Has Apple just opened up the world to mobile wallets?

Pay is way more than just a machine-to-machine transaction

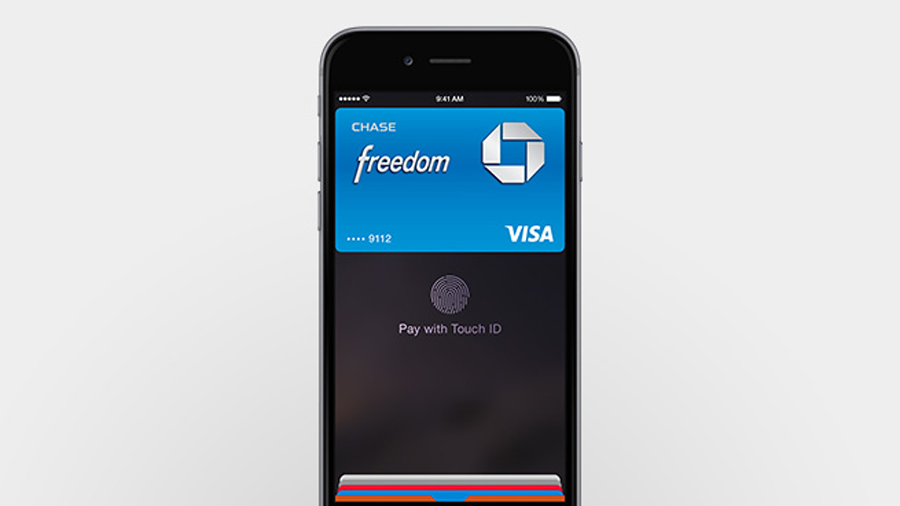

On the 9th of September, Apple announced a series of products and services that will possibly change the way we pay for things forever. With ApplePay, Apple could be set to move mobile wallets into the mainstream, in much the same way the company's first iPhone ushered in a sea change in personal computing in 2007, proving to be the catalyst for smartphones and apps going mainstream.

Apple is far from the first to step into this arena; Google's offering has been available for some time in the US, while Amazon launched its wallet stateside in July. The industry sees mobile wallets as a key component in the future of payments but things haven't quite clicked yet for consumers.

But, what has made the likes of Google, Apple, Visa and PayPal push digital wallets with such fervour? For banks and the like, there is a clear practical advantage.

The cost of fulfilling credit and debit cards is not limited to the production of the card itself; it includes the management and distribution of cards, including maintaining dedicated customer helplines to activate or reorder lost, stolen or expired cards. Considering this, the fact that financial institutions are so keen on digital wallets as a cost-effective alternative is no surprise.

Winner takes all?

In spite of this, consumers have yet to really embrace the technology. In the UK, for instance, very few digital wallets are available, with Starbuck's and EE providing customers with the option to "preload" funds for payments to their smartphones. That said, much has been made of the so-called 'Wallet Wars' and the fragmentation resulting from numerous merchants, banks and other players looking at bringing their products to market.

As is the case with your everyday physical wallet, the average person only wants one place for all their credit, debit and loyalty cards. This introduces the challenge of which cards take precedence. Every issuer wants their 'card' front and centre in the wallet, meaning that card issuers are looking to deploying their own wallets so as not to be marginalised by competitors.

Much of the success of digital wallets will come down to consumer choice. Until now, there hasn't been any real choice in the UK, although Paym is the big move by the banks into mobile payments it only operates on a person-to-person basis, like Barclays' Pingit app. Neither enables the customer to pay in store. Apple, however, has the infrastructure and relationships to make this a possibility.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Factor in that the company reports having over 800 million iTunes account holders and the capacity to make new technologies both desirable and user-friendly, ApplePay could be the first truly compelling digital wallet offering. It does no harm that it will come pre-loaded on the most desirable smart devices around too.

- Check out everything businesses need to know about Apple Pay on our sister website, ITProPortal.com

The security question

With any payment solution there are also always consumer concerns around security. This has been true of ApplePay with a lot of the early analysis focusing on the issue. In fact, a customer survey from just before Apple's launch found that while 80% of US consumers were aware of digital wallets, concerns around security have been the main barrier to adoption. Interestingly, we have seen that device security itself is not people's biggest worry; the primary concern is what to do when a phone is lost and what happens to their card details then.

When mobile wallets and Near Field Communication (NFC) first entered the public consciousness, the focus was on storing payment card credentials on the Secure Element on the devices SIM – if you lost your phone, then there was a complex provisioning process required, which could mean long delays in getting your replacement phone and subsequently your ability to make payments. Now, however, there has been a move towards Host Card Emulation (HCE).

HCE allows an app on any NFC-enabled device to emulate a contactless smart card. The app essentially accesses your payment card credentials in a remote location and communicates these via the cloud directly to the devices NFC reader.

This uses the same infrastructure as used in the card payments today, so in addition to meeting the stringent security standards set out by the PCI Security Council, if a person should lose their mobile, they can simply get a replacement, download the app and login to their mobile wallet to reactive HCE on their new device.

With Apple's long anticipated adoption of NFC in the iPhone 6 and Apple watch, ApplePay is likely to spur the mass adoption of mobile wallets into everyday use. iOS retains over 30% of market share in the UK alone, and the trusted relationships Apple has built with its user base should encourage them to finally embrace wallet technology.

However, the UK with the rest of Europe will have to wait a little while longer as ApplePay will only available to the U.S. in October, with no official announcement of when this will be available elsewhere.

With Apple finally putting its weight behind the mobile wallet revolution, it could be that we're paying for our iPhone 7s in September 2015 via ApplePay on our Apple Watches.

- Mark Prior-Egerton is Solutions Marketing Manager, The Logic Group