Smartphone shipments in India decline in Q1 2022 - But Realme sees YoY growth

Xiaomi continues to lead with 23% market share

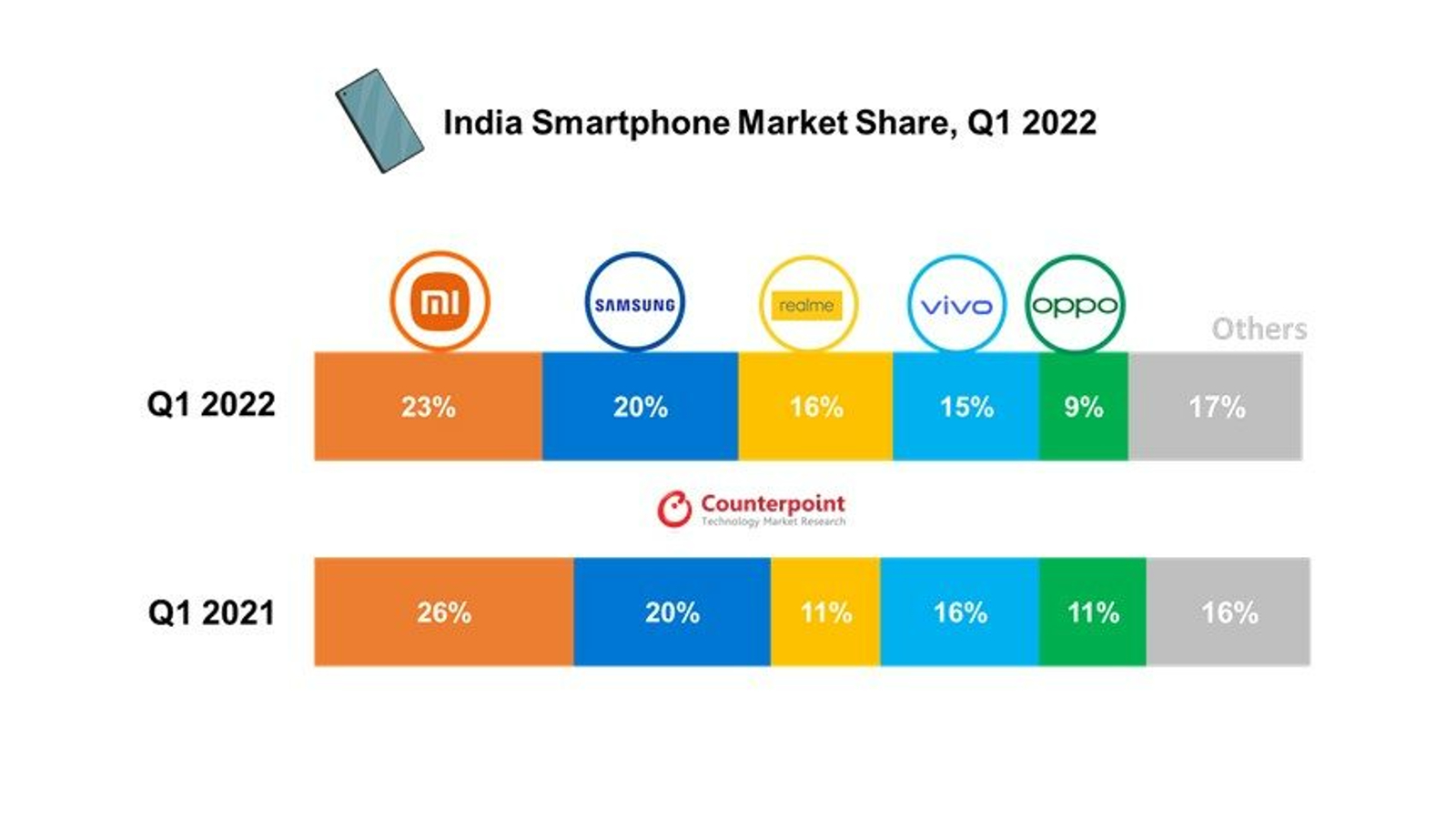

Smartphone shipments in the country were on the decline in Q1 2022, according to a report by Counterpoint Research. The study also found that Realme is the only company on the list that has seen a YoY growth of close to 40% while Xiaomi continued to lead in market share even though it saw a decline of 13% YoY performance.

The Counterpoint Research indicates that smartphone shipments in India declined by 1% to register a total of 38 million units in Q1 2022. A major reason for the decline has been attributed to the global chipset shortage and supply constraints of components due to the recent lockdowns imposed in China. The rising inflation in India added to the decline in demand for smartphones as well.

The study also suggests that many smartphone manufacturers have begun looking at alternatives like sourcing more local resources and expanding their suppliers for components to help ease many of the manufacturing hurdles.

Chinese brands still lead

Chinese smartphone manufacturers accounted for 74% market share. This includes Xiaomi which continues to maintain its lead market share in India with 23% followed by Samsung, Realme, Vivo and Oppo. Xiaomi has seen consistent growth in the market due to the large success of the 11i series as well as the refreshed Redmi Note 11 series.

While Samsung’s Galaxy S22 series has helped the South Korean smartphone manufacturer secure the second position, Realme has seen an immense YoY growth of 40% which made it the best performer in comparison to competing brands. The reports indicate the company’s decision to release smartphones with Unisoc chipsets and providing discounts and offers for many of their devices contributed to achieving this level of performance.

Vivo and Oppo saw a decline in their smartphone shipments in Q1 2022 due to the rise in Omicron variant cases that affected the offline sales model. But the study does suggest that the brands could soon expect to see better performance in the next quarter after the recent launch of Vivo’s T1 and Oppo’s online K10 smartphones.

When it comes to premium brands, Apple grew its market share by 5% YoY. The discounts and offers provided on the iPhone 13 and iPhone 12 series in the offline stores have contributed to this growth, according to the study.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

No 5G yet 5G-ready smartphones

While 5G is yet to make its official debut to the larger public, many of the 5G smartphone shipments in India has seen an immense growth of 314% YoY. While the current study shows that this constitutes 28% of the total shipments for Q1 2022, the research company forecasts this to increase to 40% by the end of this year.

While manufacturers have been marketing their products to be 5G ready with support for almost 13 5G bands in the country, consumers will be more interested in getting these in the coming months. The government recently announced price cuts of up to 36% for many of the spectrum bands and is expected to roll out the services by August or September this year.

A Malayali-Mumbaikar, Sachin found an interest in all things tech while working in the BPO industry, often spending hours in tech blogs. He is a hardcore foodie and loves going on long bike rides. Gaming and watching TV shows are also some of his other hobbies