New WhatsApp Pay shortcut will help you send payments quickly

Only available for Android users as of now

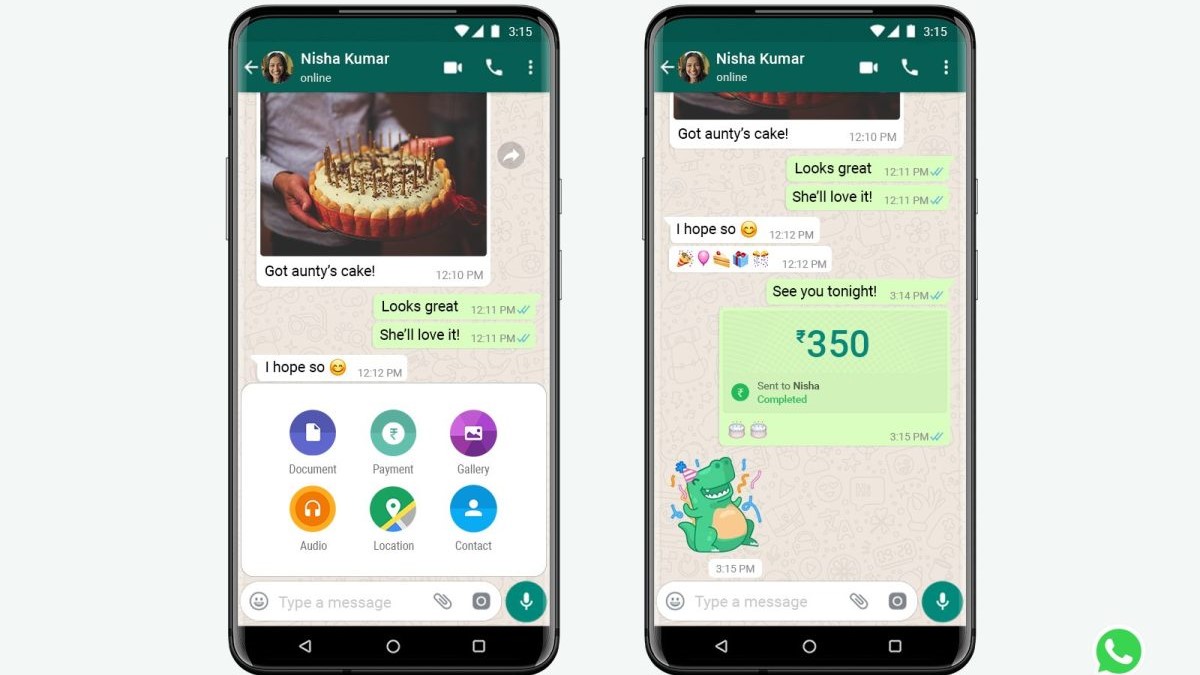

In a bid to boost the acceptance of WhatsApp Pay, Facebook-Led WhatsApp is making some changes in its user interface. These changes will not only make WhatsApp Pay more prominent to the users but Facebook is also hoping that this move will help boost transactions via the payment system.

According to WABetaInfo, this feature is being made available on the latest WhatsApp beta for Android 2.21.17 in India and some users in Brazil. Some users in India have already spotted this feature and one such screenshot can be seen below where the WhatsApp Pay button can be seen right next to the camera button on the chat bar.

WhatsApp has now added direct payment option to the chats to quickly transfer money. pic.twitter.com/txBf9T8HZKAugust 20, 2021

Reports suggest that this feature is available to WhatsApp users on Android right now while the iOS app is still under development and may be launched at a later date.

- WhatsApp Pay: How to setup, send and receive money

- Concerned about your WhatsApp privacy? Here are the best alternatives

What is WhatsApp Pay?

To recall, WhatsApp Pay was first introduced in November 2020 and it is yet another way to transfer money to your contacts, pay utility bills, recharge your phone connection and more. It uses the UPI platform introduced by the National Payments Council of India and competed with the likes of Google Pay, PhonePe, Paytm and others.

Though it is backed by Facebook and relies on one of the most used messaging apps globally, WhatsApp Pay got off to a slow start and in the first few months, it hardly had any traction. Only in January this year, NPCI revealed that WhatsApp pay recorded more than 100% increase in its use in both volume and value compared to previous months.

Attempts to change gears now

That said, while WhatsApp Pay processed 0.81 million UPI transactions worth Rs 29.72 crore in December, its rivals PhonePe and Google Pay processed 902.03 million and 854.49 million UPI transactions, respectively.

One of the primary reasons why WhatsApp Pay has not gained popularity is because NPCI has capped the total volume of UPI transactions process by third-party app providers to a maximum of 30%.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Additionally, as a pilot project, WhatsApp was limited to roll out the WhatsApp Pay feature to 10 million users only. Though this number was later increased to 20 million, that again is a fraction of the platform's total user base in the country.

Now with the aggressive in-your-face integration, WhatsApp wants to remind users about WhatsApp Pay and wants it to be used as a primary payment service.

Want to know about the latest happenings in tech? Follow TechRadar India on Twitter, Facebook and Instagram!

Jitendra has been working in the Internet Industry for the last 7 years now and has written about a wide range of topics including gadgets, smartphones, reviews, games, software, apps, deep tech, AI, and consumer electronics.