Best payment gateway of 2025

Set up your online store

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

We list the best payment gateways, to make it simple and easy for businesses to securely handle card payments online and in person.

Payment gateways offer the flexibility of being able to take card payments, either online or in-store. The allows quick and easy credit card payment processing, both online and offline. Payment gateway systems also work with Point of Sale (POS) processing in-store.

Put simply, payment gateways provide a means to charge cards and any fees are subsequently charged to the business owner, or merchant, with rates commonly anywhere between 1.4%-3.5%, and often with no monthly fees either.

In addition, if you have a merchant account, processing fees are reduced to around interchange fees, which are typically around 0.10%-20% per transaction, and come with monthly fees.

Having a simple payment gateway can be a great way to handle low volume sales. However, as monthly fees can eat into income more than processing fees you may find that once sales volume reaches a critical threshold it becomes cheaper to pay a monthly fee for merchant processing with interchange fees.

Some of the best payment gateways offer both options, or a similar advantage over the competition. This may be in the form of processing fees for certain cards, to direct integration into accounting software. The same can be said for anyone with dedicated accounting software needs in the UK too.

We've compared these payment gateways across many factors, including ease of setup, ease of use, global processing, pricing plans, and mobile payments. We also looked at their security features, the currencies they support, and what types of businesses they'd best for.

Featured below are the current best payment gateways available.

We've also featured the best tax software.

The best payment gateway of 2025 in full:

Why you can trust TechRadar

Best payment gateway overall

Reasons to buy

Reasons to avoid

PayPal is one of the most widely used online payment platforms. Founded in 1998 as Cofinity, it lets you make and receive payments all over the world.

PayPal provides payment processing services for e-commerce vendors, auction sites and other commercial entities globally, and allows you to accept credit cards including Amex and Visa. It also offers easy cart integration, plentiful customization options, online invoicing, and facilitates credit card payments over the phone.

PayPal is normally associated with online marketplace eBay, but it’s worth noting that since 2020, it ceased to be eBay’s main payment option (as the company switched to Adyen – although PayPal is still offered as an optional payment service). In a statement made last year, eBay said it made the move to offer customers more competitive prices.

Pricing is competitive, with processing charged at 2.99% (+ fixed fee) per debit/credit card transaction, with no monthly fees, making it ideal for new and small businesses.

Read our full PayPal review.

PayPal - quick and easy card processing

Like all of the best credit card processing companies, PayPal regularly features deals and incentives. Take a look at the latest methods for processing credit and debit card payments, including point of sale, QR codes and a mountain of other small business-friendly options.

Best payment gateway for growing businesses

Reasons to buy

Reasons to avoid

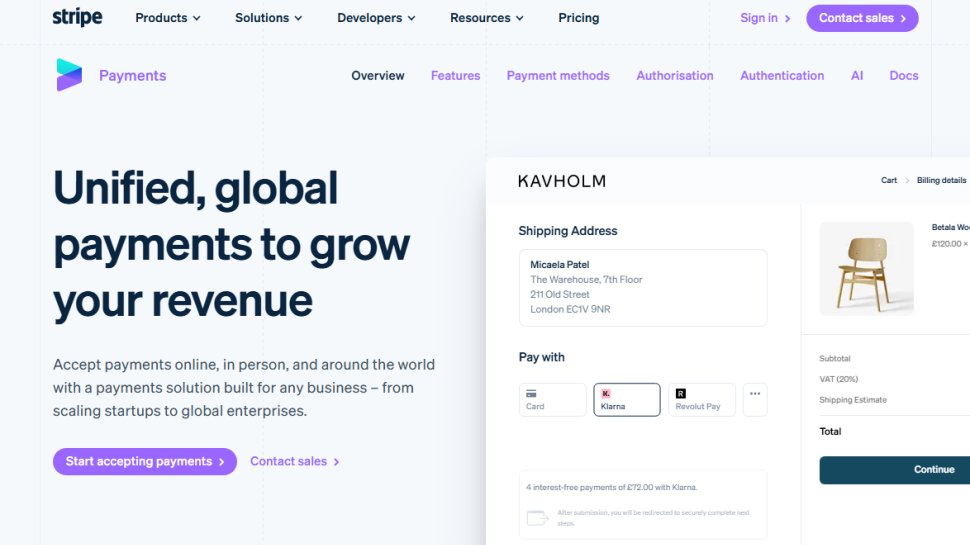

Stripe is yet another powerful payment platform designed for internet businesses, with the company claiming to handle billions of dollars worth of transactions annually. The main difference between this service and many others is that it isn’t an out-of-the-box solution. Instead, you’re provided with a range of flexible tools to customize your own payment processes.

Designed for larger firms, it offers a plethora of APIs that allow you to create your own subscription services, on-demand marketplaces, or crowdfunding platforms. It supports a range of development languages, including Ruby, Python, PHP and Java.

