WhatsApp Payments to be widely available only after it meets all norms: NPCI

The statement comes after concerns of “close garden implementation”

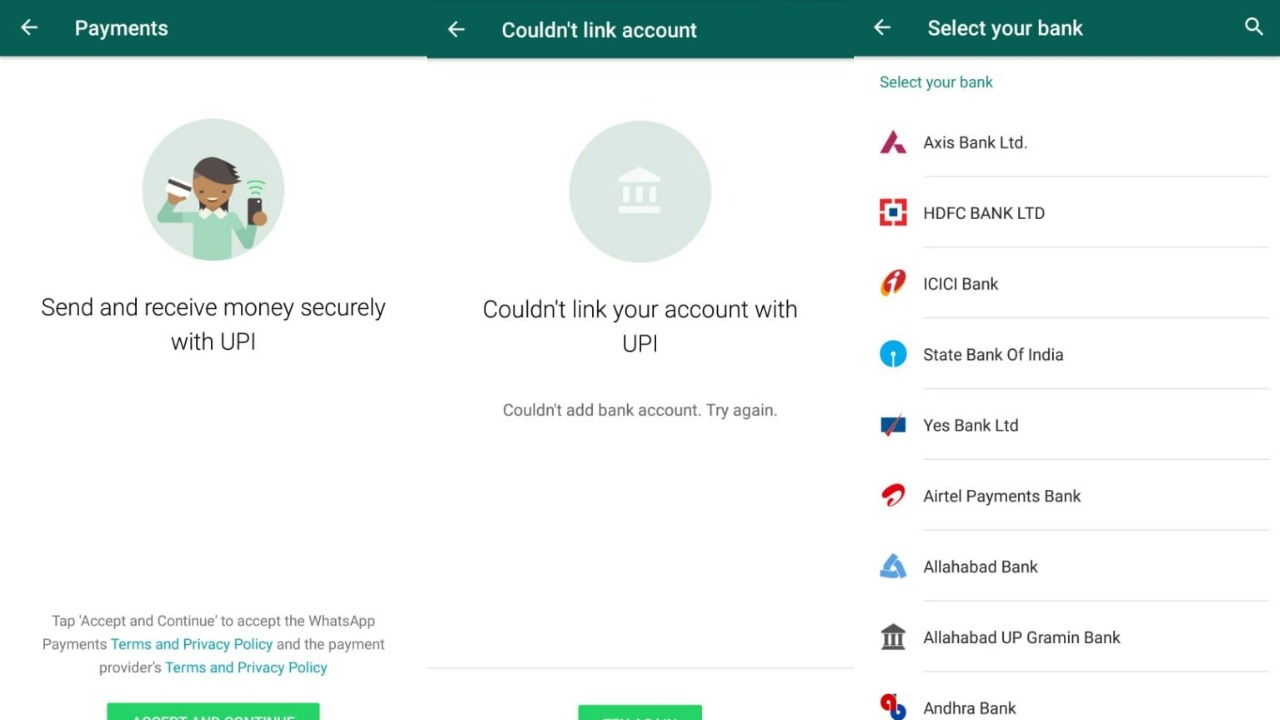

The digital payments battle is heating up in India and the latest to join the fray is WhatsApp, the global instant messaging behemoth.

Understandably, the entry of such a big player in a field like digital payments is going to ruffle some feathers. Vijay Shekhar Sharma, the founder of Paytm, an India-based payments platform, had recently raised concerns about WhatsApp Payments violating UPI norms.

Paytm versus WhatsApp Payments

In a tweet posted last week, Vijay Shekhar Sharma had called out WhatsApp for being a "custom close (sic) garden implementation". Sharma also tried to draw attention to the possible security issues of such an implementation, suggesting that he hopes "BHIM like security" features would be implemented before the full launch.

To address those concerns, NPCI issued a statement on Friday, saying - "Currently, NPCI has given its consent to roll out WhatsApp BHIM UPI beta launch with limited user base of one million and low per transaction limit."

Clarifying further, the NPCI statement said that the final release of WhatsApp Payments will be allowed only if it meets BHIM UPI principles of interoperability, the ability to send/receive money through any UPI ID, and reading/generating ability of BHIM/Bharat QR codes.

In a statement, Deepak Abbot, Senior Vice President of Paytm, said, "Our objection to WhatsApp’s UPI payments system is not about competition, but fair play. The company has custom-implemented UPI to affect the platform’s core principle of inter-operability."

In a response to the NPCI statement, Paytm said that while it sees that the statement addresses concerns of interoperability, it is silent on the critical issue of security, app login/password and SMS notifications for transactions.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

"We are still concerned that this statement is silent on the critical issue of safety/security of a financial transaction through UPI, where consumers need to mandatorily sign-in with username and password. This violation is fundamental and very serious," Paytm said.

It will be interesting to see how the WhatsApp Payments feature looks like at final release, and if/when the Facebook-owned app implements a login ID/password authentication system.

Rounak has been writing about technology for over five years now. Prior to Business Insider, he has worked with Tech Radar and PCMag where he covered the latest news and reviews of gadgets. In his free time, he likes to follow cricket.