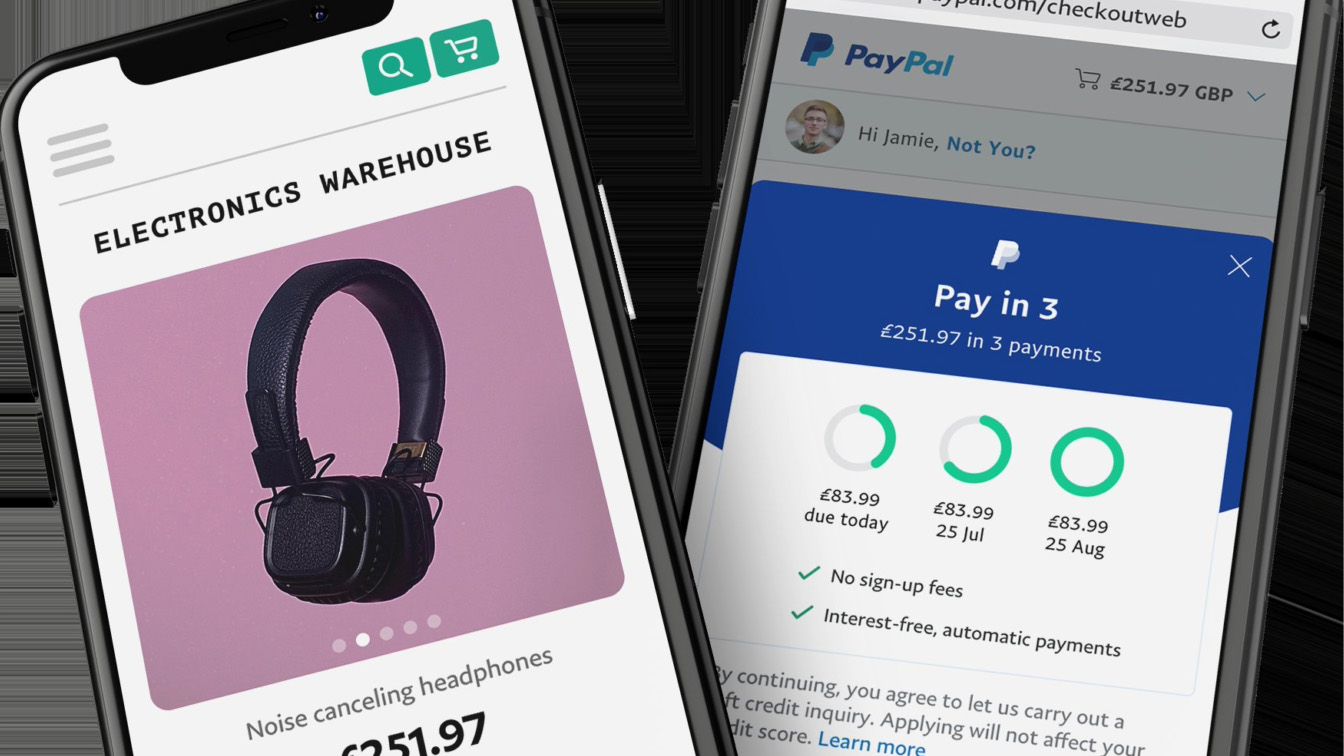

PayPal is launching a new Pay in 3 service for UK shoppers, designed to encourage spending and offering another lifeline to beleaguered businesses. The move will see consumers having the option of paying for purchases and spreading the cost across three interest-free installments. However, customers will be subject to credit checks to ensure they can afford it.

With money becoming increasingly tight due to the ongoing economic problems being caused by coronavirus the option of installments might appeal to many shoppers. Businesses could well benefit from the launch too. They’ll be able to offer customers the option of making purchases between £45 and £2000 to be paid back over a three-month period.

PayPal Pay in 3 will be displayed in the customer’s PayPal wallet, allowing consumers to manage their payments without incurring any additional fees. Meanwhile, businesses will get the payment for purchases in full and up front from PayPal. This could prove to be a vital lifeline, particularly for small businesses that need to keep a keen eye on cashflow.

- Check out the best money transfer apps and services

- The best point of sale systems

- Have a look at the best credit card processing service

PayPal Pay in 3

According to Worldpay’s, FIS 2020 Global Payments Report earlier in the year, 2019 saw a 39% year-on-year rise in the proportion of buy now, pay later payments in the UK. It shows consumers are increasingly keen on extending their payment options, with the trend expected to double by the year 2023.

Rob Harper, UK Director of Enterprise Accounts at PayPal, said: “During the coronavirus pandemic, we have seen the number of people in the UK shopping online increase dramatically. At the same time, many more consumers are looking to spread the cost of those purchases.”

The move is similar to services offered by the likes of Klarna and Clearpay, which gave people more flexible ways to pay as sales skyrocketed during the lockdown period. PayPal’s Pay in 3 is also is expected to prove additionally popular in the run up to Christmas, along with Black Friday where cash-strapped consumers could see it as a practical solution for getting bigger ticket items. The idea isn’t completely new for PayPal though as it already has its Pay in 4 offering in the US.

- We've also highlighted the best mobile credit card processors

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.