Furthermore, Stripe supports more than a hundred currencies, and offers features such as mobile payments, subscription billing and one-click checkout. Users also get access to a dashboard where they can visualize transactions. Clearly, then, this is a feature-rich payment gateway, although Stripe does demand a lot more technological knowledge from the user than most providers.

Stripe's processing fees for US cards are 2.9% (+30¢). Additionally, for larger volume needs, it has a customized plan with volume discounts.

Read our full Stripe review.

Stripe - easy access card payment processing

If you're looking for a quick and easy way to start processing card payment then Stripe has a range of options. It features a complete payments platform with simple, pay-as-you-go pricing currently set at 2.9% plus 30¢ per successful card charge. Check out Stripe's current best deals.

Best payment gateway for advanced analytics

Reasons to buy

Reasons to avoid

Adyen is used by companies such as Uber, Spotify, Microsoft and eBay to handle business and customer transactions. The software lets you accept every payment made to your company from a single platform, as well as giving you tools to manage risk and track results.

Not only does Adyen accept more than 250 payment methods and 150 global currencies, but it also lets you analyze transaction data to benefit from “data-rich insights to learn customer behavior.”

For example, you’re able to identify buyer behavior and patterns, allowing you to tweak products and services appropriately. There’s also a built-in risk management tool that sifts through data to identify and fight cases of fraud.

Processing fees vary by the method of payment, but the firm uses Interchange pricing, with an additional transaction fee. However, you will need a merchant bank account to take advantage of interchange pricing.

Read our full Adyen review.

Adyen - The global gateway

The Adyen payments platform supports all key payment methods globally. Also, many payment methods can be used outside of the shoppers’ country. There's a processing fee plus payment method fee per transaction, no set-up fee, 24/7 in-house support and access to a full range of tools on the platform.

Best payment gateway for fraud detection

Reasons to buy

Reasons to avoid

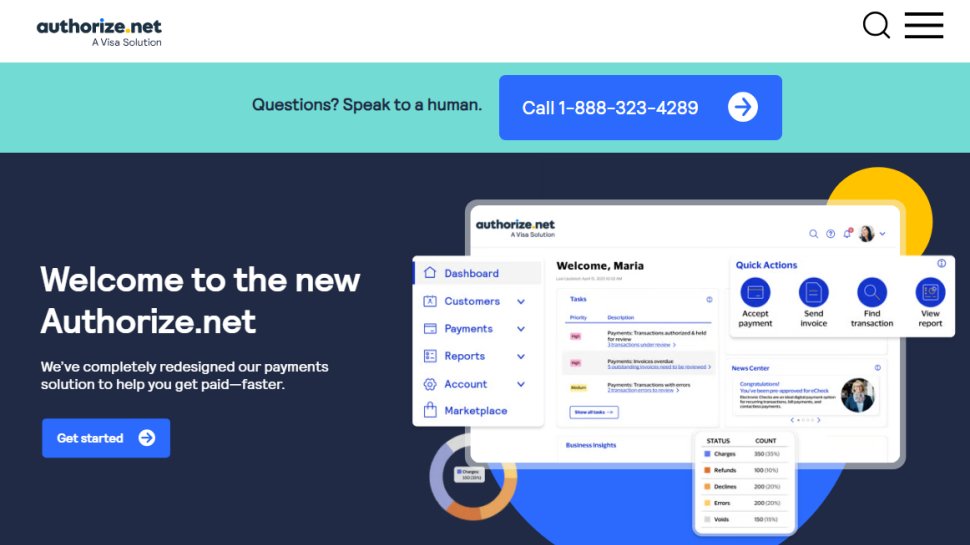

The main aim of these solutions is to streamline the payments process, and Authorize.net (from Visa) does exactly that. Developed with firms of all sizes in mind and offering a choice of plans, the platform gives you the tools to sell items and take payments online, or in-person at a store.

With the solution, you can accept payments from websites and transfer funds into a merchant bank account quickly. It supports all major credit cards, including Visa, MasterCard, American Express, Discover, Diner’s Club and JCB. As well as this, the platform is compatible with digital payment services such as Apple Pay, PayPal, and Visa Checkout.

Although all payment gateways offer some tools to support fraud detections/prevention, Authorize.net takes it to the next level. The Advanced Fraud Detection Suite (AFDS) offers peace of mind by identifying, managing, and preventing suspicious transactions.

Although the software can accept transactions made by customers all over the world, your business must be registered in the US, UK, Canada, Europe or Australia if you’d like to use this service.

The entry level 'All-in-one' account comes with a $25 monthly fee, no sign up fee, and a 2.9% (+30¢) transaction fee.

Read the full Authorize.net review.

Authorize.net - fast and easy card processing

There's an easy three-step system in place for processing payments via Authorize.net. Choose a plan, complete the application and start processing. Pick from flexible options that include an All-in-One option with a per transaction rate of 2.9% + 30¢ or a Payment Gateway Only package with a per transaction rate of 10¢ and daily batch fee 10¢ with no setup fee for both.

