Record quarter for wearables in India - 165% YoY growth

Major shift from bands to watches

The accent on health awareness and work from home and learning norms have set off a good demand for fitness watches and earwears --- all falling in the wearables segment.

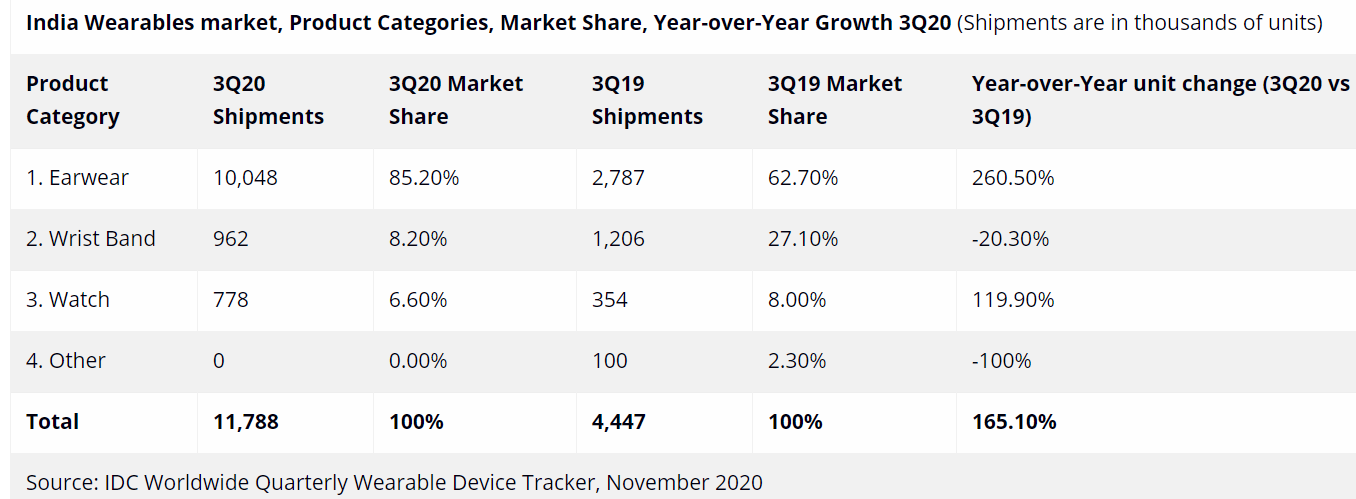

The India wearables market posted a record quarter with 11.8 million units shipped in the July-September quarter at an impressive 165.1% year-over-year (YoY) growth. This marks the highest quarter shipments to date, according International Data Corporation’s (IDC) Worldwide Quarterly Wearable Device Tracker.

It said wearable devices have become more affordable with the average selling price of watches coming down to $111 (close to Rs 8200) in 3Q20 compared to $175 (close to Rs 12, 920) in 3Q19. This is enticing consumers to upgrade from wristbands to watches. Similarly, the average price of true wireless stereo (TWS) has dropped by 48.6% YoY to $57 (close to Rs 3600). TWS now contributes to 39.7% of the overall earwear category, as close to 4 million TWS devices were shipped during the quarter, recording a four-digit annual growth of 1156.3%.

"The pandemic has created a new norm of learning and working from home. Virtual meetings, online classes, and increased time spent on entertainment have led to an intensified demand for earwear devices,” said Anisha Dumbre, Market Analyst, Client Devices, IDC India.

- The best budget fitness trackers under Rs 5,000 in India

- The best noise-cancelling headphones available in India

Xiaomi tops wristbands

Wristbands grew 83.3% quarter-over-quarter (QoQ) after seeing a sequential decline in the first half of the year. However, it declined by 20.3% YoY as users started upgrading to watches. Xiaomi maintained its lead, accounting for more than half of the category shipments with a 52.4% share in the quarter. Realme stood second with a 14.6% share in the category.

Increased demand for wireless devices supported the earwear category to hit its all-time high shipments in the country, witnessing a 260.5% YoY growth.

BoAt with multiple launches during the quarter, led the category with a 32.4% share, followed by Samsung that includes devices from Samsung, Infinity, Harman Kardon, and JBL with a 15.0% share.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

BoAt also led the overall TWS category with a 26.1% share, followed by Realme who expanded the truly wireless portfolio and secured the second position with a 15.5% market share in the TWS category.

Noise leads watches list

The watches category, which includes wearables with big screen and fitness trackers and smartwatches that can install third party apps, grew 119.9% YoY with 778,000 unit shipments, their biggest growth since launch in India. Indian lifestyle technology brand Noise with 28.5% share, dominated the category, followed by smartphone brand Realme (24.2% share).

Noise has witnessed a tremendous growth in the sales in the last few months that 1 in every 4 smartwatches sold is a Noise smartwatch. As a part of the festive season sale 2020, Noise has recorded a sale of over 100K Smartwatches in a time span of 100 hours.

Summarising the shift in wristwear devices from the band to watches, Jaipal Singh, Associate Research Manager, Client Devices, IDC India said, “The pandemic has reinforced the importance of fitness in our life. The motivation of staying fit and leading a healthy lifestyle is now forcing users to upgrade to more sophisticated wearable devices with greater expectations around improved health tracking.”

Source: IDC

Over three decades as a journalist covering current affairs, politics, sports and now technology. Former Editor of News Today, writer of humour columns across publications and a hardcore cricket and cinema enthusiast. He writes about technology trends and suggest movies and shows to watch on OTT platforms.