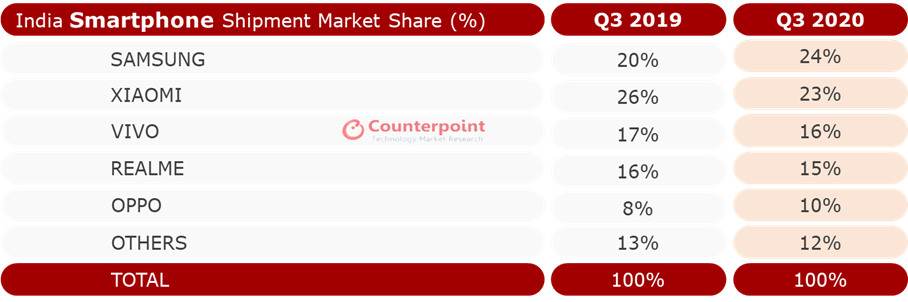

Samsung breaks Xiaomi’s three-year streak to top the Indian smartphone market

Inches ahead with 24% market share

As India slowly gets back up on its feet post the lockdown, the smartphone segment has shown one of the strongest rebounds. A new report states that Samsung has captured the pole position in the market, ending Xiaomi’s spree of three years.

Counterpoint Research has published its smartphone shipments report for the third quarter of 2020, revealing how interesting trends in the country. Q3 was also the quarter that saw the highest-ever smartphone shipments, growing by 9% YoY. This seasonal rush is likely due to the upcoming festive season.

The biggest talking point is Samsung finally pipping Xiaomi to lead the market with a 24% share. At a 23% share, this is the first time since Q3 2018 that Xiaomi registered a decline. This fall can be attributed to the manufacturing constraints caused due to supply chain disruptions, making it unable to match the demand. Counterpoint suggests that Xiaomi will come back strongly in Q4.

Touching upon the border disputes, Research Analyst Shilpi Jain said “During the start of the quarter, we witnessed some anti-China consumer sentiments impacting sales of brands originating from China. However, these sentiments have subsided as consumers are weighing in different parameters during the purchase as well.”

Samsung surpassed the pre-Covid level shipments in this quarter with 32% YoY growth. The recovery was fueled by a stronger local supply chain along with numerous new launches across various price points and an aggressive push in online channels.

The mid-tier segment (Rs 10,000 - Rs 20,000) registered the highest growth, thanks to strong performances by other brands such as Poco (counted under Xiaomi), Oppo and Realme. Affordability schemes such as discounts and cashbacks might continue in the next quarter.

Sales of the OnePlus 8 helped the company retain its lead in the affordable premium segment (Rs 30,000 - Rs 45,000) while the OnePlus Nord became the best-selling device in the upper mid-tier (Rs 20,000 - Rs 30,000). Apple continued to lead the premium segment with strong demand for the iPhone 11 and the iPhone SE 2020. The iPhone 12 is expected to take this further.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

In the near future, Micromax will be making a comeback with its new In series of mid-range smartphones.

Aakash is the engine that keeps TechRadar India running, using his experience and ideas to help consumers get to the right products via reviews, buying guides and explainers. Apart from phones, computers and cameras, he is obsessed with electric vehicles.