Could speech analytics prevent the next financial crash?

Big data has come to banking

Dealing with big data

Traders' calls have been taped since the 1970s, but they've never been analysed until now. "The average trader will generate 2,000 hours of recordings every year," says Winter. "Multiply that by 500 on a small trading floor then multiply that by five trading houses … that's 5.6 million hours of calls per year!"

Since the Dodd-Frank Act defines that the lifetime of a swap is 35 years, it's a lot of data to sort and archive. "A proper trade reconstruction is impossible," says Winter. "The banks have not got a chance."

Dealing with city-speak and slang

Before computers, traders dealt with each other in coffee houses and other public places, so they developed their own language to keep the details private. It's a tradition that's stuck, but it's about to become redundant. Take this example of a concluded deal picked-out by the Linguistics Voice Platform: "Hi how are you, mine." Now that's subtle, but easy to spot if you're looking for it.

"Traders shortcut a lot – time is money – and prices change by the second," says Winter, who's steeped in bankers' lingo. "We put context into language, so if something looks out of context, it's flagged and categorised," she says.

Can it catch fraudulent bankers?

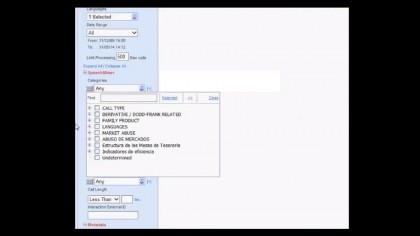

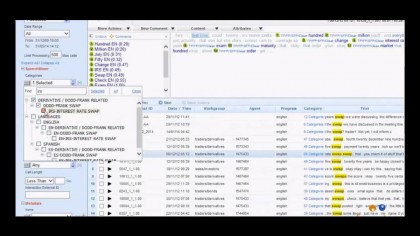

Absolutely. Here's an example of how the tech operated during the period of Libor fixing – we've capitalised the examples of word strings or phrases the software picked out:

"This is the way you PULL OFF DEALS LIKE THIS CHICKEN, DON'T TALK ABOUT IT TOO MUCH, two months of preparation ... THE TRICK IS you MUST NOT DO THIS ALONE … THIS IS BETWEEN YOU AND ME but REALLY DON'T TELL ANYBODY."

The rest of that conversation was punctuated with promises of Bollinger champagne alongside odd sounding compliments such as 'big boy', which were all flagged by the tech.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Another more subtle – but detectable – Libor-related conversation went like this:

Senior euro swaps trader: "Hi, is it too late to ask for a low 3m?"

Euribor submitter: "Just about to put them in ..... so no."

However, whether this kind of technology can prevent the next financial crash entirely depends on the reason for a fall in the markets. That could be fraudulent behaviour, though that wasn't the issue last time around in 2008.

"The banking crisis was to do with liquidity in the market, and that's what triggered Dodd-Frank to make the market more competitive and liquid," says Winter. "Whether we could have helped, who knows, but we do know that with our solution trader behaviour would probably have been different."

The recent Forex foreign exchange rate fixing scandal, however, could have been prevented by the Linguistics Voice Platform because it works across all sources of communication, both written and spoken.

"That's just a bunch of guys who got together probably in a chat room," says Winter. "Markets move on events – they need an election, an event to move the market – so these guys got together to put their money together to move the market between them. They've been fixing their position prior to their market move then selling out at the top of that position to maximise profits – it's highly irregular."

The software spots that kind of behaviour easily because it looks at trading patterns, and because criminal activity tends to happen in short periods of the day. "Once you are suspicious, you can track everything," adds Juanmo.

Does it work in other industries?

Anywhere that has a high volume of calls, emails and other types of communication could benefit from speech analytics.

"The software is found in call centres, in the telecoms industry, energy, insurance – any company handling big volumes of calls which they want to analyse," says Juanmo, picking out three examples of how speech analytics can produce data to improve efficiency: the churn in the telecoms sector, calculating customer satisfaction in call centres, and processing insurance claims. The platform is already used by Vodafone, Telefónica and Direct Line.

Users' 'voice-prints' will soon be integrated to increase security, while sentiment analysis is now possible, and already used by Fonetic in the call centre-centric versions of its Linguistics Voice Platform to detect underlying feelings of anger or frustration in customers' voices by studying intonation. That doesn't apply to banking, which is largely about facts. That's not going to change, but banking culture is about to be shaken up – and shaken down – by the sheer thoroughness of speech analytics.

Jamie is a freelance tech, travel and space journalist based in the UK. He’s been writing regularly for Techradar since it was launched in 2008 and also writes regularly for Forbes, The Telegraph, the South China Morning Post, Sky & Telescope and the Sky At Night magazine as well as other Future titles T3, Digital Camera World, All About Space and Space.com. He also edits two of his own websites, TravGear.com and WhenIsTheNextEclipse.com that reflect his obsession with travel gear and solar eclipse travel. He is the author of A Stargazing Program For Beginners (Springer, 2015),