Indian smartwatch market: Domestic brands dominate with 75% share

And 78% of business is online driven

India’s smartwatch market is mostly online driven, with 78% of the shipment coming from online channels, where Flipkart and Amazon contribute 48% and 43% shares respectively.

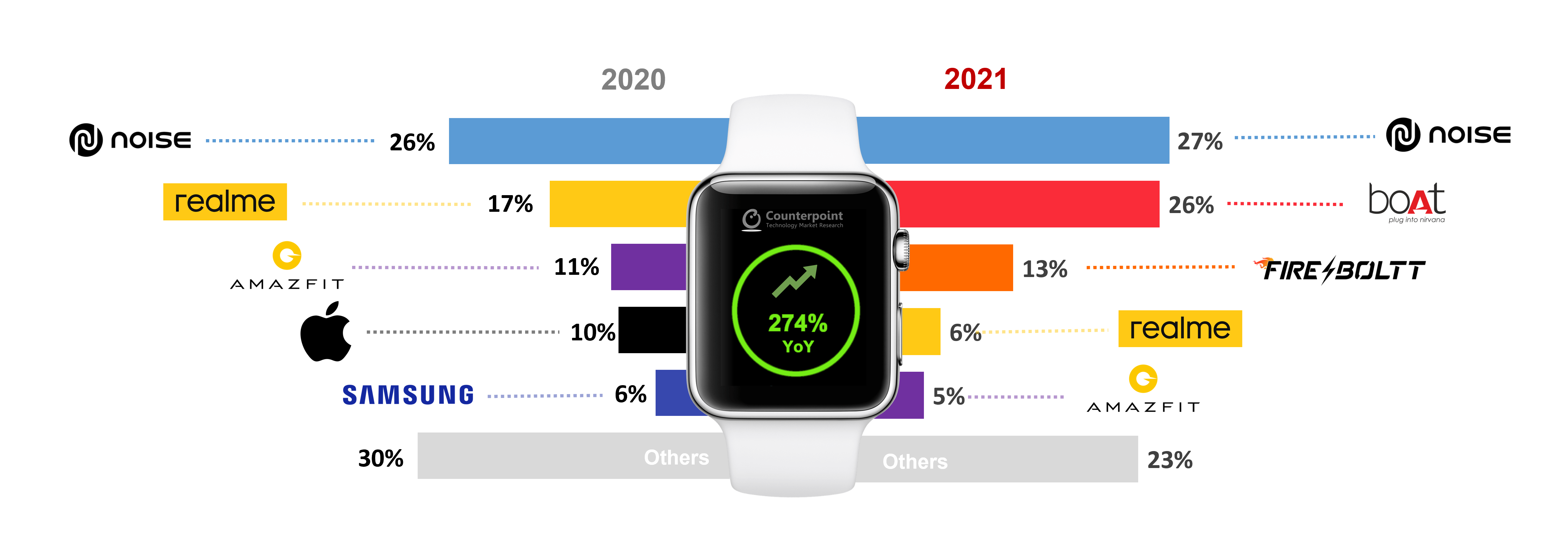

Further, domestic brands continue to have a stranglehold on the market, contributing 75% of the total market shipments. Noise led the market in 2021 with a 27% share, while Boat, which has been in the market for just a year, was not far behind at second position at 26%. Although only 1% of the total smartwatches shipped were domestically assembled, this number is likely to jump many times due to duty structure changes and government push.

In general, India’s smartwatch market saw record growth of over 274% YoY in 2021 shipments. Further, with QoQ growth of over 8%, Q4 2021 became the market’s biggest ever quarter.

These data were put out by Counterpoint’s IoT Service.

Noise, Boat, Fire Boltt lead the pack

Counterpoint said that around 80 brands are present in India’s smartwatch market, and over 10 brands entered the market in 2021. The top three Indian brands captured two-thirds of the total smartwatch market in 2021, compared to just half in 2020.

Noise led the market in 2021 with a 27% share and over 278% YoY growth. Four out of the top 10 models in 2021 were from Noise. The ColorFit Pro 2 remained the brand’s most popular smartwatch.

Boat had a 26% share of the market in 2021. It was at the first position in Q4 2021 though. It has launched over 10 models so far. Its Storm was the best-selling smartwatch in 2021.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Fire Boltt was one of the key new entrants and it quickly managed to capture the third position with more than 20 models across price bands. It has a presence in more than 600 cities, major large retail formats, and online The brand also entered the Middle East in 2021.

Senior Research Analyst Anshika Jain said: “More than 86% of the total shipments were driven by the under- Rs 5,000 price band, compared to 59% in the previous year. Many of the features which were earlier present in the Rs 3,000 – Rs 5,000 price band smartwatches are now found in the Rs 2,000 – Rs 3,000 segment.”

Apple growth remains flat

Counterpoint said Realme grew 23% YoY in 2021 to take the fourth position, and its Watch S contributed to around 30% of its total sales. Amazfit registered 65% YoY growth, and it led in the Rs 10,000 – Rs 15,000 price band with over one-third of the total shipments.

Samsung grew more than 2x in 2021 driven by its most popular model, the Galaxy Watch Active 2. The newly introduced Galaxy Watch 4 series contributed to over 16% of its total shipments.

Apple remained flat in 2021 with the Watch SE contributing around 44% of its total volume. The refreshed line-up of Series 7 saw a great start with shipments crossing 100,000 units in Q4 2021.

Dizo entered the smartwatch market in Q3 2021. With successful launches in the budget segment, the brand managed to capture a position in the top 10 The Watch 2 model drove most of its volume, Counterpoint said.

Want to know about the latest happenings in tech? Follow TechRadar India on Twitter, Facebook and Instagram!

Over three decades as a journalist covering current affairs, politics, sports and now technology. Former Editor of News Today, writer of humour columns across publications and a hardcore cricket and cinema enthusiast. He writes about technology trends and suggest movies and shows to watch on OTT platforms.