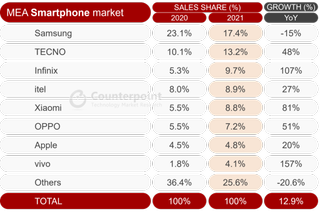

Smartphone sales in the MEA (Middle East and Africa) region grew 13% YoY in 2021, according to the latest research from Counterpoint’s Market Monitor service. After crossing the post-pandemic phase of pent-up demand, smartphones remained in high demand throughout the year, despite the market facing many difficulties, including macroeconomic worries, supply chain issues and the emergence of new COVID-19 variants.

Most major brands such as Oppo, Apple, and Xiaomi enjoyed stable market growth from 2020 to 2021. Samsung however, dropped in sales share due to issues with factory closures and various component shortages, but is on a strong start to 2022 with the upcoming release of its Galaxy S22 lineup.

- Best Smartphones in the UAE and Saudi Arabia

- These are the best smartphones under AED 2,000 you can buy now

Senior Research Analyst Yang Wang said “The Transsion brands, namely TECNO, Infinix and itel, continued to gain strength to record another fantastic year. The three brands together accounted for 32% of the smartphones sold in 2021, up from 23% in the previous year. Mass-market models from TECNO and Infinix have been a big hit, while more pricey models have also been positively received. More importantly, the Transsion brands have found success away from the African home market. Their market share in the Middle East almost doubled in 2021, while sales increased 127%.”

“Xiaomi and OPPO started the year strongly due to substantial investments in channel penetration and product availability. However, both were hit hard in the second half of the year by component shortages. While the situation has improved somewhat, the two brands are likely to take a more careful approach in the first half of 2022.”

Despite overall growth across the MEA region being positive, the Middle East markets performed better in terms of volume and value. Governments in both Africa and the Middle East did generally well in combating the pandemic, but vaccination rates were far higher in the Middle East. Africa was also hamstrung by the emergence of new COVID-19 variants, which meant that the Middle East saw a quicker reopening of the international travel and services sectors.

Both Africa and the Middle East benefitted from the commodities boom, but Africa faced higher inflationary pressures due to governments being in worse fiscal positions during the pandemic. As such, smartphone affordability was a bigger issue for Africa, especially in the lower-priced segment, as lower-income consumers struggled more. Despite this, smartphone market fundamentals remain strong across the MEA as consumers continue to adopt digital services.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

A former IT & Marketing Manager turned full time Editor, Nick enjoys reviewing PC components, 3D Printers, projectors, and anything shiny and expensive. He can also be found baking up a storm in the kitchen, which we are more than happy to encourage.