Nvidia kills off $40bn Arm acquisition - here's what might happen next

Nvidia left with no choice but to back off merger deal with Arm

Nvidia has confirmed the termination of its bid to acquire Arm from SoftBank Group in the face of insurmountable regulatory hurdles.

In late January, there were whispers that Nvidia was quietly preparing to back out of the deal, but the company has now made its stance official.

In lieu of an acquisition, SoftBank will now take Arm public via an IPO, which will take place within the next year or so. The UK-based firm is also undergoing a shake-up at executive level, with CEO Simon Segars to be replaced by Rene Haas (former VP of Arm IP) effective immediately.

Nvidia-Arm deal collapses

Arm operates upstream of Nvidia and its rivals, licensing out chip architecture to hundreds of different customers, including the likes of Intel, Samsung, Apple, Huawei and Qualcomm (and Nvidia, of course).

The company receives an upfront licensing fee from each customer, but also a per-unit royalty on all chips that incorporate its technology, typically worth 1-2% of the selling price.

The Nvidia-Arm deal attracted a great deal of suspicion from regulators and competitions from the outset. Broadly, the concern was that Nvidia might use its new position to meddle with Arm’s neutral licensing model, or steer the company’s R&D activity in its own favor.

The US Federal Trade Commission (FTC), UK Competitions and Markets Authority (CMA) and European Commission all launched separate antitrust investigations. And even if these inquiries had come to nothing, it was expected that China would raise objections in an effort to avoid a situation whereby companies like Huawei (which faces restricted access to US products) were unable to utilize Arm IP.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Although Nvidia had expected to be able to push the deal through within 18 months of the initial announcement, it quickly became clear this timeline was too ambitious. And now, the company will have to make do with partnering with Arm in the same way as any other customer might.

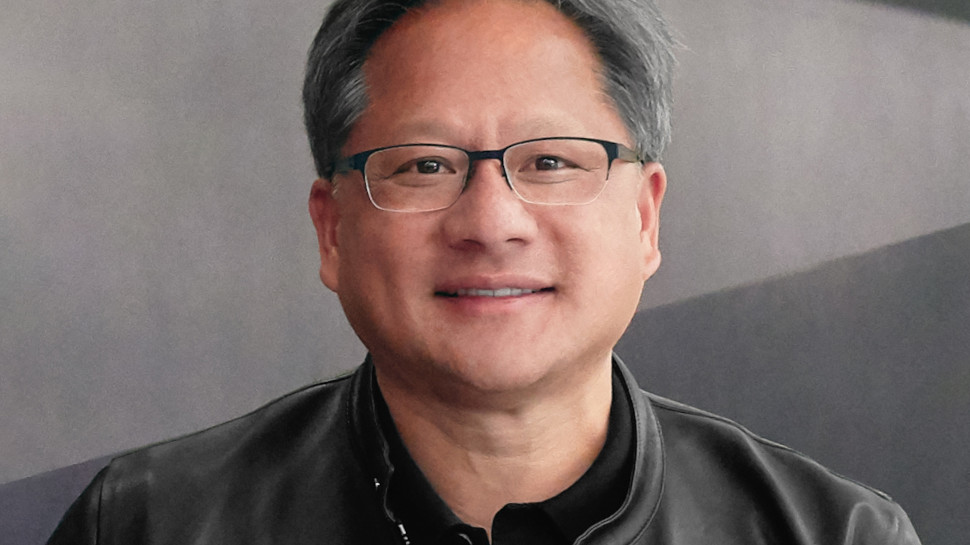

“Arm has a bright future and we’ll continue to support them as a proud licensee for decades to come,” said Jensen Huang, Nvidia CEO. “Arm is at the center of the important dynamics in computing. Though we won’t be one company, we will partner closely with Arm.”

“The significant investments that [SoftBank] has made have positioned Arm to expand the reach of the Arm CPU beyond client computing to supercomputing, cloud, AI and robotics. I expect Arm to be the most important CPU architecture of the next decade.”

However, the collapse of the deal is not the end of the world for Nvidia. As noted by analysts consulted by TechRadar Pro last month, the company is still free to pursue its Arm-based developments and could also work to make its GPU IP available to the Arm ecosystem.

According to Glenn O’Donnell, Research Director at Forrester, Nvidia is also likely to hunt down alternative candidates for acquisition, albeit on a smaller scale. Asked whom and what sectors the company might target, he told us:

“The answers are all over the map, but Nvidia needs more depth in areas outside of its core processor line. Watch for moves in networking, sensors and specialized memory. Some of this will come via partnerships rather than acquisitions.”

- Also check out our lists of the best workstations and best mobile workstations

Joel Khalili is the News and Features Editor at TechRadar Pro, covering cybersecurity, data privacy, cloud, AI, blockchain, internet infrastructure, 5G, data storage and computing. He's responsible for curating our news content, as well as commissioning and producing features on the technologies that are transforming the way the world does business.