India ships 8 million TWS headphones during Q3 2021 - bOAT tops the charts

Year-on-year growth of 55 per cent

Ever since the pandemic-led lockdown forced remote working and education, there has been a sharp uptick in the demand for TWS earbuds. India has been no different as sales grew by 55 per cent year-on-year, crossing 8 million shipments at the end of September. Of course, there were other factors such as discounts and lite versions.

Not only did these earbuds keep pace and tackle any leftover competition from the wired audio products, brands moved away towards mid-range TWS earbuds too. In a report by analytics firm CounterPoint Research, the most number of TWS launches in recent months were in the sub-Rs.3000 band.

Realme adopted a unique approach for the same as it has introduced a sub-brand, Dizo, to offer TWS products at affordable prices. The most amazing part is that these brands are not compromising with the features offered in the devices, which could be one of the main reasons for the rapid growth in demand.

- Best true wireless earbuds under Rs 5,000 in India

- Best true wireless earbuds under Rs 3,000 in India

- The best wireless headphones available in India

Customer perspective and brand strategy

That lugging around a pair of TWS earbuds is far easier than carrying the wired ones also contributed to this tectonic shift. In the past, the price barrier was perceived as a reason for users to prefer the wired earphones, but with prices dropping in recent times, more users have been lured into this segment.

In fact, brands such as Realme, Truke, and Ptron have reduced prices considerably with those from Basspods 882 by Ptron being available at a starting price of Rs 799.

Brands also focused more on offering Active Noise Cancellation(ANC) and gaming-focused TWS products. Key industry players like Ptron and Truke introduced their first gaming TWS earbuds with low latency gaming mode. These gaming TWS earbuds are available at affordable prices too.

What the stats tell us

If one looks at the premium segment of TWS, popular brands like OnePlus, Samsung, JBL, Apple, and others, these too are getting robust sales. The Counterpoint research report put Apple at the top of the pack with its Airpods registering a 63 per cent share of the market.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

In addition, we had competition from the likes of OnePlus Buds Pro, JBL Pro Plus, and Samsung Galaxy Buds 2 that were recently launched. The premium segment TWS has seen a quarter-on-quarter growth of 20 per cent. Nothing, a recent entrant in the Indian TWS market, had the third-highest market share (7 per cent) in just a single quarter after its launch.

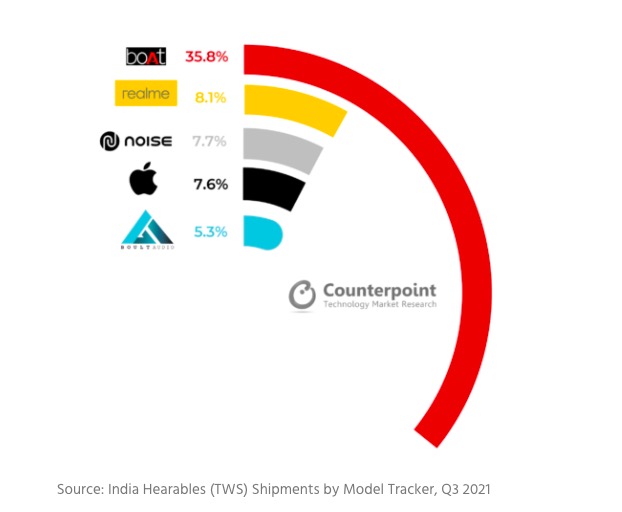

Current statistics say that boAt has been dominating the TWS market in India for the last five quarters. boAt has a market share of 35.8 per cent, followed by Realme with a market share of 8.1 per cent. Noise possesses the third-highest market share of 7.7 per cent, followed by Apple, which has a market share of 7.6 per cent.

Other brands that have shown signs of robust growth in recent times include Dizo and Truke. This is one segment that we would be keeping a close watch on in order to bring you the latest reviews and our recommendations.

- Best gifting ideas for family and friends this Diwali week

- This Diwali, convert your house into a Smart Home

Want to know about the latest happenings in tech? Follow TechRadar India on Twitter, Facebook and Instagram!

A career journalist who spent three years playing around with smartphones, associated apps and home appliances. As a hobby, Rudra enjoys researching mobile games. When he's not busy in the world of gadgets, Rudra is busy with a paper and pen writing poems or engaging with his growing digital audience on the Hindi rap circuit.