How Caped Koala funded their business with KickStarter

A users' guide to getting start-up funding from KickStarter

Ever had an idea for a new business but worried about getting the cash to start? Crowd-funding is one of the new ways to fund a business by offering an already keen audience the ability to pay-up-front for your products and services.

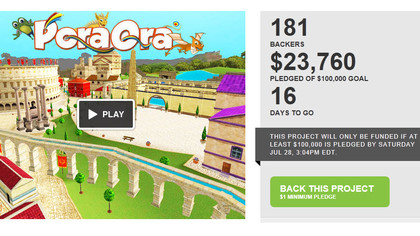

UK and Ireland gaming start-up Caped Koala are using US crowd-funding business KickStarter and so far they've raised a quarter of their funding, and they're well on the way to moving their first game PoraOra from Beta into a fully-fledged business.

TechRadar spoke exclusively with Neil Gallagher, Caped Koala's CEO about his experiences with crowd funding.

Do you think that crowdfunding such as Kickstarter are the new way to fund specific projects within small businesses?

Absolutely. The beauty of Kickstarter is that it allows small companies to market test to determine if people are prepared to pre-order. It provides micro-seed capital without relinquishment of ownership, which is extremely powerful.

Statistics seem to show that over half of all Kickstarter projects do not reach their funding goals. What does this say about this funding system as a whole?

Approximately 56% of projects do not get funded – so Kickstarter should not be regarded as an unlimited source of money. As Co-founder Yancey Strickler argued in a recent interview: "Most unsuccessfully funded projects come up short because of a lack of interest in the project or because their creators didn't promote it enough, not because of the Kickstarter page itself". An optimist would consider that a 43% of project success a reasonable.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Do you think that the crowd funding services that are available today offer investors enough protection from fraud, or the failure of the projects they are supporting?

We need to be clear that Kickstarter is not investing, it is effectively pre-ordering a product and I guess Kickstarter isn't exactly special in that regard. When fraud does happen, people will fight it just like they do anywhere else. Kickstarter advisor and board member Sunny Bates doesn't deny the risks of pledging but argues the price of individual Kickstarter pledges is so low that even if fraud did rear its head it wouldn't be worth the legal action from a backer.

Is there a danger that due diligence and proper business planning can get forgotten in the rush to obtain what can seem like an easy source of funding?

Unlike funding from banks Kickstarter does not require a history of revenues, cash flow projections and a string balance sheet. Succeeding on Kickstarter however does require a good product, a clear story, meticulous planning and an excellent PR campaign, all of which are not easy to full together.

Is venture capital funding dead in the face of the growing number of crowd funding services?

The on-going challenge for venture capitalists is to select companies that are going to produce a product that customer are willing to buy. Crowd funding provides this validation and proves whether a product/company has a market fit. They completely complement each other.

What do you think the future of crowd funding looks like? Will it become a legitimate source of business financing?

I think companies will use it more and more to test the market before implementing full product development. The old model was 'let's spend lots of money building a shiny box that someone may buy.' the new model is 'would you like to buy this new shiny box that I could build you," which is less painful for everybody.

To read more about crowd-funding see our article How to use crowd funding to finance your business?