India is the biggest adopter of digital wallet apps

Survey throws up interesting findings

The adoption of fintech applications including digital wallets is booming in the Asia Pacific region, according to a new study by Rapyd, a global Fintech as a Service company.

The survey said digital wallets are particularly taking off for personal transactions, such as personal repayments from family or friends, rebates, and sale of personal goods or services.

Across the seven markets studied, India was found to the biggest adopter of digital wallet apps for both business-to-business (B2B) and P2P transactions, recording the highest usage rates.

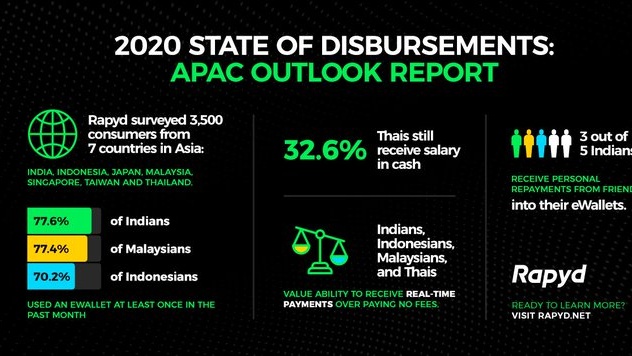

Rapyd surveyed 3,500 online consumers in the Asia Pacific region (India, Indonesia, Japan, Malaysia, Singapore, Taiwan, and Thailand) in March and April 2020, found that consumers across the region are rapidly embracing mobile fintech apps, with 77.6% of Indians, 77% of Malaysians, 70% of Indonesians, and 66% of Thai, having used a digital wallet app over the past month.

We surveyed 3,500 customers in 7 countries in Asia and asked them about their favorite ways to get paid. And here's what we found. Full report: https://t.co/FeJoQKfRcZ#disbursements #payouts pic.twitter.com/7yO7QrAHKBMay 5, 2020

The survey respondents were identified as household decision-makers aged 18-64 across a full spectrum of income levels and asked questions around banking and payment preferences, behaviours, and concerns.

The survey, which contrasted attitudes between different countries, is a sign of where they are on their digital payments journeys. The report also found that there is no one-size-fits-all approach to global payouts. Every country is unique in its preferences and digital leaders must be prepared to localize their payout experiences to drive beneficiary loyalty and engagement.

The survey, however, threw up some interesting info about India: Indian users who are self-employed and work on a contract basis received payments more via wallets than cash or bank transfers. Around 33.5% of Indians chose this as their preferred option.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

India is the only country that picked e-wallets as an option for transferring remittances. The possible reason is that the cost of remittances remain high in India.

Indians value data safety

Most interestingly, India cared more about keeping its data and private information safe than any other Southeast Asian country.

The survey said that 82% of Indians, 75% of Malaysians and Indonesians, and 68% of Singaporeans cited keeping personal information safe as the most important attribute of receiving payments.

The Reserve Bank of India, India's Central bank, would be happy to know of this as it has mandated a mechanism for all companies to store data in India, much to the chagrin of international tech giants and credit card networks.

Their insistence on safety and security reflects the mood of the Indians.

Overall, the study reflects remarkable buoyancy in the finance app industry which has seen staggering growth in global adoption, from 16% in 2015 to 64% in 2019.