WhatsApp Pay eyes expansion by offering affordable health insurance

To offer micro-pension products as well

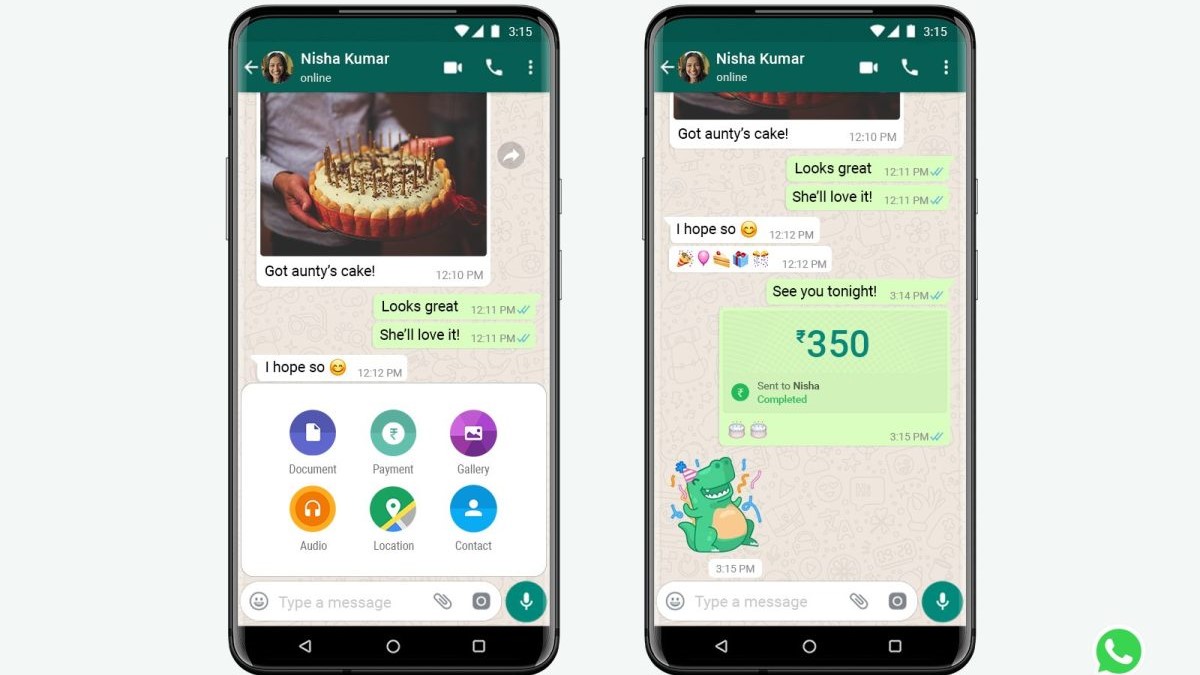

WhatsApp recently received requisite government clearances to start its UPI-based payment service in India. Close on the heels of this achievement, the Facebook-owned messenger service plans to off sachet health insurance policies to customers across India.

The cross-platform messaging application has chalked out plans to collaborate with SBI General Insurance to offer health insurance plans to kick start its plans to offer financial services. It also has plans to offer micro-pension products on the platform.

This announcement was made at the Fuel for India 2020 event, where Facebook’s founder and CEO Mark Zuckerberg announced that India is the first county where the company is working closely with 140 local banks to offer payment services. He further added that the company is, “grateful to be able to support this kind of innovation and to help to work, to create more prosperity, and help achieve a more Digital India.”

- Digital payments in India: UPI transactions cross 2-billion mark in Oct

- PayTM has returned to Play Store - but, the battle is far from over

WhatsApp recently got conditional approval to introduce UPI-based payment services and can only get 20 million users, a fraction of its 40 million users, to sign-up its payment services. This approval, however, came after the company facing various regulatory hurdles over the last two years or so.

Though, reports suggest that the WhatsApp Pay has got off to a slow start. The company has been able to only accumulate mere 310,000 transactions amounting to Rs. 14 crores. While digital payments are on an all-time high in terms of acceptance and penetration, peers like Google Pay, PhonePe and PayTM have enjoyed a majority of business.

One of the primary reasons behind this that unlike other services, WhatsApp pay did not offer other services like bill pay, recharges or merchant services. Instead, WhatsApp currently focuses on peer-to-peer money transfer. Missing discounts and offers are another reason why users prefer more established payment services.

- Upcoming smartphone launches in India for December: Specs, launch date, price

- Announcing TechRadar India Awards 2020 (and a giveaway!)

Follow TechRadar India on Twitter, Facebook and Instagram for the latest updates.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Via: NDTV Gadgets

Jitendra has been working in the Internet Industry for the last 7 years now and has written about a wide range of topics including gadgets, smartphones, reviews, games, software, apps, deep tech, AI, and consumer electronics.