Here's why Apple Pay is good news for everybody

Might not be the leader, but it's a core arrival

You might think that some of the big players in e-commerce would be quaking in their boots at the arrival of Apple Pay, but the likes of PayPal and Mastercard seem anything but cowed by this big new player.

Apple Pay has arrived in the UK in its typical blaze of glory bringing effortless payments to anyone with an iPhone.

Of course, that actually means a relatively small amount of people with the requisite and relatively recent Apple kit, and the range of retailers accepting Apple Pay is small.

But, nitpicking aside, the writing is on the wall for a digital future in payments, and the industry seems happy to embrace Apple's entry.

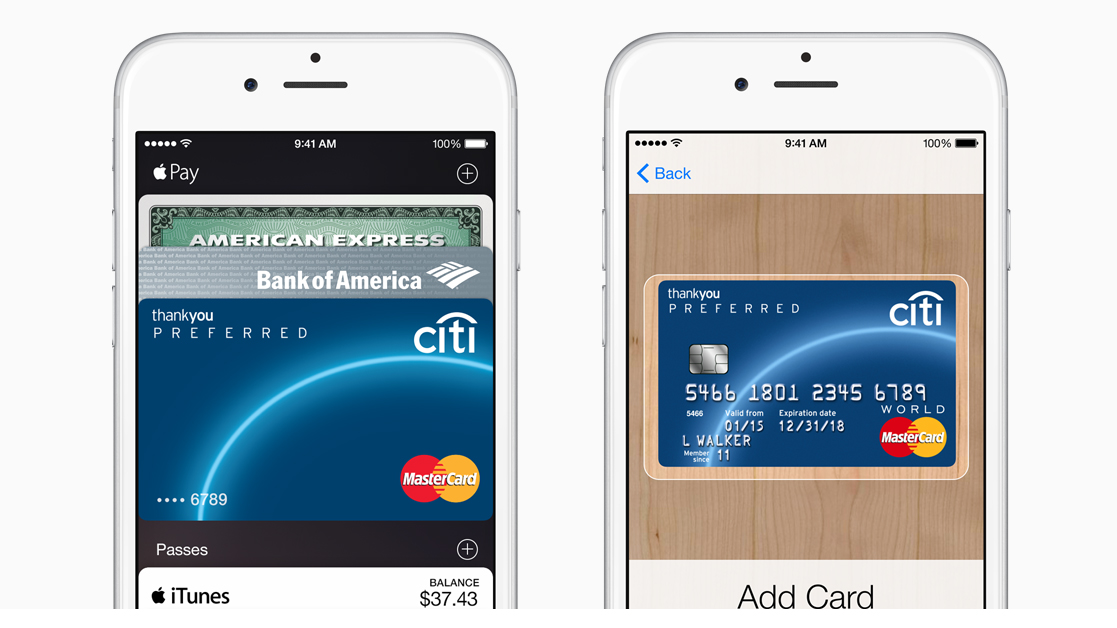

For a credit giant like MasterCard Apple Pay is almost wholly positive, allowing you to add your cards to your Apple Passbook and pay with a flourish of your phone (or, if you really want to blow someone's mind, your Apple Watch).

But for the likes of PayPal you have to dig into the reasons why the company doesn't view Apple as a potential disruptor to its core business.

Rob Skinner, the director of PR for PayPal in the UK, explained to techradar that a mixture of other irons in the fire and an already big and happy user base allowed it to be welcoming rather than hostile.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

"We don't really shout about the fact we own Braintree, which is actually facilitating Apple Pay for a number of businesses," he told techradar.

"And in the summer our new PayPal here terminals will allow anyone to use Apple Pay on them, so that means anyone can take advantage of Apple Pay with a low-cost device."

And, of course, Apple pay is limited to Apple devices.

"Most people have different types of phone, and PayPal is available on any device. We've had a mobile view since the company started and Forrester's research just suggested we were the most trusted form of digital payment."

The principle of all boats being raised by a high-tide is significant here, with Apple's truly wonderful hype engine making the waves that lift the entire digital payments industry.

Mike Cowan Head of Emerging Payments Product for MasterCard UK & Ireland believes that Apple's involvement represents a significant step for digital payments, telling us: "I think what makes it a game-changer is the scale.

"Within the first 72 hours of it launching in the U.S. Apple registered over a million users. And now it's launching into a market like the UK that has already seen contactless heavily adopted."

Cowan believes that the arrival of other big tech brands will take payment by phone to a whole new level, with Samsung Pay and Android Pay on the horizon.

"Both of those have the same model and work with parties such as ourselves with the MasterCard Digital Enablement Service."

Right back in 2011, PayPal boldly claimed that by 2016, if you chose to, you could manage without a traditional wallet and use your phone to get by, something that Skinner has proudly flagged up to techradar ever since, and that statement is looking increasingly likely to prove spot on.

"Funnily enough a lot of people told me that 2016 sounded cautious over the years, but we knew adoption of payment could be slow," he said.

Cowan thinks that the prediction is close to perfect as well: "I think we're getting very close to that.

"We effectively standardised contactless in Europe - and from January 1 2016 all new terminals have to accept contactless. And from 2020 all terminals should have contactless."

But what does that mean to our cash?

"It would be a very bold person who says cash will disappear any time soon," concludes Cowan. "But what we can talk about is more and more cash transactions becoming electronic."

So, believe the hype - Apple might not be the 500 pound gorilla in the payment industry just yet - but it certainly is one of a band that is ready to take on the big old silverbacks of cash and cards.

Patrick Goss is the ex-Editor in Chief of TechRadar. Patrick was a passionate and experienced journalist, and he has been lucky enough to work on some of the finest online properties on the planet, building audiences everywhere and establishing himself at the forefront of digital content. After a long stint as the boss at TechRadar, Patrick has now moved on to a role with Apple, where he is the Managing Editor for the App Store in the UK.