Best mobile credit card processor of 2025

Process in-store payments

We list the best mobile credit card processors, to make it simple and easy to take payments by credit and debit card, whether in store, at an event, or on the go.

While there are plenty of credit card payment processors for online stores, what happens if you want to sell at a trade fair, set up a market stall or pop-up shop, or swipe a credit card tableside in a restaurant?

This is where mobile card readers really come into their own for credit card processing, allowing you to take card payments wirelessly on the go. You don't need a checkout till, just a smartphone or tablet able to run apps that can connect with a mobile card reader.

Mobile card readers can even be great for small mom-and-pop shops that are looking to keep their initial costs down, and a tablet running apps on a stand can work in lieu of a till.

Credit card readers are the front end to your point of sale (POS) system, which can do much more than simply read cards. The best POS systems can manage your inventory, ensure you're on top of compliance-related payment regulations, and help your business avoid fines and other administrative costs (such as chargeback fraud), all while offering advanced security features that protect from data theft and cyber breaches.

Where mobile credit card processing really comes into its own is its sheer flexibility. Using nothing more than your smartphone, a downloaded app and a cheap card reader costing from $25 to $50, you can take payments anywhere there is a cellular network signal. Some merchants offer an offline option to boot.

Even better, it's not just the ability to process payments from credit/debit cards with an EMV aka chip-and-pin, but contactless payments can now also be taken, including Apple Pay, Android Pay and Samsung Pay.

Most merchant services that provide a mobile card reader offer rates similar to online payment processing systems. Many charge no monthly fee either, just transaction fees in the range of 2.5-3.5%. There are options to pay a monthly fee in order to reduce transaction fees down to interchange fees only, i.e. the pennies the bank will charge for movement of funds between accounts.

Below we list the best mobile credit card processors for taking payments on the go.

We've also showcased the best accounting software for small business and the best tax software.

The best mobile credit card processors of 2025 in full:

Why you can trust TechRadar

Best affordable mobile credit card processor

Specifications

Reasons to buy

Reasons to avoid

SumUp is mobile card reader that is available in 31 countries, although it is a more recent entry to the US market. Notably, it supports cards with EMV, popularly known as the newer ‘chip cards,’ and is powered via a micro-USB port, and has a lithium ion battery.

This mobile card reader solution is well suited to lower volume users as it offers a fixed transaction cost, with no monthly fee, or minimum usage level. The card reader connects via Bluetooth to your smartphone with a downloadable app.

There is also support for a wide variety of credit cards, including MasterCard, Visa, American Express and Discover Card, as well as the newer services Apple Pay and Google Pay. Payouts to your bank account take an efficient one to two days. Unfortunately, the card reader is required for any transaction to occur, as transactions cannot be manually entered.

Read our full SumUp review.

Best mobile credit card processor for innovation

Specifications

Reasons to buy

Reasons to avoid

Square provides a range of innovative POS solutions, and their mobile card reader continues this policy. As with Square's products in general, your mobile device can serve as a checkout and sales center for your retail business, and the card reader remains an integral part of that.

The card reader itself is just a small device that clicks onto your smartphone via a Lightning USB connection for iPhones and iPads, or phone jack connection for Android phones. The attachment can then have cards simply swiped through it to be processed.

The swiping process is easy, but it's also secure with no card or customer data being stored in your phone. Instead it's sent over an encrypted connection for processing, and then that's the processing done.

The basic card reader itself is free, and transaction fees are a flat-rate for Visa, Mastercard, Discover, and American Express. Even better is that there are no monthly fees, either.

However, there is a different device required for contactless payments, which allows not just for chip and pin cards to be read, but also use Apple Pay for payments.

Altogether, Square make taking transactions a painless process, and the card reader is both easy to use and simple to work with. The charges are very reasonable, too.

Read our full Square Reader review.

