HP finally splitting up: Let the FUD-ness begin!

Karma, something, something...

Just hours before HP officialised its split into two companies - HP Enterprise and HP Inc - one of its Twitter accounts (Convergence Infrastructure) tweeted:

"The question IBM server buyers need to ask: do they want to take a chance on Lenovo?"

Lenovo and Dell will surenly now the same question to HP's Enterprise buyers. That could kickstart what would be the beginning of a long, protracted campaign of FUD (fear, uncertainty and doubt).

It's one that will end next year when HP is expected to go through the process, which is likely to be completed by the end of fiscal year 2015.

By then, HP is likely to become a $35 billion (£21.9 billion, AU$40 billion) company with HP Enterprise worth roughly the same amount - give or take a few billion dollars. HP was today valued at around $68.9 billion (£43.1 billion, AU$78.9 billion) after what seems to be a thumbs up from the investment community.

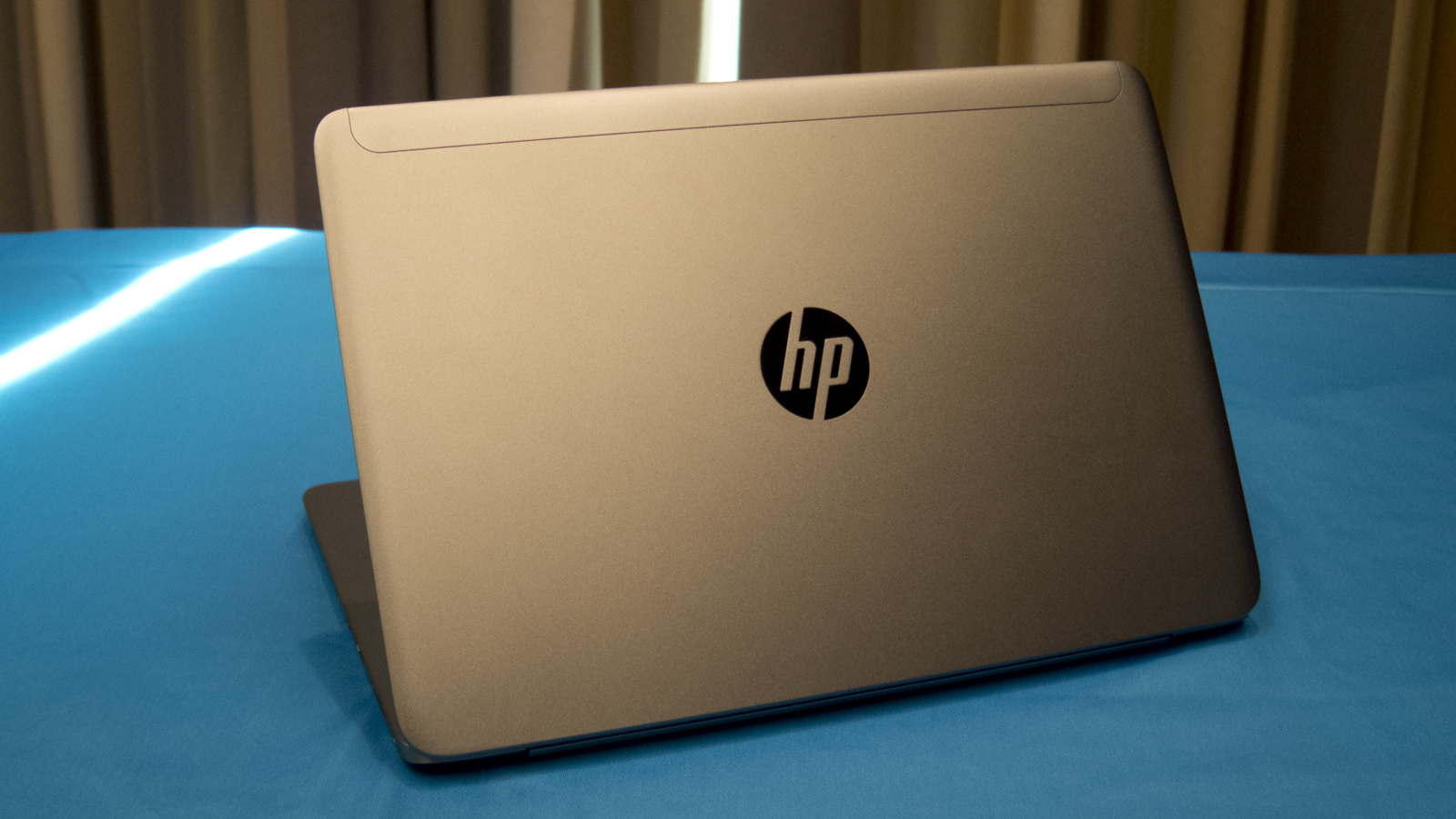

HP will take onboard the personal systems and printing market while the HP Enterprise will get the rest of the family jewels. They have roughly the same revenue and operating profit as well as operating margins.

It's clear that changing market conditions and possibly growing shareholder rumbles have convinced the HP board to split the company but that decision is fraught with dangers as well, something its biggest competitors will be aware of.

Acquisitions, mergers and spinoffs are never simple processes and HP has been through a number of them, most notably the 2001 merger with Compaq, which at that time was worth $25bn (adjusted for inflation, it is equivalent to $33.5 billion in 2014, roughly what HP PPS would be worth today).

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

More acquisitions on the way?

Lenovo will probably be the biggest winner; the new HP PPS is now a smaller, nimbler competitor; and with the prospect of Lenovo launching printers globally in a near future, HP could find itself targeted by a second end-to-end print-and-PC manufacturer, after Dell; a frightening prospect.

As an entirely Intel-based boutique, HP Enterprise, unlike Oracle (SPARC) and IBM (Power), will face growing competition not only from Dell but also Huawei and Cisco (and to a lesser extent Fujitsu). It has however recently tried to reduce its dependency on Intel by moving – timidly – to ARM.

HP enterprise, on the other hand, is also a tantalising, potential target, not for Lenovo but for the likes of Oracle and Cisco (or even IBM).

At under $40 billion, HP Enterprise would be a massive bet but one that would not only bring in some of the brightest talents in the industry but also a sizable IP portfolio (more than 37,000 patents) and some exciting future prospects like The Machine and the Memristor.

Whatever happens between now and the completion of the process, one thing is certain, after Motorola, Ebay, splitting up looks like the new "merger".

PS: Just as I was writing this column, Lenovo sent us a statement on what it calls HP's structural announcement.

"We have no specific comment on our competitor's structural or organizational maneuvers. However, Lenovo has been continuing to gain share in the $200B PC market, and we have outgrown the market and our competitors for 20 straight quarters. We are confident this trend will continue, as we are focused and will continue to leverage the consolidation of this industry to grow; as we are innovative and the market can expect we will launch more and more exciting PC , mobile, enterprise and ecosystem products in the near future and in the long term; and as we are consistent and clear with our strategy, which after we close both the IBM System X and Motorola deals, will give us 3 growth engines – PC, Mobile and Enterprise."

Désiré has been musing and writing about technology during a career spanning four decades. He dabbled in website builders and web hosting when DHTML and frames were in vogue and started narrating about the impact of technology on society just before the start of the Y2K hysteria at the turn of the last millennium.