Google Tez vs other e-payment solutions in India: How do they differ?

Which one is better?

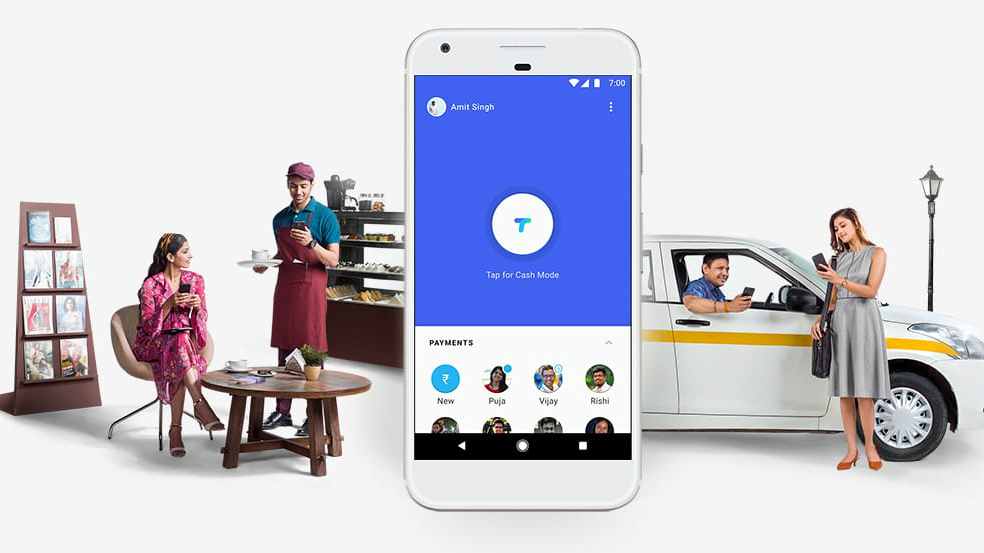

Google launched a new digital payments service called Tez in India. Based on Unified Payments Interface, Google Tez offers a very simple and fast way to send and receive payments. With the Tez app, Google is trying to take advantage of the digital payments boom in India.

However, there are a lot of hurdles in Google Tez’s path at launch. There are several popular and more feature rich digital payments apps and services out there. Paytm is amongst the oldest of these apps, having set up itself years ago and shoring up a decent sized userbase. Relatively new entrants like BHIM and PhonePe have fared considerably well, too.

In this post today, we take a look at how Google Tez fares against the likes of Paytm, PhonePe, BHIM and Android Pay.

Google Tez vs Paytm

Paytm is one of the most popular mobile wallets in India, having established itself as a reliable and yet comparatively conservative service over the last few years. Owned by One97 Communications, Paytm has gone from offering mobile recharges to setting up a decent sized ecommerce store.

Most recently, Paytm received a license to operate as a Payments Bank as well, allowing its customers to save up money in a digital savings account.

For the most part, Paytm and Google Tez are aimed at two completely different sets of use-cases. While Paytm is a recharge-cum-ecommerce portal, it also has a mobile wallet and a Payments Bank service. Paytm does allow you to use your existing UPI VPAs (example@upi) to make payments, rather it use debit and credit cards, as well as net banking as payment modes.

With Google Tez, all your receipts and payments are routed through UPI. Tez is also a mobile-only service, available on both Android and iOS devices. Paytm, on the other hand, can be used on the desktop as well.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Google Tez vs PhonePe

PhonePe is another popular payments app in India, attracting users with a very good looking interface and a slew of cashback offers. It does share a lot of features with Paytm. However, unlike Paytm, it offers native UPI integration in addition to a mobile wallet.

With PhonePe, users get to customize their UPI VPAs, with a @ybl suffix. The PhonePe app is made by Flipkart, and is supported by Yes Bank. While you can customize your VPA to your liking in PhonePe, in Tez you can only choose from one of the three suffixes.

Apart from customizable VPAs, a good interface and mobile wallet, PhonePe also lets you send and receive money to/from bank accounts, transfer money to one of your own bank accounts and make recharges and bill payments.

Google Tez, on the other hand, is still in its nascent stages, so it’s not a surprise that its feature-set is still very rudimentary.

Google Tez vs BHIM

Google Tez versus BHIM is a more direct comparison, as both the apps offers a similar set of services. However, when you dig further, you will find that Google Tez is already a better service when compared to BHIM.

Google Tez not only lets you send/receive money like Bhim, it also offers a much better user interface. The Cash Mode is a decent addition as well, allowing you to transfer money to Tez users nearby without revealing your personal information. Additionally, Google Tez also comes with some interesting offers, giving users a cashback of Rs. 51 on every successful referral.

Google Tez vs Android Pay

Android Pay never made its way to India, and after the launch of Google Tez, it looks like Google users will have to wait a while before Android Pay is launched here. Google Tez leverages on the Unified Payments Interface’s increasing popularity in India. Android Pay, on the other hand, requires smartphones with NFC and compatible point-of-sales devices.

Android Pay, unlike all other payment services mentioned here, is a contactless payments service that relies on NFC to make payments. To use Android Pay, you will have to link a card from a supported bank and make payment at a supported point of sales terminal. The logistics required for such a service need a good amount of investment from all parties involved – the customer (using a phone with NFC), the vendor (using a compatible point of sales terminal) and the banks (for ensuring compatibility with this payments system).

Google Tez, on the other hand, utilizes an already-established UPI infrastructure and requires only an Android or iOS device and a working internet connection. Once you link your bank account with Google Tez, you can make payments by simply entering the receiver’s UPI address or their bank account number. It’s not as simple as the contactless system that is used in Android Pay, but it is cheaper in comparison.

Conclusion

All in all, Google Tez is a decent offering from Google, especially for a version 1 product. With the growing popularity of digital payments in India, and with the government pushing UPI and digital transactions heavily, the time is right for companies like Google to push their payment services. While Google may not have been the first company to offer a digital payments service, the Tez app is a good step in the right direction.

With that said, it may not be an easy ride for Tez in India, especially when you consider the fact that there are multiple popular competitors in the market already. Services like Paytm, PhonePe are well established and popular, and with banks offering their own UPI apps, this is a fairly crowded market. Will Google Tez still manage to be successful? Only time will tell.

Rounak has been writing about technology for over five years now. Prior to Business Insider, he has worked with Tech Radar and PCMag where he covered the latest news and reviews of gadgets. In his free time, he likes to follow cricket.