Best mobile credit card processor for PayPal users

Specifications

Reasons to buy

Reasons to avoid

PayPal Zettle allows your mobile device to accept cards and contactless payments by using a PayPal card reader and the PayPal payment app. All you need to do is download the PayPal Zettle app and pair your smartphone or tablet with the card reader.

The PayPal Zettle card reader works with the Point of Sale app to allow you to process card payments by Visa, Mastercard, Amex, and Discover, as well as contactless payments from Apple Pay, G Pay, and Samsung Pay.

Of course, you will need a PayPal account to run the app and card reader, and payments are made into your PayPal account typically within one business day. You can also print or email receipts, whichever is best for your customers.

There's a small one-time fee for the card reader, and a flat-rate processing fee for each order.

Read our full PayPal Zettle review.

Best mobile credit card processor for QuickBooks users

Specifications

Reasons to buy

Reasons to avoid

Intuit, best known for TurboTax, produces the QuickBooks small business accounting offering, and under that umbrella is its mobile card reader effort, which is known as QuickBooks Payments.

The smartphone app is notable, and this has a companion card reader, both of which come for no additional charge. Unlike free card readers from competing services, this one from QuickBooks can handle both mag-stripe and chip methods of entry, and connects to the smartphone wirelessly via Bluetooth.

Another benefit of this service is that there is no setup fee, or any minimum usage level, making QuickBooks more attractive for the lower volume user.

Of course, being part of Intuit means that this large concern has produced an array of solutions for whatever kind of business you run. Using the app-based approach QuickBooks Payments is therefore tailored more to an on-the-go or mobile business where you don't necessarily have the traditional point of sale arrangement in place. And, as you would expect, transactions can be handled via Apple or Android devices.

Overall, if you're already a QuickBooks user, QuickBooks Payments could be your priority choice.

Read our full QuickBooks Payments review.

Best mobile credit card processor for e-commerce

Specifications

Reasons to buy

Reasons to avoid

Shopify will be instantly familiar, after all it is known as one of the best ecommerce platforms on the market. However, aside from catering for all kinds of business on the selling front, Shopify has also expanded its products and services and now includes mobile card reading.

In addition to the mobile card reader offering, this also integrates into Shopify solutions including the Shopify POS smartphone app. However, do note that the mobile reader comes as an extension to existing Shopify services, and isn't provided as a standalone.

Due to the fact that Shopify offers an array of services on what amounts to a global scale there are territorial and geographical differences when it comes to costs too aside from the basic WisePad 3 Reader device.

Considering the breadth of options it’s a good idea to investigate them to determine which one is going to be best for your business.

Read our full Shopify review.