Best payment gateway for flexibility

5. Payline

Reasons to buy

Reasons to avoid

Payline is a Pineapple Payments company headquartered in Chicago, Illinois. It provides solutions to businesses ranging from startups to Fortune 500 companies, with a focus on the payment experience.

Payline offers gateway payment processing, and its web solutions are designed to integrate with over 175 online shopping carts. The company also offers mobile solutions designed to accept payments via mobile apps. The Payline payment processing gateway also integrates with QuickBooks for ease of payroll management, and business financials in general.

Payline offers pricing based on the service. A swipe falls under Payline Start, which has a monthly fee with an additional small charge per transaction, which includes AMEX as well for an additional per transaction fee.

Pricing for bricks and mortar stores includes a monthly fee of $10 and a 0.4% (+$0.10) fee per transaction. For online stores, the monthly and transaction fees are $20 and include a 0.75% ($0.20) fee per transaction.

Payline - small business specialist gateway

Payline has packages to suit both small business and enterprise options for bigger concerns. Swiping in-person 0.4%, $0.10 per transaction / $10 per month. Online stores pay 0.75%, $0.20 per transaction / $20 per month. Try the free cost calculator.

Other payment gateways to consider

While we've mentioned some of the best merchant gateways, there are a number of others worth considering. This is especially as many are available to integrate with existing ecommerce platforms using nothing more than an easy-to-install plugin. Here, therefore, we'll list some additional merchant gateways that are well worth considering, according to the differing needs of online businesses.

2Checkout is another payment provider that is commonly used by online merchants, not least because as well as one-off purchases it's easy to set up subscriptions. This makes it especially useful for online businesses selling digital services such as web hosting or web design companies. It's also commonly available as a plugin for major ecommerce platforms, and can process a wide range of global currencies.

Opayo, offers not just a merchant gateway, but the ability to directly record all sales and transactions directly into your Sage accounting software. This makes it especially invaluable for efficiency purposes, not least because it means you can see your costs and income in real-time. However, while there are different plans available for Opayo, it's best to have a merchant account to get the most out of the software, not least for reducing transaction fees in the first place.

FIS Global (previously Worldpay) is another popular payment gateway, with a number of integrations available for popular ecommerce platforms. You can set up as a paid-monthly service, or else use a merchant account to take advantage of interchange fees on all transactions. However, Worldpay has undergone significant changes over the past few years, after being owned by at least two different companies, so it's worth inquiring as to what services are currently available and at what price.

We've also featured the best merchant services.

Best payment gateway FAQs

What is a payment gateway?

Payment gateways are tools used by merchants to receive payments from customers.

An online payment gateway is cloud-based and it helps merchants receive online payments from customers, while a brick-and-mortar retail store's payment gateway is a point-of-sale (POS) system or a card reader.

How to choose the best payment gateways for you?

Choosing the best payment gateway to suit your business needs largely depends on what size your company is. If you're a smaller outlet, or sole trader, it may not be necessary to have a powerful payment gateway setup. That's especially so when you consider the sort of flexibility and convenience offered by PayPal.

Being able to offer the convenience of accepting card payments is an everyday necessity for most businesses and customers expect to have the option. So lookout for those that offer simplicity, value for money and also the opportunity to link them to POS systems, along with the ability to integrate into your accounting software.

At the same time, keep an eye on those terms and conditions, as outlined in our introduction. Fees can vary wildly from one payment gateway to another, so be sure to factor this in to your costings. Processing and interchange fees can add up, so be sure to allow for these.

If your business plans to process higher volumes of sales then you'll obviously want to plump for one of the more advanced packages, even though these invariably come with a higher price tag.

How we test the best payment gateway

When we test payment gateways we're always on the lookout for a system that will make life easier for a business. Therefore, any package should suit the type and size of business its targeting. This means that some of the payment gateway options shown above are better suited to smaller, low volumes sales-type outlets.

On the other hand, if you're processing large volumes of credit card payments you'll need one of the beefier options listed in this guide. We try to find a practical balance between how systems operate on the target business market and compare that with the costs and fees that are involved.

Businesses are always looking for good value, so we try to ensure that any system we test provides all of the features and functions needed, without adding in extra costs for unwanted features that may never be needed. Our buying guides help you hone your search by showcasing the strengths and weaknesses of each key player.

Read how we test, rate, and review products on TechRadar.

Get in touch

- Want to find out about commercial or marketing opportunities? Click here

- Out of date info, errors, complaints or broken links? Give us a nudge

- Got a suggestion for a product or service provider? Message us directly

- You've reached the end of the page. Jump back up to the top ^

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Jonas P. DeMuro is a freelance reviewer covering wireless networking hardware.

- Rob Clymo

- Owain WilliamsB2B Editor, Website Builders & CRM