UPI keeps rewriting record books - What makes it tick?

6 billion transactions in July

UPI (Unified Payments Interface), which is in a sense the backbone of payment platforms like GooglePe and PhonePe that have transformed the Indian commercial transaction scene in the last few years, is on a record breaking spree. It has reported 6.28 billion transactions amounting to Rs 10.62 lakh crore (trillion) for the month of July, according to data released by the National Payments Corporation of India (NPCI), which operates the platform. Month-on-month, the volume of transactions was up 7.16% and value increased 4.76%.In the seven months of 2022, UPI transaction volume has already crossed 92% of 2021’s volume.

Prime Minister Narendra Modi hailed the achievement of UPI transactions crossing 6 billion in July — the highest ever since its launch six years back. "This is an outstanding accomplishment. It indicates the collective resolve of the people of India to embrace new technologies and make the economy cleaner. Digital payments were particularly helpful during the COVID-19 pandemic," Modi said in a tweet.

UPI and its staggering numbers

This is an outstanding accomplishment. It indicates the collective resolve of the people of India to embrace new technologies and make the economy cleaner. Digital payments were particularly helpful during the COVID-19 pandemic. https://t.co/roR2h89LHvAugust 2, 2022

UPI is currently the most popular digital payment system in India with linkage to 330 banks led by State Bank of India (SBI) (162.5 Cr transactions), followed by HDFC Bank (52.9 Cr transactions) and Bank Of Baroda (38.3 Cr transactions). UPI crossed 1 billion transactions for the first time in October 2019, almost three years after its launch. The next billion came in under a year, as in October 2020, UPI processed more than 2 billion transactions. It breached the 5 billion mark in March this year. And now it has crossed the six billion threshold.

The UPI-based transactions are most popular one across the country. Reflecting the rapid adoption of digital payments in the country, the Reserve Bank of India’s (RBI) digital payments index (DPI) rose to 349.30 as of March 2022, as against 304.06 in September 2021. Launched in January 2021, the DPI index indicates the extent of digitisation of payments across the country. In March 2019 the index stood at 153.47 and by September 2019, it rose to 173.49, followed by 207.94 in March 2020, 217.74 in September 2020, and 270.59 in March 2021.

NPCI is now going international to take the homegrown payments system to countries like Nepal, the UAE, Japan, and China. This means, UPI transactions are possible in these countries.

So what makes it tick?

It is handy and convenient

The Covid-19 pandemic had understandably fueled the acceleration of adoption of digital payments. It is here UPI transactions have taken the centre stage. Credit and debit cards, while continuing to be easy and handy, are still seen as a tool for the urban and clued-in individuals. The UPI-based transactions, mostly done via the smartphone, is more egalitarian, as it were. It is as popular in cities as it is in villages and towns. Its ease of usage and convenience is hard to beat, and that is at the centre of its popularity.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

UPI’s target is to process a billion transactions a day in the next five years. The RBI’s decision to allow linking of Rupay credit cards to UPI will add further impetus to its widespread use.

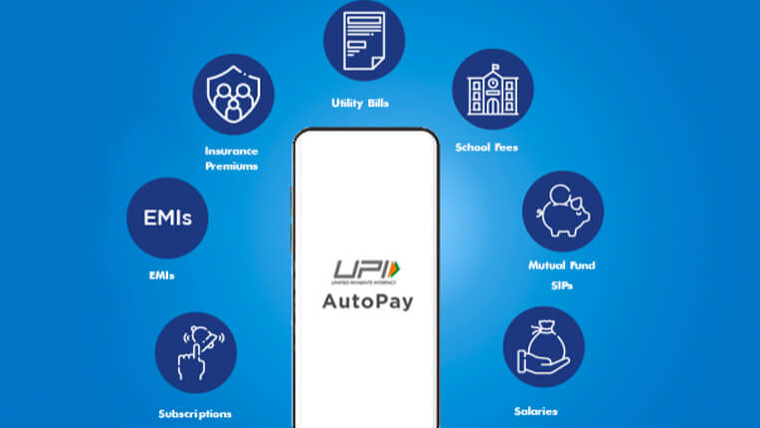

The NPCI was incorporated in 2008 as an umbrella organisation for operating retail payments and settlement systems in India. It started UPI in 2016 and also operates other payment features such as RuPay card, Immediate Payment Service (IMPS), Bharat Interface for Money (BHIM), Fastag and Bharat BillPay. NPCI has also inked a Memorandum of Understanding (MoU) with France’s Lyra Network for acceptance of UPI and RuPay Cards in the country.

As the countries and usage increase, UPI's numbers are bound to increase. More records are waiting to be broken.

- Amazon Great Freedom Festival 2022: Everything you need to know

Over three decades as a journalist covering current affairs, politics, sports and now technology. Former Editor of News Today, writer of humour columns across publications and a hardcore cricket and cinema enthusiast. He writes about technology trends and suggest movies and shows to watch on OTT platforms.