Microsoft Teams zooms past Zoom in the race for collaboration tools supremacy

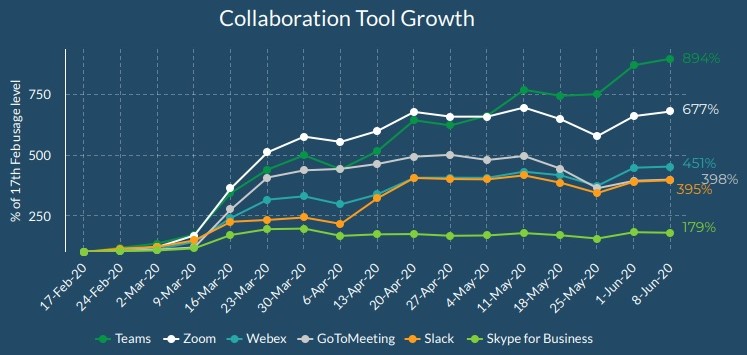

Teams usage grew 894% from its base usage during Covid-19, followed by Zoom at 677% and Cisco’s WebEx at 451%

Microsoft Teams continued to make strides during the Covid-19 pandemic despite Zoom making headway in collaboration tools adoption.

The pandemic underscored the importance of digital transformation as it has changed the way we work, the way we communicate and the way we interact with society.

Work-from-home and long-distance learning initiatives have increased the uptake of communications tools like Zoom, Teams, Skype, Slack and WebEx as employees use multiple tools to serve different needs.

According to the data tracked by enterprise software company Aternity between February 17 and June 14, Teams usage grew 894% from its base usage, followed by Zoom at 677% and Cisco’s WebEx at 451%.

Jyoti Lalchandani, Group Vice-President and Regional Managing Director for Middle East, Turkey and Africa at IDC, Investments by CIOs in the next 12-18 months will focus on team collaboration applications, unified video communications and conferencing systems and digital workplaces.

“Many organisations are increasing their investments in automation and robotic workers to reduce operational costs and improve efficiency. The current crisis will accelerate workforce transformation as more non-human workers are expected into the workforce as the economy expands, building dynamic and hybrid workforce in the future,” he said.

IDC predicts that the contribution of "digital coworkers" will increase by 35% by 2021 as more tasks are automated and augmented by technology.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

By 2024, enterprises with intelligent and collaborative work environments will see 30% lower staff turnover, 30% higher productivity, and 30% higher revenue per employee than their peers.

Industry reports show that collaboration software market revenues will grow to $13.58b by 2023 from under $ 12b in 2020.

Aggressive Office 365 adoption

While Zoom grew the fastest in the first month of the surge in remote work, Microsoft Teams was not far behind and eventually surpassed Zoom during the week of May 4. This is likely due to Microsoft’s aggressive Office 365 adoption push during this period as well as organisations’ growing concerns about Zoom’s security.

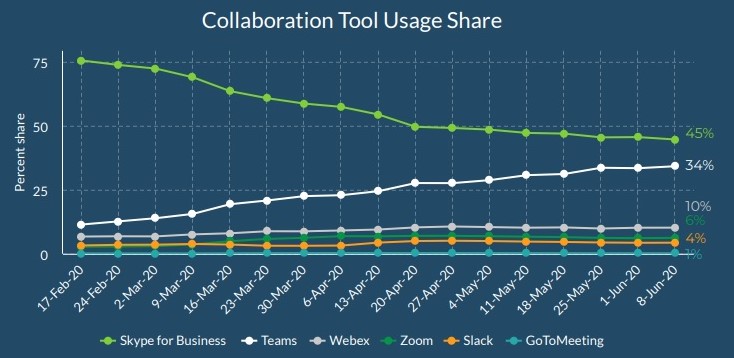

The growth in usage share of Microsoft Teams came at the expense of Skype for Business. Skype for Business usage share declined from 76% to 45% while Teams usage share grew from 11% to 34%.

This shows that Microsoft-heavy enterprises migrated from Skype for Business due to Teams’ richer set of collaboration capabilities.

Based on this trend, Aternity expects Microsoft Teams to overtake Skype for Business in usage share within the next 6-8 weeks.

The growth of Zoom has not occurred in the largest enterprises and this may be because enterprises are slow to move to new web conferencing and synchronous collaboration tools, especially within Microsoft-heavy enterprises.

However, the simultaneous decrease in Skype and increase in Teams use was not a one-for-one swap. A portion of the decline in Skype usage share resulted from increased usage share of Zoom (+3.49%), WebEx (+3.49%) and Slack (+1.08%), further illustrating growing collaboration app sprawl within enterprises.

Moreover, when looking at the usage of the application, Microsoft Office accounted for 38% of total usage time, with Outlook usage growing 46% between February 17 and June 14.

Non-work-related web browsing by employees dropped sharply in late April as employees became less preoccupied about the Covid-19 outbreak.