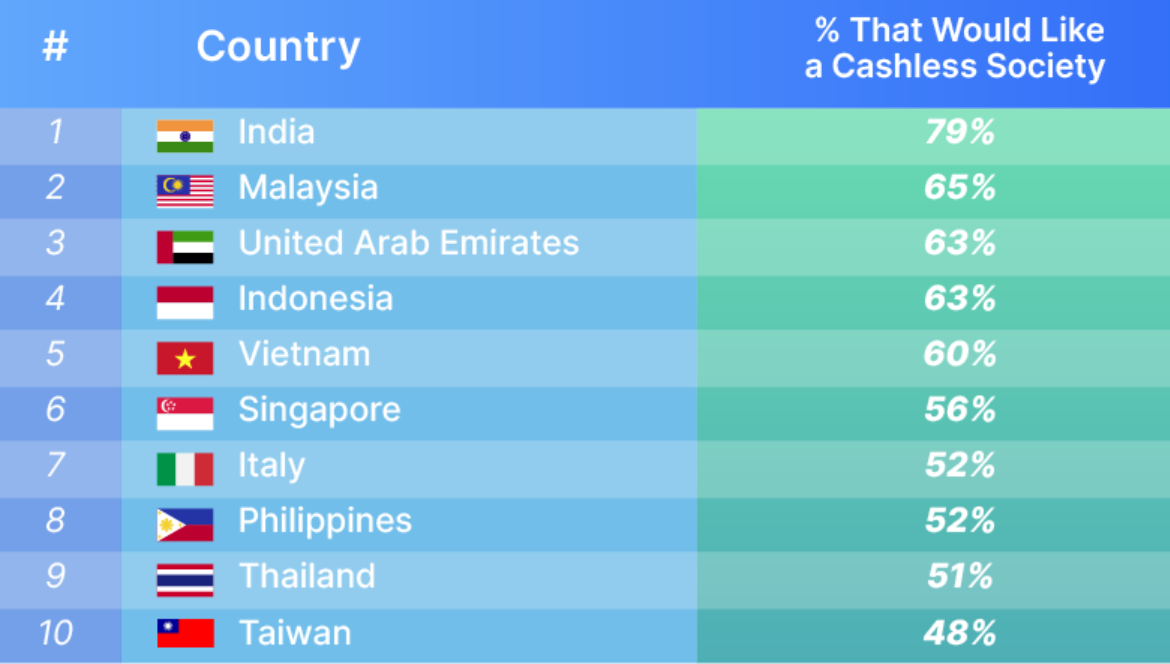

India tops the list of countries that are for cashless economy - 79% Indians in favour

Global survey throws up interesting findings

India's digital payments, especially routed through the official NPCI-backed UPI system, have been showing huge spike, especially in the Covid-19 world for obvious reasons. And the Narendra Modi-helmed government is also backing aggressively the drive for digital economy as rivals of NPCI are also now being developed. Little wonder then, India is the country most in favour of a cashless society as 79% of Indians believe going cashless would have a positive impact on their country.

Furthermore, 47% of Indians have paid in cash less often since the Covid-19 outbreak.

These numbers emerged in a survey done by MoneyTransfers.com, which as its name makes it clear is an international money transfer company.

Malaysia (65%), UAE (63%) and Indonesia (63%) are among the other countries where over 60% of citizens would welcome their countries transitioning to just electronic payments, the survey said.

- Google, Facebook, Amazon mull options for rival to NPCI - We tell you why

- PayTM has returned to Play Store - but, the battle is far from over

- WhatsApp Pay rolls out in India - but there is a caveat

Not many in USA seem to be in favour of cashless society

Vietnam (60%) and Singapore (56%) are among the other countries where over 55% of citizens are in favour of transitioning towards a cashless society, respectively in fourth and fifth position.

Italy is the highest-ranking European country in joint sixth place (alongside Philippines), as 52% of Italians think going entirely cash free would be a great decision for their country.

Interestingly, the United States is joint 15th (alongside Sweden), as just 24% of Americans feel a cashless society would be a good thing for their country.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

At the other end in 17th position is France, where only 18% of French citizens would welcome their country being entirely dependent on electronic forms of payment.

For the record, a total of 25,823 individuals were surveyed for the research, 1,010 from India.

Residents of 21 different countries were surveyed for this research.

Over three decades as a journalist covering current affairs, politics, sports and now technology. Former Editor of News Today, writer of humour columns across publications and a hardcore cricket and cinema enthusiast. He writes about technology trends and suggest movies and shows to watch on OTT platforms.