Study shows there's hope for online stores that aren't Amazon

You're big, but not that big

With Cyber Monday in full swing across the United States, a new study found that Amazon is the big winner where online shopping is concerned, though there's good news for small businesses that offer online shopping.

Deepfield, which produces technology to track and analyse cloud-based service performance, released findings from a large scale, multi-month study of online shopping Monday, the same day Americans hit the internet in search of post-Thanksgiving Day deals.

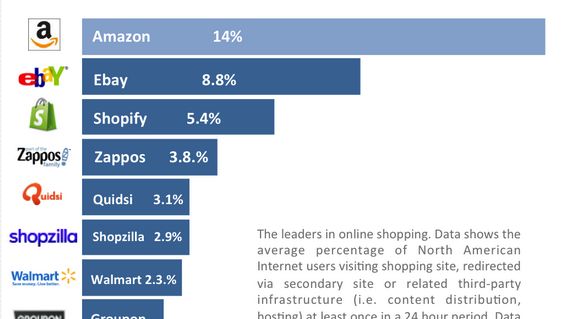

Using data culled from internet backbone traffic across North America, Deepfield found that Amazon and sites it owns lead the pack with 14 percent of all online shopping taking place on a daily basis.

Amazon is expected to see the bulk of Cyber Monday 2012 shopping (as it does every year), however there is a silver lining for competitors and small businesses shilling products online.

Browsing for bargains

According to Deepfield's data, the only e-tailer that comes within reach of Amazon is eBay, the ever-changing auction website that currently sees 8.8 percent of daily internet shoppers.

The next four spots were taken up exclusively by online portals like Shopify (5.4 percent), Zappos (3.8 percent), Quidsi (3.1 percent) and Shopzilla (2.9 percent), some of which aren't even household names.

Zappos and Quidsi, by the way, are Amazon-owned properties, but Deepfield explained that, in its estimation, the sites are big enough to warrant independent data.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Shopify's figures are particularly interesting because although less than half of the numbers Amazon pulls in, the site is an online storefront hosting service for more than 30,000 retailers.

Its No. 3 position points to a decent number of shoppers heading towards smaller-scale stores while also indicating Cyber Monday could be a sales boon for sites that aren't Amazon or eBay.

As for the rest of the pack, Walmart mustered 2.3 percent of internet shopping traffic, trailed by Groupon, Target, Footlocker and Best Buy.

Best Buy, though struggling, did manage to spike its internet traffic from 1.5 percent to more than 5 percent over the Thanksgiving weekend thanks to deep price cuts and millions spent on promo material.