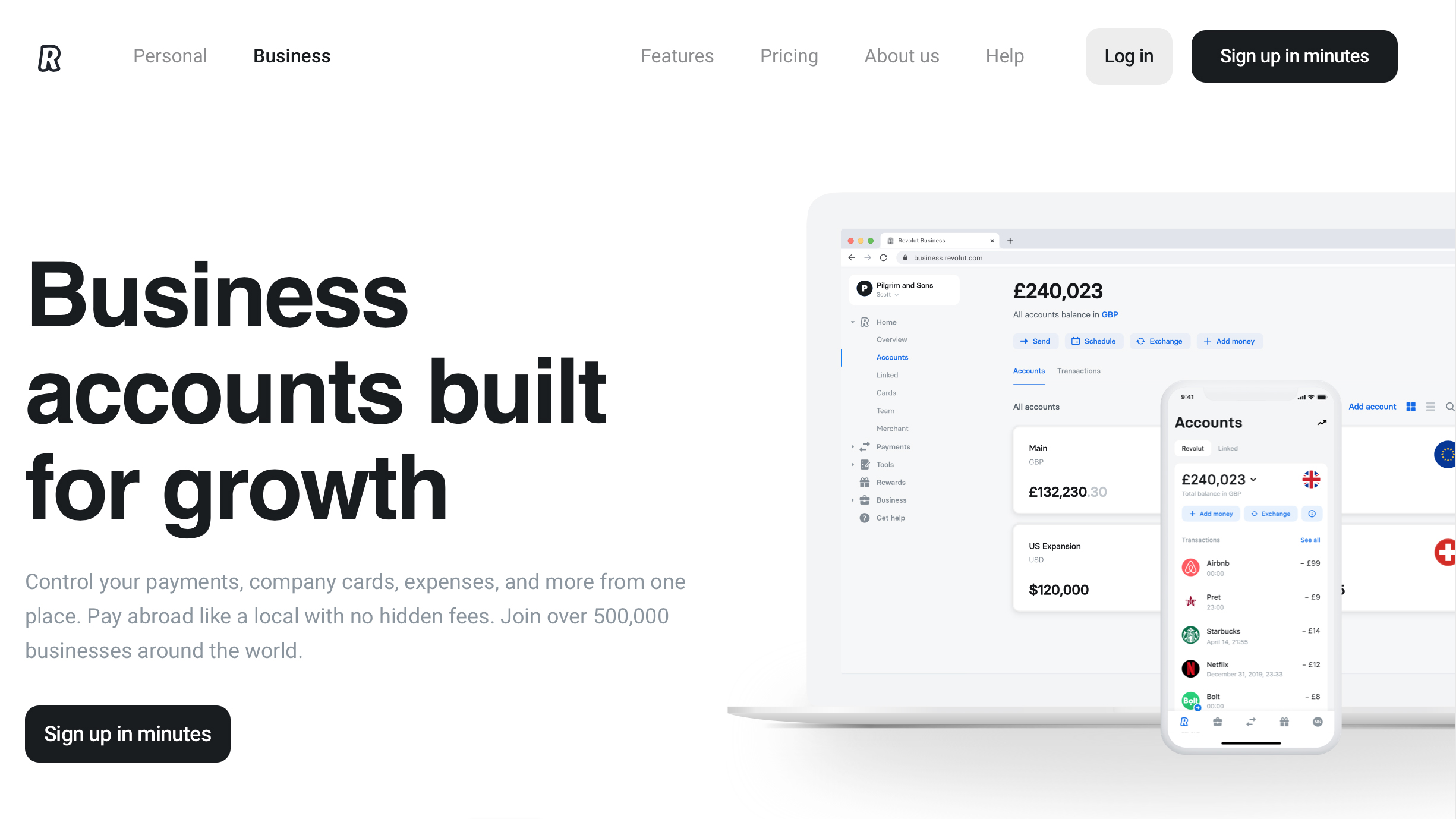

Revolut, the London-based challenger bank, will let businesses accept online card payments as it moves into the merchant acquiring marketplace. The growth in demand for digital payments will see it roll out the option for businesses across 13 European countries, allowing customers to pay using one of 14 different currencies.

Other digital payment firms such as Stripe and Adyen already offer the convenience of being able to accept card payments online and receive funds directly into business accounts. Revolut’s processing capability functions using a checkout plugin or a customizable widget. Business owners will also be able to make use of a secure Revolut payment link that can be sent to customers.

A starter pack has been developed that will let businesses manage their financial transactions in one place, with the new Revolut Business Acquire service forming part of the package. The move follows Revolut’s launch last week of Modulr, which gives UK customers the opportunity to be paid a day early, along with providing a supporting app for regular customers.

- We've also featured the best UK tax software

- Take a look at the best bookkeeping software

- Check out the best free accounting software

However, despite the brace of new product launches, Revolut has tripled its losses since 2018. The challenger bank is attracting more customers, particularly since the enforced lockdowns caused by the coronavirus pandemic, but its annual report in August highlighted a decline in interchange revenue, which accounts for over 60% of Revolut’s income.

Acquiring service

As an incentive to boost take-up, business customers will enjoy lower fees for the new acquiring service. There'll be a 1.3% fee for UK and European Economic Area (EEA) consumer cards along with a levy of 2.8% for all other cards, aimed at making the option appealing for business owners.

Customers using Revolut Business in the UK, Austria, Belgium, Denmark, France, Germany, Ireland, Italy, Netherlands, Poland, Portugal, Spain and Sweden will all be able to take advantage of the online payment option over the next few weeks.

“Payments sit at the core of any business,” said CEO Nikolay Storonsky when unveiling the product at last week’s Web Summit. “So, we have crafted a solution that meets not only their business account demands but also their payment acceptance requirements. Our mission is to democratise acceptance and we are already on the way.”

Revolut’s pricing looks to be competitive, currently undercutting Stripe’s transaction fee by 1%. It also comes without the 20p per transaction fee charged by the challenger rival.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

- Also, check out our roundup of the best budgeting software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.