Best mobile credit card processor for on the go

Specifications

Reasons to buy

Reasons to avoid

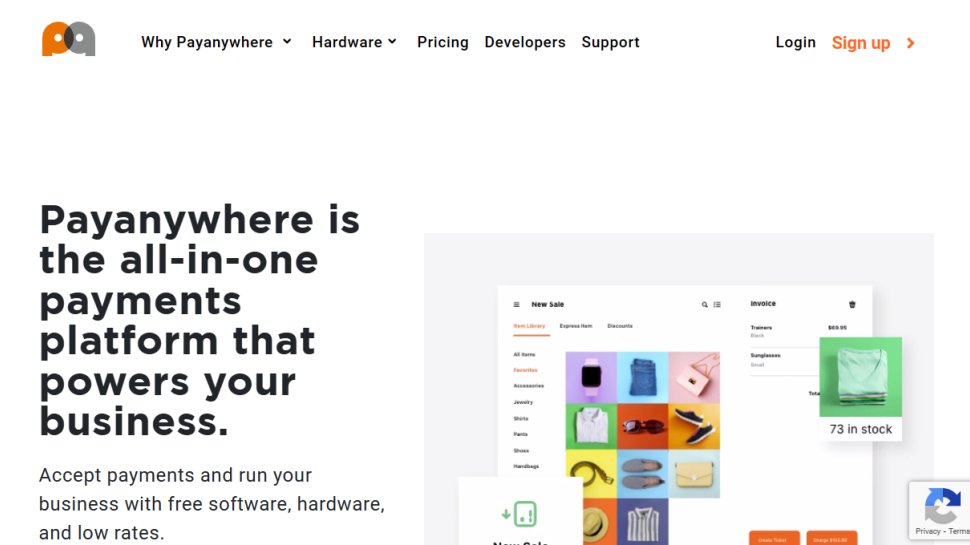

PayAnywhere has been in existence for around a decade or so now, although it's only in the last couple of years that it has been improved enough to be called a serious player in the card processing stakes.

PayAnywhere currently comes with two different packages for the mobile market, so currently you can opt for their pay-as-you-go package, which covers transaction processing of under 10k per month for swiped, dip or tap payments.

PayAnywhere caters for business users right across the board with a whole selection of hardware devices to let you process payments. There are smart terminals, smart point of sale devices and a brace of card readers. There’s the 2-in-1 option and a 3-in-1 reader unit too, as well as miscellaneous accessories designed to make the acceptance of customer funds all the more straightforward.

Of the two readers then the 3-in-1 obviously does that little bit more as it is able to process magstripe payments (swipe), EMV chip card payments (dip) and also handle NFC contactless payments including the likes of Apple Pay and Samsung Pay. Meanwhile, the Smart Terminal can process PIN debits, print receipts and has a built-in barcode scanner. Both the Smart Flex machine and the Smart Point of Sale hardware add on a customer facing second screen.

Read our full PayAnywhere review.

We've also highlighted the best payment gateways.

Best mobile credit card processor FAQs

How to choose the best mobile credit card processors

If you're looking to make the processing of transactions quick and easy then the best mobile credit card processors on the market can help. They're ideally suited to small businesses, especially those that need a more dynamic approach to taking payments.

For example, if you regularly run your business at trade fair events, markets, or even in the pop-up environment, you'll find mobile credit card processors are perfect. They're also great for taking payments at a diner's table in your restaurant if that's your line of business. The possibilities are endless.

You'll need to ensure you've got a compatible smartphone or tablet, which in turn will have an app installed that is associated with the credit card processing service you pick. A mobile card reader will form the other part of the puzzle, which will be supplied by your provider. It's effectively like having one of the best POS systems, but in a mobile environment.

If you're keen to keep overheads down lookout for costs involved. The hardware is usually cheap or even free in some cases but there'll be transaction fees too. Convenience and the ability to take a wide range of payments is vital though, including credit/debit cards with an EMV aka chip-and-pin. Contactless payment functionality is another bonus with the latest systems and this frequently includes the likes of Apple Pay, Android Pay, and Samsung Pay.

How we tested the best mobile credit card processor

Small business owners are always looking for the most cost effective way of getting the job done. In the case of the best mobile credit card processors, it's all about speed, efficiency and value for money. We test hardware and software to check the ability of providers to get the job done, without too much in the way of overheads.

Hardware, as in mobile card readers, are checked for reliability and durability. They're also monitored for stability, particularly during busy times, or where the signal strength may affect their performance. The same goes for software, with provider apps being a key part of the mobile credit card processing chain.

We then test to see if all of the links in the chain join together to provide a cohesive and efficient transaction service. On top of that, we evaluate the value-for-money factor, ensuring that any fees chargeable are in direct relation to the service required. Any business wants to get value, but if you're working in a sector with small margins, the cost factor is one of the key ingredients for us to consider.

Read more on how we test, rate, and review products on TechRadar.

Get in touch

- Want to find out about commercial or marketing opportunities? Click here

- Out of date info, errors, complaints or broken links? Give us a nudge

- Got a suggestion for a product or service provider? Message us directly

- You've reached the end of the page. Jump back up to the top ^

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Jonas P. DeMuro is a freelance reviewer covering wireless networking hardware.