although Google is a little late to the party, but it still has a huge scope of adoption as majority of India’s population is still moving towards e-payment options. As we all know, India is developing economy, where there’s more potential for adoption of mobile based banking and payments. Google is expecting that digital payments in India could hit $500 billion by 2020, thanks to better availability of faster internet and increasing number of smartphone users.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Sudhanshu Singh have been working in tech journalism as a reporter, writer, editor, and reviewer for over 5 years. He has reviewed hundreds of products ranging across categories and have also written opinions, guides, feature articles, news, and analysis. Ditching the norm of armchair journalism in tech media, Sudhanshu dug deep into how emerging products and services affect actual users, and what marks they leave on our cultural landscape. His areas of expertise along with writing and editing include content strategy, daily operations, product and team management.