WhatsApp Pay set to get big in India: We explain why

User-base can be increased to 100 million

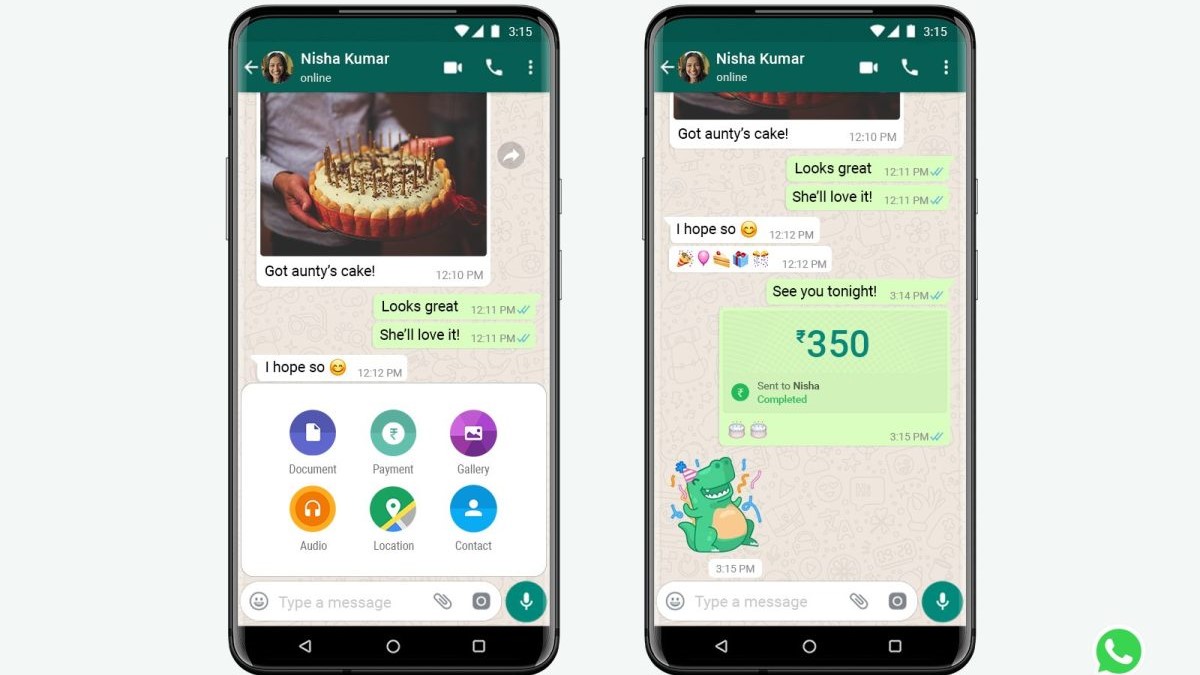

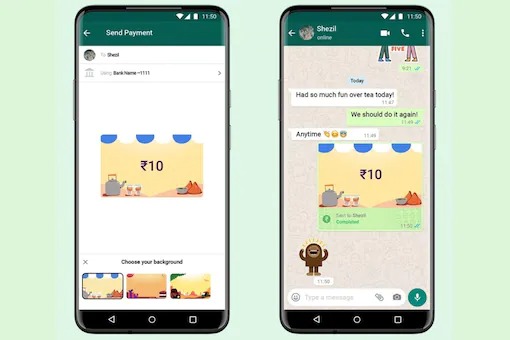

WhatsApp Pay, which was rolled out in India in late 2020, was expected to create a big impact in the digital payments market. But the platform was shackled by the NCPI (National Payments Corporation of India, the payments body that oversees the widely popular UPI instrument) caveat which initially pegged its user-base to 20 million. Also, for reasons that are unclear, the NCPI also mandated that WhatsApp Pay can expand payments to its users only in a 'graded manner'.

In the event, WhatsApp Pay has not really taken off in India in the manner that its owning platform Meta might have wanted.

But, as it happens, WhatsApp Pay has got the good turn it was waiting for: NCPI has now allowed it to increase the user-base on the platform to 100 million.

It may be recalled that in November 2021, WhatsApp Pay was allowed to increase its user base to 40 million from 20 million. In all, WhatsApp, which runs WhatsApp Pay, has a whopping 500 million users in India.

WhatsApp has also plans to start multiple pilots in areas like digital lending, micro-insurance and micro-pension.

Competition to get intense for UP pie

This new approval will help WhatsApp Pay take on arch-rivals Walmart-backed PhonePe and Google Pay, which dominate the transactions on UPI. WhatsApp can aggressively push its payment service to attract more merchants to the platform.

With Tata Digital also coming into the picture now --- thanks to its super app Tata Neu, the competition for UPI pie will doubtless get intense. At stake is India’s mobile payments market, which is estimated to reach $1 trillion by 2023. As per NPCI data, there are a total of 25 third-party application providers, including WhatsApp, that are allowed to provide payment services on UPI.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

For the record, in March, WhatsApp Pay accounted for 0.05% of UPI transactions, which amounts to 2.54 million transactions worth Rs 239.78 crore. This is pittance in comparison to PhonePe that recorded 2.5 billion transactions and Google Pay which saw 1.8 billion transactions in March.

Also, the NPCI’s much-discussed UPI market share cap will come under more focus. In a move to ensure fair play, NPCI has mandated that no one company/platform/app should be able to process more than 30% of the total UPI transaction volumes in a three-month period.

NPCI keeps reviewing this figure and then decides whether a platform needs to be capped at a lower number or it should be higher than before. Market leaders PhonePe and Google Pay have been given time till the end of 2022 to comply with the order.

It is not clear as to how these two platforms whose existing volumes are over the capped limit will cut down their businesses. How they will reduce their market share is something difficult to tell now.

Over three decades as a journalist covering current affairs, politics, sports and now technology. Former Editor of News Today, writer of humour columns across publications and a hardcore cricket and cinema enthusiast. He writes about technology trends and suggest movies and shows to watch on OTT platforms.