Business intelligence for the SMB market

Start small with BI and build up over time

Many companies are yet to adopt business intelligence (BI), despite predictions of continued growth in the area.

Expansion in the mid-sector is expected to fuel the worldwide BI market to reach over $17 billion by 2016, according to research firm Gartner. Meanwhile, the global BI market will reach $13.8 billion this year, up 7% from 2012, analyst predictions say.

BI encompasses a wide range of technologies and practices, allowing firms to process data and support decision-making in departments such as sales, finance, marketing and HR.

Much of the increasing need for BI is created by a surge in amounts of data, known as 'big data', which has seen companies of all sizes trying to turn huge amounts of information into something meaningful.

Traditionally, most technology tools and applications, especially from larger BI providers, have focused on big enterprises; but now vendors such as IBM are also targeting small to midsized business with software. At the same time, newer deployment models are making it easier and cheaper for firms of all sizes to implement BI.

More choice

New deployment models are broadly split into several different camps. The first includes the big vendors such as IBM and Oracle, which now offer software that can benefit SMBs. Competition is also growing from independent BI players such as QlikView and Tableau Software, whose strategy has been based on success in the SMB space.

Adding to the choice are the vendors that focus on deployment models such as cloud - SaaS subscription services - or running the infrastructure for an organisation, providing BI capabilities at a lower cost.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Lastly, open source deployment involves using a cloud licensing model which is cheaper than on-premise. This type of solution is offered by companies such as Pentaho.

"BI is about making the best possible use of data for decision-making," says Helena Schwenk Principal Analyst at MWD Advisors. "If you look at it from a licensing perspective there can be a lot of advantages."

Before putting in BI, it's important to get IT systems in order to create a single view and assess their ability report back the data. "The situation in smaller firms is often to do with the IT systems," says Alex Whittles, Business Intelligence Consultant at business communications consultancy Purple Frog. "Often the systems do their job pretty well but the major flaw is, they are designed to do the job, not report on it."

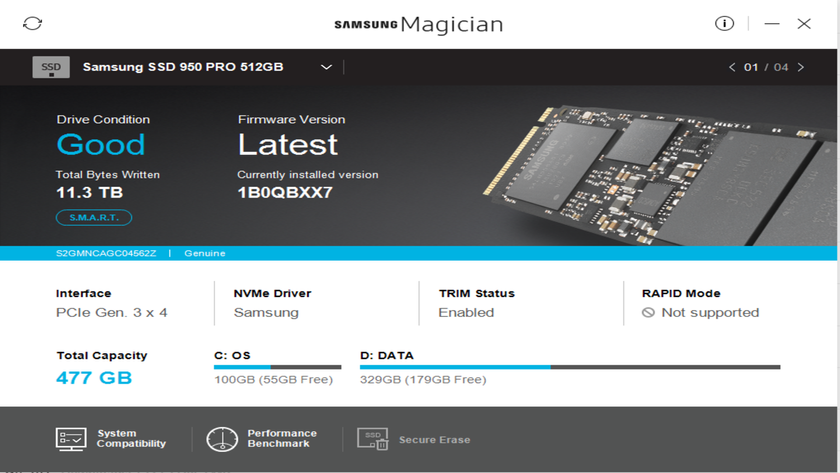

Many firms are already considering BI, but they should first examine what type of support they need, and then look at where they will store the information. With huge amounts of valuable and sensitive data created by BI, businesses will often need to use an external storage provider. Some SMBs don't have the specialised skills for BI internally so may prefer to work with consultants.

Build up over time

All BI projects can be approached by building up over time. "SMBs should start small - where is BI most needed? Look for a single problem you want to resolve, learn about how it works and then you can expand it," says Whittles.

Meanwhile, those looking for a toned down solution or foundation for BI, can look at pre-packaged apps such as a dashboard offered by many vendors. This type of solution allows firms to create dashboards where they can go to a single page and see key performance indicators.

"A dashboard is really a single page that gives you a high level overview," says Whittles. "Part of BI is a visual exercise - turning data into information and information into knowledge."

Trials are offered by many vendors to allow organisations to download free software, but most have a one user-only version, with cost added as the BI is expanded out to all users.

IT vendors have also realised the familiarity of Microsoft Excel so are offering tools with an Excel interface - or at least compatibility with Office.

"Part of the problem with historical BI is the new tools," says Whittles. "The biggest BI tool for Microsoft is Excel - you use Excel but not in the same way you are used to."

Yet in order to scale an Excel spreadsheet, the data must be stored so it is secure, consolidated and so it can scale. At the same time, Excel can only work so far - and as data volumes grow, the tool "will run out of steam" says Schwenk.

A growing market

As data volumes grow, firms can use BI to structure information such as sales figures, giving a real insight into what is going on inside the business.

The market is waking up to the value of analytics, so BI software is here to stay - and choice is growing too. Schwenk says: "You have all the options now that you get with other segments of the software market - like CRM where you have cloud as well as on-premise."

Organisations should take the approach of building up their BI over time. With the correct BI in place, time running reports and collating data can be saved, reducing costs overall. For most firms, that's an attractive proposition.